Cryptocurrencies were born with the noble idea of having a currency with no central authority of control, and value based on the actual utility of the currency.

Bitcoin was that first cryptocurrency, and the value or price of Bitcoin was to be determined by supply and demand. Since Bitcoin there have been hundreds of other cryptocurrencies created with the same goals. To get there, some coins were created with a cap on the number of total coins (similar to Bitcoin) in order to limit inflation, while others intentionally allow an unlimited number of coins to provide incentives for miners.

One idea has not been tried, but DigixDAO is looking to change that with a unique new platform and token. The next new currency to be created by DigixDAO is planned to be tied to a physical commodity, with each coin being backed by a gram of gold bullion. That’s earth-shattering as it will give us back something we’ve been missing for decades — a currency on the gold standard.

The guide below is meant to bring you up to speed on what DigixDAO is, how it works, the details of the coin being created, and whether or not it’s a platform you feel you should be backing.

The Proof of Provenance (PoP) System

DigixDAO already has a token known as DGD, which was the coin offered in a crowdsale for the platform, and currently being traded on several exchanges. It has seen massive growth since the crowdsale price, and is currently (April 2018) the 41st largest coin by market cap as measured by Coinmarketcap.com.

The DGD token gives it holders the right to vote on the development of DigixDAO, giving each person who owns the token a stake in approving or declining new development proposals. It will also reward each person holding it with the new DGX token — and this is the token that will be tied to gold, with each token tied to one gram of gold.

The idea behind the DGX token is that by tying it to the price of an already stable commodity — gold — the price of the token will remain stable as well. Current gold reserves are being held in a vault in Singapore known as The Safe House. That vault has plans to hold up to $2 billion worth of gold bullion, but if demand calls for a greater amount DigixDAO is prepared to open a second vault.

The consensus mechanism used for the DGX token will be a Proof of Provenance (PoP) system. In this system each gold bar will have its information recorded on the Ethereum blockchain. The information will include the time it was created, the serial number, its custody history, and the fees associated with it.

Note that initially this was called Proof of Asset (PoA), however the Digix team decided to change this to avoid confusion with the Proof of Authority consensus mechanism when using the acronym “PoA”. The DigixDAO team presented the following:

Since our protocol at its core addresses the issue of proving the existence of the physical asset (gold in the first instance for DGX 2.0) and the authenticity of its ownership, Proof of Provenance (PoP) as a name accurately captures the essence of our technology, while avoiding the confusion that could be caused by an identical and popularly used acronym PoA.

The DGX Token

Now that we know how the information about the gold will be stored on the blockchain, let’s look at how the token will fit in.

Basically, when the PoP card is processed by a DigixDAO smart contract it will create DGX tokens for each gram weight of the bar. It is also possible to reverse the process. So, if someone has 200 DGX tokens they will be able to redeem them for a 200-gram gold bar.

They can then either physically collect the gold or have it sent to them. It’s unclear if DigixDAO will also provide a facility for storing gold that has been redeemed from DGX tokens, but it would certainly make sense to do so.

With this scheme it becomes far easier for anyone to own gold, even if it is just a few grams. Having a digital currency that represents a set amount of actual physical gold will make it far simpler to increase the ownership of gold.

The DGD Token

The already created DGD tokens are not so much a currency as they are both a voting right and a stake in the upcoming gold standard DGX token. Owning DGD tokens gives you something similar to shareholder privileges when you own a company stock. As a DGD token holder you are able to vote on development proposal and help guide the direction of DigixDAO. Holders will also be entitled to discounts and rebates.

The DGX token hasn’t been released yet, so we’ll all have to wait and see the actual effects of the proposed discounts and rebates, but so far the cryptocurrency community seems quite positive about the upcoming DGX token. Once it’s released we’ll see how things develop and settle out.

There does remain some confusion over the actual function of the DGX reward system. The DigixDAO team has already come out to say that holding the DGD token isn’t a way to create a passive income.

They’ve said that holding DGD won’t entitle you to a portion of created DGX in the way NEO holders are entitled to GAS. Instead it seems rewards will come as a portion of the fees charged for transactions, but we’ll have to wait for clarification from the DigixDAO team to be certain how this will work.

The History of DigixDAO

Digix was started in Singapore in 2014 within the Ethereum network as a Distributed Autonomous Organization (DAO). In 2016 they had a crowdsale for the DGD token, reaching their funding goal of $5.5 million in under 24 hours.

In the short two years following the crowdsale DigixDAO is now ready to take its next step — the release of the gold-backed DGX token.

By tying the token to actual physical gold, Digix feels it can provide the cryptocurrency community with a stable value alternative versus many other cryptocurrencies, which can change value dramatically in a matter of hours.

The Digix Team

The DigixDAO team is comprised on members with backgrounds in blockchain technology, finance and development, making it a strong contender in the cryptocurrency space. The leader of the team is Kai Cheng, who was formerly a currency trader on Wall Street.

The other two founding team members are Shaun Djie, a blockchain developer who has extensive experience working for the Singaporean government on data and networking solutions to grow the economy, and Anthony Eufemio, a software developer with nearly 20 years of experience.

