Huge Regulated Token Sales Indicate ICOs May Be Coming Back

Germany's Financial Regulator Approves €250M Coin Offering

As though to show coin decisions are generally not a perishing style, the German Federal Financial Supervisory Authority, Bafin, just of late certify thought about one of a legitimate estimation. Through its token deal, the Berlin-based blockchain startup Fundament Group is making an endeavor to lift €250 million ($278 million). As indicated by the declaration, each authorize and retail merchants will be fit for take an interest inside the gathering pledges showcasing effort and specific individual ventures won't be confined.

Also Read : Bitcoin Weekly Close Nears as Bears Maintain Control; Will BTC Soon Drop Below $9,000?

Also Read : Bitcoin Weekly Close Nears as Bears Maintain Control; Will BTC Soon Drop Below $9,000?

The endeavor objectives to enable people to burn through cash on the improvement of financial genuine property by its Real Estate Tokens. At this beginning period, it covers three sites in Hamburg, one inside the fiscal capital Frankfurt, and one other one inside the school city of Jena, Forklog announced. Fundament Group's ERC20 tokens will allow holders to acquire yearly profits of Four-Eight% on their interests notwithstanding endless supply of the improvement works.

The German startup intends to lead the token deal without a go between like a subsidizing money related establishment, in light of the fact that the point is to diminish the costs of the giving. Financial specialists will be fit for buy the things using both bitcoin center, ethereum, U.S. or then again euros. The individuals who pay with fiat forex will acquire the tokens securely saved money on a pockets. What's more, in light of the fact that the coin giving is managed, passing KYC is an obligatory necessity for all brokers.

Undertakings like Fundament Group's present that token gross deals could likewise be returning, and never exclusively in Europe anyway all through the lake as appropriately. In the essential long periods of July, the U.S. Protections and Exchange Commission (SEC) certify Blockstack's $28 million giving. The firm, which is building a decentralized registering network and application biological system, has gotten authorization to lift as much as $50 million yearly. SEC also gave the unpracticed mellow to the dissemination of $187 million estimation of Props tokens between substance material makers and clients of the gushing stage Younow.

Russia Legalizes Crowdfunding With a New Law Applicable to Token Sales

The Russian Federation, which is inside the prime 5 areas for ICOs, has embraced an approved structure to control the lifting of capital by crowdfunding. This week, the State Duma, the decline home of Russia's parliament, decided on third and extreme examining the extensive anticipated Law "On Attracting Investments Using Investment Platforms," for the most part known as the "Crowdfunding Law."

The receipt, which is a segment of a total pack designed for controlling the Russian advanced financial framework, together with the crypto part, presents some key new expressions like "utilitarian computerized rights." rights to the results of mental exercise.

The new laws builds up rules and decides that may administer crowdfunding stages. For example, they will be required to have at any rate 5 million rubles (almost $80,000) of their own special capital. The Central Bank of Russia (CBR) will keep up a register of the elements that capacity them and eagerly screen their activities. The enactment furthermore presents shields for "inadequate financial specialists." They will most likely be permitted to spend exclusively as much as 600,000 rubles ($9,500) yearly on all crowdfunding stages in Russia.

At this stage, cryptographic forms of money are typically not expressly discussed inside the crowdfunding enactment, however bunches of its writings are significant to the crypto exchange. The biggest weakness of the spic and span laws is its dependence on substatutory acts embraced by the CBR which remains against the total legitimization of decentralized monetary forms. Another downside is that to have the option to satisfy its maximum capacity, the receipt needs unique legitimate rules that manage the rest of the crypto house.

Russia has been delaying the appropriation of its first crypto-related receipt, the Law "On Digital Financial Assets," for over an a year now, paying little respect to various due dates set by President Putin's organization. The last one, July of this a year, simply won't be met both. The draft, which was decided on first examining inside the spring of 2018, is inclined to be embraced in October, in accordance with Anatoliy Aksakov, seat of the parliamentary Financial Market Committee. By that point a normal spot between various Russian foundations should be accomplished concerning the guideline of digital currencies.

Aksakov moreover celebrated that each one three installments inside the administrative pack – which diagram computerized rights, authorize reasonable contracts, and manage crowdfunding – are eagerly interconnected. He accepts a trade off between the places of arranged Russian controllers and specialists is plausible. "By October 1, this issue ought to be settled by law. Preparation is high and we are getting down to business hard in September," the administrator was cited saying by the Parliamentary Gazette.

Guidelines Bring Coin Offerings Into the Mainstream

Close to Russia, a wide range of countries have to this point embraced laws that manages crowdfunding in a solitary confirmation or one other. In Belarus, for example, a declaration marked by President Lukashenko went into weight in March of conclusive a year sanctioning crypto-related activities together with the issuance, stockpiling, and purchasing and selling of advanced tokens. Estonia pulled in numerous new companies with crypto-accommodating laws and countless ICOs provided in various purviews are truly completed by substances enrolled inside the Baltic country.

