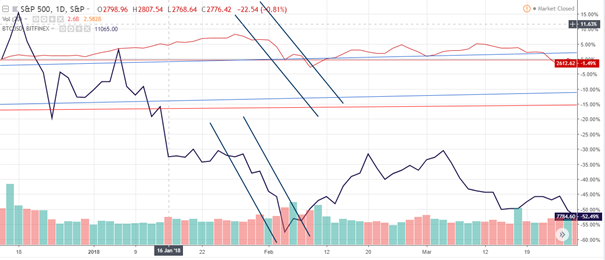

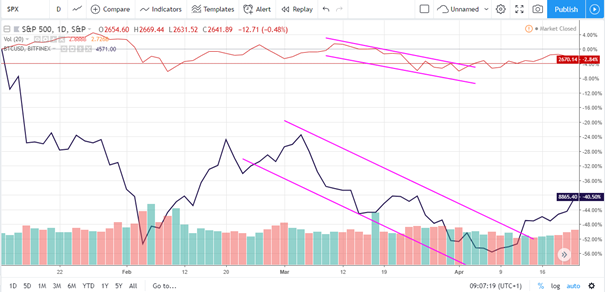

This is not the first time we have observed, in fact its easily the third time this year, that BTC and the stock market have suffered significant price drops in the exact same time frames.

BTC / SPX price drop Jan29th to Feb9th

March 8th -April 2nd

September 20th until Today

Gold vs Bitcoin

(Can you find the correlation? Probably Not)

My previous blog about Gold vs Bitcoin: https://steemit.com/trading/@renej/btc-can-t-be-compared-to-gold-not-yet

If people still believe, crypto and financial markets have no connection at all, you probably should get back to your books and study a little harder. Its time you face the reality. The incredible amount of exchanges that are accessible to retail and institutions have made the crypto industry extremely accessible for the capital investment and withdrawal.

Currently all industries are suffering, transports, homebuilding, mining, you name the industry, its probably in the red, so is crypto. The current believe that bitcoin is a safe haven hedge has been disproved 3 times this year already. (charts above)

There is further data, that Bitcoin is indeed classed as a risky investment class and not as a safe-haven. Earlier this year I had pointed out the negative correlation of BTC and the VIX, in fact it is so incredibly well correlated, (in a negative way) data at this point can no longer be considered as pure luck.

My blog| BTC and its negative correlation with VIX https://steemit.com/trading/@renej/bitcoin-vs-vix-or-a-perfect-negative-correlation

BTC VIX negative correlation Chart

2018 was the first year of data collection that can be taken on a serious note. If financial markets suffer, so does the crypto industry. There have been a few articles this year for Bitcoin’s chart being the same as the gold chart before the ETF, comparing decades of gold prices to Bitcoin. There is a chance they could be right, but if you look at live facts and data, you may wonder if Bitcoin already has found its place on the equity markets. (or you can keep trying to find the ONE chart of a different commodity, somewhere out there, that might, just might, look the same as Bitcoin….)

My previous Blog: https://steemit.com/trading/@renej/bitcoin-vs-vix-or-a-perfect-negative-correlation

Why would Bitcoin not be a safe haven?

There are 2 reasons it can’t be a safe-haven for now (perhaps it will be in a decade or so)

Reason 1: BTC Futures, Futures of bitcoin are traded by instructional investors. Institutional investors see bitcoin as a new financial class that carries great risk. Try convey a professional investor that Bitcoin is such a safe asset to invest in if it had a price movement of +300% and -80% within 365 days. Even more extreme price movements could be witnessed for the majority of the altcoins out there. As Bitcoin rises, the risk acceptance of investors increases (or its probably already at the top). S&P500 and Bitcoin have dropped significantly 3 times this year in the same time frame. These are important signals that tell us, big money is moving out of crypto, when general risk acceptance for the money market dries out. (It could be compared to biotech, it is common to follow biotech ETF prices to assess the risk acceptance on the capital markets).

Reason 2: Bitcoin and top 20 coins need to move independently.

In my short blog earlier on this year (btc vs gold), I had stated that bitcoin and altcoins need to have independent price movements. As long as Bitcoin represents the rest of the crypto industry, Bitcoin can’t be a safe haven, as it reflects too many risky classes at the time being. Perhaps the individual well read crypto fanatic, understands the differences of Zcash, Monero, Bitcoin, Ethereum, Cardano, IOTA etc. They all have different purposes and in fact have created their own crypto asset segments, but for the general public, the rest of the world, its all well, just Bitcoin. It is going to take a few more years before the acceptance of various segments within crypto to take place and creat highly capitalized ETFs reflecting each segment within. Such a day will arrive, but only when crypto has reached a general market usage that improves our way of living and making business as a whole on a daily basis.

Bitcoin will remain a high-risk asset class. Only when capital markets are doing well in general, with decent risk taking undertaken in other high-risk classes such as Biotech or IPO participation, as well as the VIX fluctuating at relatively low levels over a longer time period, institutional investors may decide to move into Bitcoin. In the end they are reliable in the face of their clients, if things go south.