The world of blockchain technology introduces an interesting solution to some of the problems with cash-flow and trust in a lot of conventional, fiat-based systems around the world today. With cryptocurrencies, these systems and can be streamlined to be cheaper, faster and more transparent, solving the bottlenecks that exist with trust and the introduction of a middleman.

However, as the world adoption of crypto-assets slowly increases each day, there exists the obvious need for standard marketplaces or platforms where these assets can be exchanged between users at their convenience. And that is exactly what cryptocurrency exchanges do!

Cryptocurrency exchanges exist to provide a means by which several cryptocurrencies can be traded or exchanged for one another. Exchanges allow its users (commonly referred to as traders) to buy and sell cryptocurrency assets directly between each other, without the need for communication between buyer and seller at all. The only means of communication on exchanges are the graphical representation of price quotes that are put up by the buy and sell orders of both the buyers and the sellers respectively.

However, over 70% of all the cryptocurrency trading platforms operate the same way today, which creates a list of challenges for both investors and traders.

First off, very few cryptocurrency exchanges meet the need of the traders as regards making money, nor do they truly reflect the standards of institutional trading platforms to keep big players interested.

Apart from the obvious challenges such as the lack of robust, modern and scalable features, poorly designed user interfaces and security systems, exorbitant fees and unreliability, poor customer support, etc, perhaps a more intriguing concern is the apparent disregard for the gap that exists between the fiat and cryptocurrency markets.

Today, getting from a complete beginner to making your first trade is almost an extreme sport due to the strenuous and unclear onboarding processes as well as the hindrances to a smooth trading experience that currently exists. This unclarity has contributed to the decrease in liquidity in the markets, and is one of the reasons why corporate investors and traders have long been reluctant about participating in the crypto industry.

All of these problems call for a solution; A more standardized trading platform that listens to, and offers all of the services that are suitable for both retail and institutional traders.

Meet BTSE - Futures 2.0.

BTSE (pronounced as Bitsie), is a multi-currency spot and futures trading platform custom-built and designed to bring efficiency and stability to the cryptocurrency trading landscape today.

Simply put, BTSE is a futuristic trading platform for both Spot and Futures. It was designed to bridge traditional fiat markets with a multi-currency derivatives trading platform and spot exchange.

The company was founded in 2018 and was originally based in Dubai and licensed by the Department of Economic Development. However, its operations are being transitioned to a new location in the British Virgin Islands, North America.

BTSE is led by a founding team of 4 elite visionary entrepreneurs, traders and engineers with over 6 collective decades of professional experience in the relevant fields of business and venture building, marketing, investment, Cybersecurity, state laws, and technology, with strong backgrounds and networks in top institutions such as Goldman Sachs, Cisco and IBM. They lead a team of great individuals and professionals from several parts of the world.

BTSE’s ultimate goals are simple; To bridge the gap between world finance and the crypto industry by making the entrance into the crypto spots and futures trading space easier and more enjoyable for everyone, and to raise the bar in the industry by creating a suite of standard tools and services that empower its users to take control of their financial freedom.

However, BTSE won’t be the first or the last trading platform on the internet. In fact, there are a plethora of exchanges that already enjoy the first-mover advantages in the Crypto and Fiat derivatives industries. This is why a lot has to be put in place to help BTSE stand-out in such a highly competitive space.

To be able to achieve these vision, BTSE is rolling out a set of smart, innovative features that allow for easy interoperability and transactions between world assets and currencies for both retail and institutional traders. These features include the following;

Rich, User-friendly Interface for Great Trading Experience.

BTSE offers a unique and intuitive trading interface and a host of modern trading tools (such as Market Trailing Stop Orders, OCO, Indicators, etc), that allows both professional and new traders the comfort and technical abilities to make the best trading decisions with very minimal or no supervision at all.

Users can create accounts for either personal use or for a corporate entity. Although there is no KYC requirement for trading crypto-crypto pairs, KYC is required for the deposit and withdrawal of Fiat currencies to respect state and regulation laws.

As seen in the gif I created above, traders can deposit and withdraw a list of Fiat and Cryptocurrencies, and as well transfer/distribute those deposits out of the wallet section to various contracts or currencies of their choice.

