Stock and commodities trading was always a thing for "rich people" in my mind. I grew up in a family and a part of the country where the idea of having extra money to invest was laughable, so now that I'm 25 and have a little disposable income that I'd like to turn into A LOT of disposable income by trading cryptocurrencies, I'm stuck with whatever information I can find online to navigate these waters. If you decide to follow along in this learning process, just know that I'm starting with 0 background. I am for all intents and purposes a complete noob.

I'm starting with a very small account of around $60 and hope to position trade my way up to at least $6000. Ambitious? You're damn right, and we'll see just where it gets me. Anyway, I want to keep these posts down to trade analysis and cut down on the fluff, so without further adieu, here we go!

I'm trying to learn the panic sell trading strategy used by @quickfingersluc. He's an awesome content creator and really does a lot to give back to the community, so please go check out his blog if you haven't already. It will give you some background to what I'm doing as well. I've taken a few trades since starting the account, but it's been for a net loss for two very simple reasons.

I've been trading with too much emotion and FOMO. I buy into a drop too early, see the price continue to shoot down, and then sell for a loss, re-buy, and don't get as high of a bounce as I was hoping for. DON'T DO THIS. It sucks

I haven't been qualifying my bases (see Luc's videos to understand what I mean by this) as strictly as I should. I'm stuck sitting on my most recent trade and waiting for it to pop back up for this very reason which I'll illustrate in a quick screenshot.

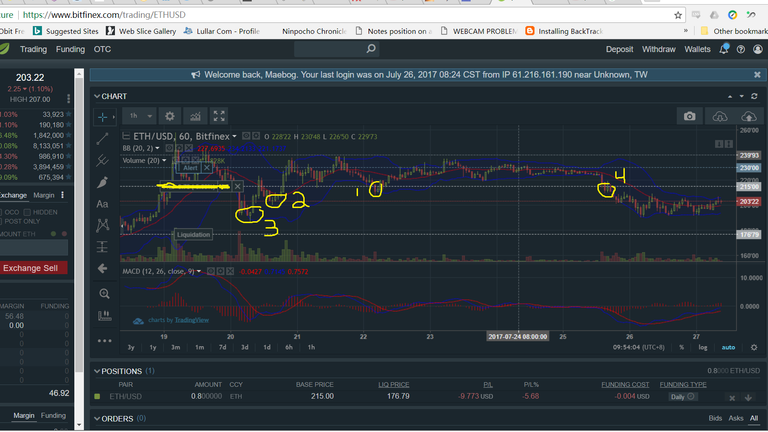

Ok, so I've circled 4 points in the graph. 1-3 are bases and 4 is where I bought in. A quick summary of a base is that it's a low that previously generated a high pop back up. As @quickfingersluc emphasizes in his videos, a lot of crypto charts behave this way because there is such strong speculation on both sides of the aisle. Ethereum is a particularly good example which is why I chose it to learn with. Now, if you're familiar with Luc's trading strategy, you know that what we're supposed to do is wait for a base to be broken, buy in at some point during the drop, and then if it was a true base, we should see a healthy pop up for a profit.

Look at this chart and see if you can pick out where I went terribly wrong.

I'll wait.

That's right! I bought in right at base 1, which was a weak base to begin with (the subsequent pop up was not very high and took a while to formulate), instead of waiting for it to drop and break base 2, which would have given me a profit after it touched base 3 and popped right back up...repeatedly! So now, because I made a rookie mistake, I'm stuck sitting on my 215 buy in waiting for this whole segwit/BCC issue to clear up so that Cryptoland can get back on its way up and I can exit this awful position for at least what I put into it. So, learn from me, folks, and don't make this mistake. I certainly won't be making it again!

What I learned:

- Only trade on strong bases that provide relatively quick, high pop ups

- Don't trade right as the price cracks the base, wait for it to fall a little farther to confirm the crack and increase returns

- Remember that these positions take as long to form as the time frame you're looking at. I trade on the 1 hour chart, so entering and exiting a position in 30 minutes is both impractical and a complete waste of time

Let's hope I've got some good news for article 2! Until then, wish me luck!

Congratulations @maebog! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP