Matt Hougan has influenced a profession to move from ETFs to digital currencies. He hopped from the customary store market to a digital currency list subsidize director, a market he depicted to Bloomberg as a "generationally noteworthy open door with fascinating difficulties."

He joins San Francisco-based Bitwise Asset Management as VP of R&D. He made a sprinkle with his call that cryptographic forms of money are en route to being a multi-trillion dollar showcase, however he admits to Bloomberg cryptos remain a "beginning time innovation" that could be a rough street on occasion.

"The pathway to $1 trillion in the long run is genuinely sure. How we arrive will be instability and awkward. I think we'll arrive quite soon, however. I wouldn't be shocked in the event that we finished the year with a cumulated showcase top of over $1 trillion. In any case, I wouldn't be amazed if there were a critical drawdown again before we arrived," Hougan told Bloomberg.

For example, Hougan proposes the cryptographic money markets could endure a half drop before accomplishing a $1 trillion consolidated market top. Furthermore, as the main advanced coins have demonstrated so far in 2018, unpredictability is the name of the amusement. "I think for speculators the essential thing to understand it's a to a great degree unstable, high-hazard resource. That is the reason you have the high potential returns," he said.

To the naysayers, who would never envision bitcoin contending with gold or working in installments/cash exchange, he courteously recommends they're foolhardy and overlooking that "tech increments at an exponential rate."

Hazard and Reward

Bitwise's most up to date enlist offered some point of view on a generally inauspicious day when the main digital forms of money were all exchanging the red. To begin with, he laid out the dangers that digital currency financial specialists are uncovering themselves as well, which can be summed up in like manner:

administrative

mechanical

organize scaling

terrible on-screen characters

Be that as it may, he didn't abandon it there, indicating next the potential prizes for being an early speculator in cryptographic forms of money.

"You will be repaid with high potential returns for going out on a limb now," he stated, indicating three-to-10 years ahead when digital currencies will be a "more settled resource class," at which time instability will be more much the same as what's typical in the value and security markets, with higher upside potential.

Hougan is no more bizarre to developing innovations, having joined the ETF space when it was as yet an early innovation before the assets fundamentally advanced into pretty much every retirement design in America.

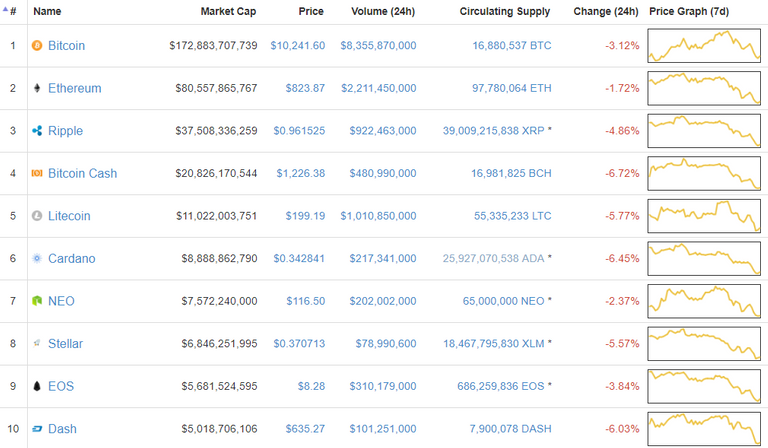

In the interim, the Bitwise Hold 10 Private Index Fund, the industry's lady cryptographic money file subsidize, holds the main 10 advanced coins by esteem. The reason, Hougan recommended, is on account of the leaderboard can move. "The main mover isn't generally the victor," he told Bloomberg, including:

"The huge tops have the biggest possibility of accomplishment however nothing is ensured. Financial specialists would be silly to wager on a solitary digital money – you need to expand your introduction," prompted Hougan.

In his new part, Hougan will be centered around order and examination of cryptographic forms of money. Bitwise's choice to court ETF veteran Hougan proposes that a bitcoin ETF could be not too far off.