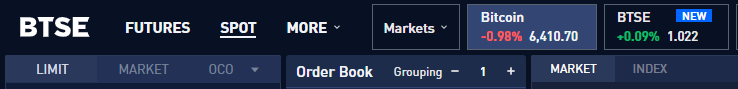

The Spot trading user interface is simple to understand. It has the market chart by the right and the panel for placing buy/sell orders by the left. It also displays the user balance both in USD and BTC values, shows the all-in-one order book with two buttons that adjusts the price grouping, and toggles the display currency to show the various currencies which are available for trading.

Spot, Margin, Futures, Cryptos and Fiats, All In One Place.

Unlike several conventional trading platforms where users are limited to trading either cryptocurrency pairs as Spot, or purely fiat pairs, BTSE bridges the gap between the liquidity of both traditional fiat and crypto traders, by offering additional capacity for trading both spots and derivatives (Futures) for a select range of currency pairs.

This includes multiple fiats on- and off-ramps support for about 9 major fiat currencies, as well as a host of other major cryptocurrency pairs and indexes.

The Fiat and Cryptocurrencies on the BTSE exchange includes;

- Fiat: USD, AUD, GBP, CAD, HKD, AED, EUR, JPY, SGD.

- Cryptos: BTC, ETH, USDT, XMR, LTC, TUSD and USDC.

Now, Traders can choose to trade both futures and spots between any pair they want. They can trade crypto-fiat pairs, crypto-crypto pairs, fiat-indices pairs, crypto-indices pairs, etc.

The All-in-one Orderbook.

On the quest to bring you the very best trading experience possible, BTSE is proud to announce an exciting upgrade. Our new “All-In-One Order Book” allows users access to more trading pairs, fairer pricing, and further savings on fees. -- BTSE Whitepaper.

BTSE implements an all-in-one multiple currency order-book that is both easy to use and easy to understand. The order book works by aggregating the orders/prices on all traded pairs on the BTSE exchange into a single, unchanging and tradable order book.

As demonstrated in the short demo available on the official blog here, users will not be tied to a single base currency as they can easily switch between trade pairs of their choice with a single click without sacrificing liquidity. This improves the speed of trade execution, allows for fairer pricing for smaller currencies, and helps boosts the liquidity on every trading pair and allows for orders to be easily placed in the currency

Life-time referral program.

BTSE is a user-centric exchange and as a way of giving back to its community of users, the platform features an unmatchable, highly-lucrative referral program that allows anyone to earn BTSE tokens for a lifetime when they invite their friends to trade on the exchange.

Currently, users can enjoy 30% of their friend's trading fees based on referral. This rate will be reduced to 20% by April 10th. They will also enjoy 10% of their friend's earned referral fees, as well as more bonuses when their friends invite more friends. There is no limit to the number of people a user can refer to the platform.

Also, users also stand a chance to increase their referral bonus by 40% depending on the amount of BTSE tokens they hold themselves. More information on the referral program can be found on the BTSE referral announcement post

No daily withdrawal limits, Lower trading/withdrawal fees.

Because the platform is built with high-volume transactions in mind, there will be no withdrawal limit on any account. This supports high liquidity on the platform and allows traders the liberty to move their funds whenever they want.

However, there are trading limits for Spot trades, with the minimum for bitcoin and BTSE token being 0.002 BTC and 1 BTSE, and the maximum amounts being 2000 BTC and 25,000 BTSE respectively.

Also, all fees on the exchange are pretty low and pocket friendly. BTSE does not have a minimum deposit amount for crypto nor does it collect fees on deposits (except a 0.3% on Diamond Coin DC). Maker and Taker fees vary according to a few metrics such as the amount of BTSE tokens being held, and the 30-day trading volume of the trading account.

For fiat, however, the exchange does have a minimum deposit amount of $100 USD with no deposit charge at all, and a service charge of $3 if the deposit is less than $100 USD.

More information on the various fees on the exchange can be found on the Support article: on the official blog.

