Let me start by saying I am by no means an expert. I am just a guy who loves crypto and how it is helping shape the future. I also enjoy trading crypto as it is not only exciting but extremely profitable if done right.

So, coming into the weeks leading up to August 1st I started working on my plan of attack to not only get me through the Bitcoin (BTC) fork but also give me the most returns. Turns out while my strategy did bring me some nice profits it also left A LOT on the table.

Pre Fork Strategy

My strategy leading up to the fork was simple, accumulate as much of my favourite ALTS as possible and taking shelter there while completely disregarding the option of receiving free Bitcoin Cash (BCH). My thoughts were that while everyone was busy trying to claim their Bitcoin Cash and ALTS were getting dumped I would scoop them up. Then when everyone wanted to buy back their ALTS prices would pump and they would need to buy them back from me at a premium to what they sold.

I also only trade with funds that I am prepared to lose or have tied up indefinitely as it takes away the emotion from trading. Doing this has always allowed me to hold bags as long as it takes to break even or see that eventual pump.

The strategy seemed simple enough. Turns out I was wrong. Whilst I still made money and will make more when the ALTS start pumping when Bitcoin settles down I did leave a lot on the table.

How would I have done it differently?

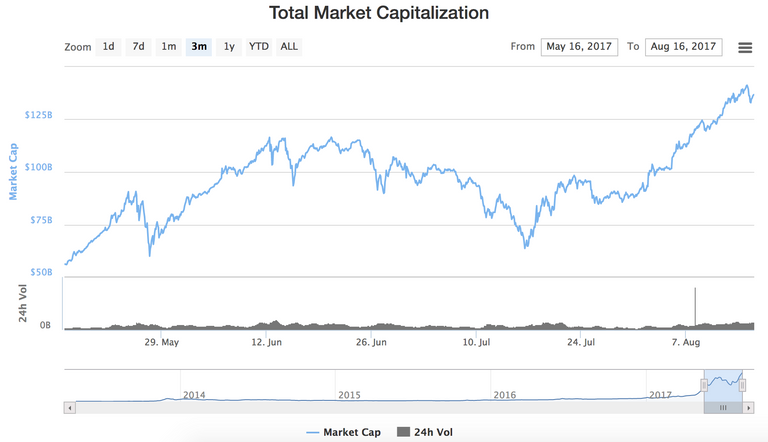

Hindsight is a real bitch but it is one of our best teachers. So what I didn’t factor in was the added attention Bitcoin would get post fork, driving the price to All Time Highs (ATH) and in turn driving the BTC/ALT prices down. With this now in mind I would have split my portfolio putting more into Bitcoin to not only claim Bitcoin Cash but to be ready for the FOMO money flowing back into Bitcoin driving the prices up and ALT prices down.

If I followed this strategy my portfolio would be roughly 30%+ than what it is now, based on rough calculations and the spread of ALTS I have.

So now that I have learned my lesson I am more prepared and I feel I have a wider perspective on crypto as a whole allowing me to make better decisions especially leading up to big events.

I also can’t stress enough to only trade/invest with funds you can afford to lose. It has been the one thing that has gotten me through some bad trades as I have the ability to remove my emotions and ride out the trade if I missed a reasonable exit.

I would love to hear in the comments about your pre/post strategy and what you would have done differently now that hindsight is in play.

Happy trading!