The rise of Tether

In the earlier days of crypto, trading crypto for fiat was very difficult (even today it's not that easy), and in this very speculative market there was a need in a way to keep your value without having to go through all this trouble.

Thats where Tether, the first stablecoin came to the picture in November 2014. Tether offered a coin that's supposed to be pegged to 1$, and Tether claimed to back each USDT issued with a real dollar in their reserve. Tether was associated with Bitfinex (Bitfinex CEO is also Tether's CEO), a very big exchange, and they were first listed on the exchange.

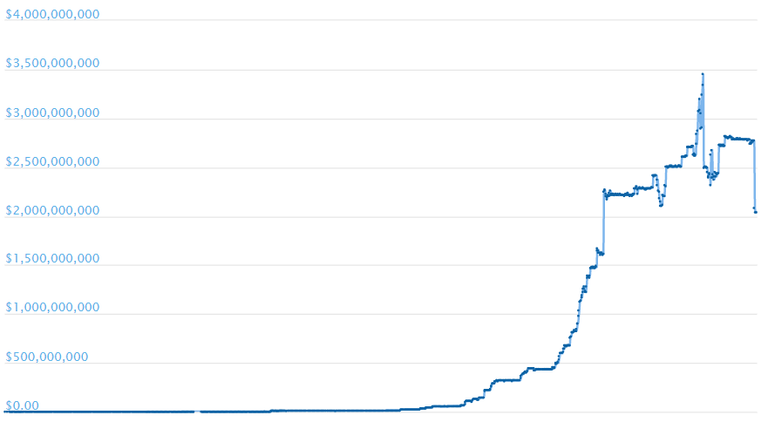

Everything seemed great at the time. USDT was listed on all major exchanges and had trading pairs of it's own allowing traders to sell crypto for "fiat" on exchanges. Tether was a hugh success, growing extremely fast and reaching unprecedented valuations, but it also started raising some questions.

Doubts starting to rise

As you remember, Tether promised to back every USD issued with 1$ in their reserves, so in 2017 when tether started issuing hundreds of millions USDT in a matter of days and weeks, an amount that even the biggest companies would struggle to achieve in such a short time, the crpyto community started doubting Tether and asking for transparency and an official audit, showing that they have all funds.

In December 2017 Tether and Bitfinex got subpoenas frin the CFTC and in January 2018 Friedman LLP to conduct an audit, but they stopped the proccess claiming it will take too long.

At this point many people saw Tether as a ticking time bomb, but Tether continued issuing USDT like everything is normal through 2018.

Losing it's peg

On October 15th 2018, everything came crushing down on tether. The coin lost it's 1 USD pegged value reaching as low as 0.85$, panic was everywhere, and with many alternatives popping up it was clear that Tether's dominance is over.

Tether burned coins even faster then issuing them before in an attempt to save the pegged value. Since it's highs a month ago, Tether has burned almost 1 billion dollars and haven't recovered completely.

What's Next?

During Tether's reign, when doubts about their ability to back every USDT, some competitors started appearing, the big ones being Maker Dai and TrueUSD offering a transparent stablecoin.

Lately, since the Gemini USD was launched in September, exchanges started launching their own stablecoins - Gemini (GUSD), Huobi (HUSD) and most recently Circle and Coinbase (USDC), which seems like the one that might take Tether's place, achieving 124M market cap already.

Congratulations @mrcryptonite! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!