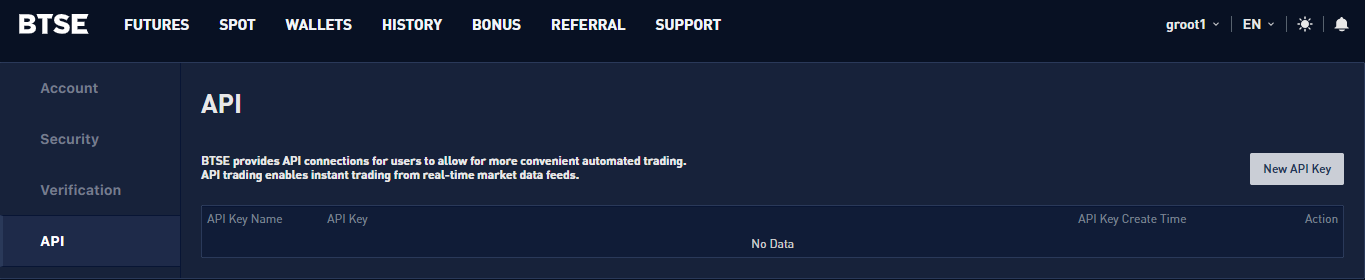

Interoperability of tools through API integrations.

The BTSE platform gives traders the ability to utilize some of their favourite 3rd party tools and services through secure API integrations. Traders can choose to automate their trades or simply control them from other applications directly as they so desire.

State-of-the-art Security Through Horizontal Scaling Tech.

Crypto trading platforms in the past have been notorious for cases of theft and loss of customers’ funds. There have also been frequent cases of unscheduled maintenance and downtimes that ultimately affect the traders.

BTSE brings stability, scalability and security to the crypto trading landscape by implementing horizontal scaling technologies to develop all of its exchange features from the ground up. This includes a self-hosted website, well-distributed data centres to reduce risk and redundancies and regular engagement and system-wide audits with penetration and cybersecurity experts. All of which enhances the safety of user funds, mitigates cases of downtimes due to system overloads and allows for uninterrupted operation of a high-volume trading system.

Currently, traders can secure their accounts through state-of-the-art 2FA and email verification systems. There will also be IP verification in the future.

Also, with Blockstream’s Green and Liquid potentials on BTSE, traders who love a bit more privacy can opt to make confidential transactions to keep things private.

Multiple Currency Collaterals/Currency Settlements on Derivatives.

Futures contracts are simply an agreement to buy or sell an asset at a later date for a fixed price. They are typically used by traders as a way to hedge other investments or to lock in profits when trading in volatile markets.

Traditionally, Futures settlements are restricted to the base currency used as collateral during the time of entering the contracts, say USD, USDT or BTC.

However, the BTSE exchange operates a multi-currency fiat-to-crypto exchange, with cryptocurrency Spot and Derivatives markets. This allows traders to use a combination of both crypto and fiat as margin collaterals, as well as the ability to enact trade settlements in either BTC, USDT and USD, without any need for conversion, regardless of the currency used as collateral when initiating the contract.

Also, with its Linear US Dollar Settled Futures, users can settle contracts and convert profits into fiat with a single click on the order book. This bridges the gap between traditional fiat-based traders and coin holders.

Strong, Meaningful Networks and Partnerships.

BTSE already have strong partnerships and connections with various financial institutions that help streamline their service to allow for a smoother trading experience on the exchange. One of such partnerships is with Blockstream.

BTSE is proud to be a member of Blockstream’s Liquid Network, an inter-exchange settlement network, and will be one of the first exchanges to integrate Liquid USDT for deposits and withdrawals. -- BTSE Whitepaper.

BTSE is solving the liquidity problems that are experienced in a lot of trading pairs on various exchange platforms. The Liquid Network helps improves the overall liquidity of BTSE exchange by connecting, comparing and then pooling together the best orders from various exchanges that are a part of the network in real-time! This instantly opens up BTSE to a larger market beyond their reach, reduces the problems associated with price manipulations and fake volumes on in top centralized exchanges, and ultimately increases liquidity on the platform!

Also, with BTSE implementation of Liquid, high-frequency and Arbitrage traders can store their crypto assets on non-custodial wallets off the BTSE exchange, and yet enjoy the interoperability and ease of moving their funds between different exchanges in the network without having to wait for long confirmation times on the corresponding blockchain for that cryptocurrency. This not only reduces the risks of keeping one’s tokens on exchanges but also allows traders to quickly take advantage of trading opportunities as quickly as possible.

Some of the exchanges in the network include Bitbank, Bitfinex, Bitmax, BitMEX, Coinone, Gate.io, Huobi, OKCoin, OpenNode, Zaif, etc. To see a full list of the exchanges and platforms that are a part of Blockstream’s Liquid network, check out Blockstream's FAQ.

BTSE has also partnered with several other projects and financial institutions in the space, example includes BTCPAY, an open-source payment processor, FBG capital, Lemniscap, CMS Holdings, Taureon capital, GBCI Ventures and BCB blockchain, and the recent partnership with BNC (Brave New Coin) to launch the BBAX index which tracks 4 altcoins (ETH, XRP, LTC and EOS).

BTSE -- One Token To Rule Them All

The BTSE token was created to power the BTSE ecosystem and to allow traders to access an additional suite of services on the BTSE platform. It is the first exchange token to be built on the Liquid Network, which is a sidechain on the Bitcoin Blockchain.

Users can either hold them or use them for a wide range of utility. The BTSE token allows traders/entities:

- Access advanced trading functions.

- Save as much as 60% on trading fees by holding it.

- Trade against other crypto and fiat currencies

- Use it as collateral and settlements for margin trades and futures contracts.

- Easily move funds between exchanges on the Liquid network.

- Use as payment for listing fees for cryptocurrencies.

According to CEO Jonathan Leong, the BTSE token is a completely voluntary facet of the BTSE environment, and its creation comes at no detriment to those deciding to opt-out. This implies that traders are not necessarily required to hold the BTSE token before being able to use the platform for trading or to access the main features of the exchange.

BTSE initiated and concluded the Public Token Sale of the BTSE token on March 5th, 2020, in which a total of 1 million tokens were completely sold within minutes. The tokens were sold with an initial sale price of $2 and included a freeze period depending on the volume bought. Each verified account was limited to a maximum purchase of 25,000 BTSE tokens.

BTSE token stats:

- Token Ticker: BTSE

- Total supply: 200 million BTSE coins.

- Current circulating supply; 3 million coins (according to Coingecko)

- Current market capacity: $3,111,131

- Token's Blockchain: Liquid Network (A Bitcoin sidechain).

- Block explorer: Blocktream.info/

- Current price: $1.03 --- Transparency Report Page

There is also a buy-back program lined up in the future to help support the liquidity of the BTSE token.

Growing and Giving Back to a Community.

BTSE isn't just interested in bringing in more liquidity into the crypto space alone. It is also keen on building the industry through a few initiatives such as its BTSE Academy, the BTSE blog, community bounties and trading competitions, regional community outreaches in continents such as Africa and Europe, etc. Through these initiatives, more people will get to know and appreciate Blockchain technology solutions as well as learn how to use the BTSE exchange.

Getting Started

To create an account is simple;

- Go to the official website: https://www.btse.com/en/home

- Hit the 'Register' button located at the top-right corner of the page

- Input a preferred username, an email address and a password of choice.

- Solve the Captcha and input a referral code (optional). Then hit the Submit button.

- An email will be sent to your provided email address where you can verify your registration.

- Follow the link from your email to login on the website.

- Viola, you can now deposit cryptocurrencies and trade them on the platform.

If however, you'd like to deposit Fiat currencies, You'll have to complete the KYC requirements on the accounts section of the website.

If all of this makes sense to you, and you are interested in finding out more about BTSE Exchange, Feel free to

Visit their website

Check their telegram channel

Watch their BTSE Academy YouTube videos

Read their Medium articles

Join their Twitter

Read the entirety of this post. I love the road map of this exchange in the long run. Their partnerships and features, all seems cool.

Absolutely bro. I also found that they have a testnet for people who want to learn how to trade derivatives without using real money. Although, emotions cannot be simulated, I do think it will help new traders understand the platform and the tools before using their real money.