The Supply of DGD and DGX

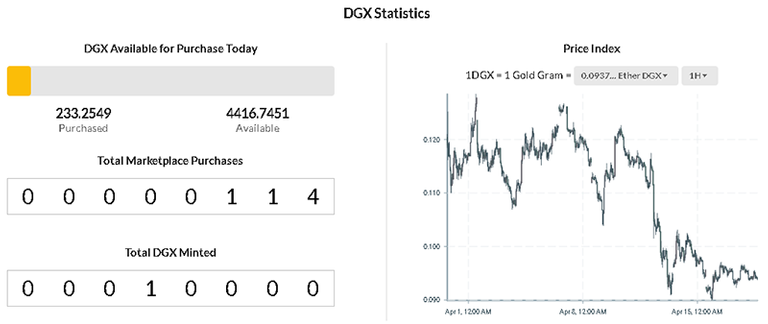

There were 2 million DGD released in the 2016 crowdsale, and that number will remain fixed, unless the stakeholders all vote to hold another crowdsale. DGX was scheduled to be released by the end of the first quarter of 2018, but has been delayed and so has yet to be released.

We can’t say for sure what the price of DGX will be once it is released, but it will be tied to the price of gold obviously. It’s unlikely that the price of DGX will drop below the market value of the 1 gram of gold each token is backed by, but it could trade at a premium to that price.

The vault being used by DigixDAO currently holds just $2 billion in gold, which caps the number of DGX that can be mined initially, but the team has already stated that they could expand to additional vaults if there’s enough demand for the DGX token.

DigixDAO’s Future Plans

While creating tokens that are backed by gold is an ambitious project, there are plans for additional features on the DigixDAO platform in the future.

Inheritance System — This will allow DGX holders to bequeath their DGX wealth to another person simply by providing their Ethereum address.

Online Games — There are plans to introduce DGX or possibly a similar token, into online games, replacing the current game tokens with tokens that have real world value.

Lending System — This would work as a decentralized peer-to-peer lending system using the stability of gold to provide loans to people in the form of cryptocurrency.

Other Assets — It is possible that the Digix team could create other tokens backed by assets such as silver or platinum in the future.

DigixDAO Competition

DigixDAO isn’t the only platform trying to offer a cryptocurrency backed by gold or other assets. GoldMoney is another gold backed project, offering digital tokens backed by their $2 billion in gold holdings. They have made their tokens even more usable by providing holders with a debit card that allows users to actually spend their gold.

Another stability coin that has seen great adoption is the Tether. These are backed by either USD or EUR, and there are also plans to create Yen backed Tether in the future. However, there have been questions about the transparency of the company that is issuing Tether, and they are currently facing a U.S. Commodity Futures Trading Commission subpoena to provide proof of their reserve assets.

Trading Digix (DGD)

While DGX is meant to be a stablecoin, the same can’t be said of DGD, which has seen its share of significant price changes. For example, the coin had a price of just around $3 at the 2016 crowdsale, but moved as high as $550 by late February 2018, only to crash by more than 60% by early April 2018. The price has been recovering off those lows, but certainly can’t be considered stable.

However, that very volatility makes DGD a good coin for traders. Investors are likely to be more attracted to the stability of the DGX coin when it is rolled out, and if strong demand is seen for DGX, that in itself should push the price of DGD significantly higher.

Where to Buy DGD

If you’re interested in buying DGD currently the best places are Binance and Huobi, with those two exchanges accounting for more than 95% of trade volume for DGD. Keep in mind that it can only be bought with BTC or ETH at these two exchanges.

Initially, DigixDAO is planning to list DGX on the Kyber Network.

In the future DigixDAO will be releasing their own marketplace, where users will be able to buy DGX with ETH, and there’s a very good likelihood they’ll be offering DGD there as well.

Storing DGD

Storing your DGD is easy since it is an ERC-20 token. Basically any wallet that supports ERC-20 tokens will work, and that includes the very popular online MyEtherWallet. Since DGX will also be an ERC-20 token the same applies for it once it is released.

In Conclusion

Much of the criticism leveled against cryptocurrencies rests on their volatility and lack of stability. Especially when used as a transactional medium, it is critical that a digital currency is stable. DigixDAO is creating exactly that kind of stability by offering a token that is tied to a physical asset that has long shown its stability.

While we haven’t yet seen if this will work out, the launch of DGX is imminent and the results of this experiment will be interesting to say the least. If the token does gain acceptance it could be the catalyst that moves cryptocurrencies from a purely speculative fad to a mainstream way to invest, store value and conduct financial transactions.

If DGX proves viable, we could see tokens being created in the future that are tied to any number of physical commodities and assets. In other words, this could be the start of something very big.

If you’d like to learn more about DigixDAO you can follow them on any of their social media channels:

Medium

Reddit

Twitter

Github

Telegram

Discord

Images via digix.global

Originally published at www.coinbureau.com on April 18, 2018.

If you got at least 0.001 STEEM worth of value from this post please upvote below and resteem so others will see the post too.

If you really like what you've read consider following @moneyinfant - I'd love to have you join me.

)