In the United States, which is the main with regards to assortment of did coin decisions, the difficulties for organizations lifting capital by token gross deals have adjusted extensively over the past couple of years. While numerous ICOs have been at first done underneath the possibility that the issued money spoke to utility tokens, various authority proclamations and administrative activities have shown that U.S. specialists see most ICOs as selections of protections that fall all through the extent of the country's protections legitimate rules.

Starting coin decisions in China have been effectively prohibited with a round issued by the People's Bank and diverse money related controllers inside the fall of 2017. The doc chose that ICOs spoke to an unlawful gathering pledges work out. In Hong Kong, in any case, advanced tokens offered for crowdfunding capacities are believed to be protections and ICOs may be done by authorized substances as a controlled exercise. Unlicensed backers may advance tokens offered they work with authorized institutional brokers.

Are ICOs Returning?

Introductory coin decisions took an extreme hit through the all-inclusive crypto winter that set in conclusive a year after the unequaled highs generally 2017. As per learning ordered by the positioning stage Icobench, with only a couple of special cases, the assortment of ICOs has been ordinarily bringing down since August 2018, when 321 ICOs have been printed. A low of 58 coin decisions was come to in February of this a year. Be that as it may, there's been a slight improve in May, with 88 token gross deals. It corresponded with the most current interim of rising crypto costs which started in April.

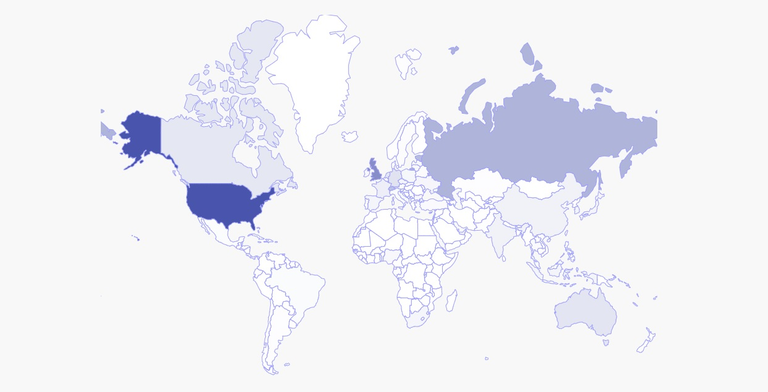

Over 90% of the ICOs followed by Icobench have effectively finished, 6% are continuous and round 2% are up and coming. The 5,639 coin decisions are from 25 very surprising enterprises, with the great larger part assembling assets to make a fresh out of the plastic new stage or present administrations related to cryptographic forms of money. With 751 ICOs and $7.5 billion of capital raised, the U.S. is besting the outlines. Singapore, U.Ok., Russia and Estonia are web facilitating the most significant assortment of ICOs after the United States, while the British Virgin Islands and Switzerland are inside the prime 5 by raised assets.

A month-to-month report printed by Icobench toward the beginning of June uncovers there's been a lower of the full finances brought up in ICOs to $230 million and the run of the mill finances raised by an endeavor to $7.Four million as contrasted and the previous interim's almost $1.2 billion and $29.7 million individually. At the indistinguishable time, the portion of ICOs which have raised any idealistic amount of assets stayed over the last normal. June recorded 31 gainful ICOs with a hit charge of 28%, a marker determined by separating the ICOs that raised assets by the ICOs which finished.

Introductory substitute decisions (IEOs) continue to get joy from rising notoriety and over $1 billion have been brought by IEOs up in May. The report notes there had been 182 IEOs by the highest point of June they for the most part have raised a total of $1.597 billion with a hit charge of over 60%. Around 90% of the assets have been raised on the most noteworthy 5 launchpads, with Coineal fundamental by assortment of IEOs and Bitfinex besting the record by raised assets.

Numerous undertakings directing primer coin decisions settle for not exclusively fiat money for his or her tokens however furthermore principle digital forms of money. On the off chance that you may be new to the crypto house anyway you may be quick to participate inside the exchange, you could need a basic and safe technique to buy computerized assets. Bitcoin.com gives you the opportunity to buy bitcoin cash (BCH), bitcoin center (BTC) and diverse principle money like ethereum (ETH), swell (XRP), litecoin (LTC) and Binance coin (BNB). You can do this using a bank card and without visiting a digital money substitute.

Disclaimer:

Readers ought to do their very own uncommon due enthusiasm sooner than taking any exercises identified with the examined exchanges, firms, programming program or any of the accomplices or associations. Bitcoin.com or the writer isn't capable, speedily or not authentically, for any fiendishness or adversity initiated or avowed to be inferable from or in reference to the use of or reliance on any substance material, things or associations examined on this article. This article assessment is for instructive limits solely.

Images courtesy of Shutterstock, Icobench.

Lubomir Tassev

Lubomir Tassev is a journalist from tech-savvy Bulgaria, which generally finds itself on the forefront of advances it can’t simply afford. Quoting Hitchens, he says: ”Being a author is what I’m, quite than what I do.“ International politics and economics are two different sources of inspiration.

IF YOU DARE THEN SHARE AND UPVOTE MY POST

Source

There is reasonable evidence that this article has been spun, rewritten, or reworded. Repeatedly posting such content is considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord