Welcome to the daily crypto news :

State-Backed German Bank Says Bitcoin Will Leap to $90,000 in 2020;

Crypto Traders’ Lawsuit Claims Bitfinex, Tether Cost Market Over $1 Trillion;

CNBC Crypto Analyst Suggests Bitcoin Price Will Rally Higher;

The Silver Lining in Block.One’s SEC ‘Slap on the Wrist;

State-Backed German Bank Says Bitcoin Will Leap to $90,000 in 2020

The German bank BayernLB has published a report on Bitcoin (BTC) versus gold, in which it predicts a big leap for the cryptocurrency in 2020.

Bitcoin outshining gold?

On Oct. 1 the Munich-based, state-owned bank published its latest research report that seems to suggest that the forthcoming Bitcoin halving effect is yet to be factored into its current price of about $8,300.

The financial institution explained that gold had to earn its high stock-to-flow ratio “the hard way over the course of millennia.” Bitcoin on the other hand will most likely succeed to obtain a similar stock-to-flow ratio to that of gold in the coming year, the report predicts.

Senior FX analyst at the Bayerische Landesbank and author of the research report Manuel Andersch, says stock-to-flow ratios are a a way to quantify the “hardness” of the asset. Andersch said:

“Historically speaking, it has invariably been the commodity with the highest stock-to-flow ratio at that juncture which has been used as money because this enabled the best value transfer over time.”

The stock-to-flow ratio of a commodity such as gold is the amount of the asset that is held in reserves, divided by the amount of the asset produced annually.

The author concludes the report by saying that the Bitcoin's stock-to-flow ratio is certain to substantially increase in May 2020, adding:

“If the May 2020 stock-to-flow ratio for Bitcoin is factored into the model, a vertiginous price of around USD 90,000 emerges. This would imply that the forthcoming halving effect has hardly been priced into the current Bitcoin price of approximately USD 8,000.”

Gold bug pounces on Bitcoin price drop

Clearly not everyone will agree with BayernLB’s price prediction. Cointelegraph previously reported that gold bug Peter Schiff returned to bashing Bitcoin as it fell from $9,700 to a low of $7,990 in hours. The Bitcoin critic claimed the shedding of $1,800 was just the start, saying:

“Bitcoin has finally broken below the support line of the large descending triangle it has been carving out for months. This is a very bearish technical pattern, and it confirms that a major top has been established. The risk is high for a rapid descent down to $4,000 or lower!”

Crypto Traders’ Lawsuit Claims Bitfinex, Tether Cost Market Over $1 Trillion

A new lawsuit claims crypto exchange Bitfinex and its sister company Tether manipulated the crypto market, harming traders and benefiting themselves.

Bitfinex and a number of affiliated entities engaged in deceptive, anti-competitive and market-manipulating practices, resulting in economic damages for the plaintiffs, according to a lawsuit filed Sunday in New York.

Notably, the plaintiffs, who seek class-action status, claim that the total damages add up to more than $1 trillion, writing:

“Calculating damages at this stage is premature, but there is little doubt that the scale of harm wrought by the Defendants is unprecedented. Their liability to the putative class likely surpasses $1.4 trillion U.S. dollars.”

The lawsuit, filed by David Leibowitz, Benjamin Leibowitz, Jason Leibowitz, Aaron Leibowitz and Pinchas Goldshtein, are represented by Vel Freedman and Kyle Roche – the lawyers who recently won a federal case against Craig Wright. Bitfinex, Tether, Digfinex and current executives; former chief strategy officer Philip Potter; and payment processor Crypto Capital are named as defendants in the case.

“The crimes committed by Tether, Bitfinex, Crypto Capital, and their executives include Bank Fraud, Money Laundering; Monetary Transactions Derived From Specified Unlawful Activities, Operating an Unlicensed Money Transmitting Business, and Wire Fraud,” the filing says.

In the complaint, the plaintiffs further claim Bitfinex and Tether “shared false information about USDT being backed 1:1 by U.S. dollars,” referring to an allegation made by the New York Attorney General’s office in April. It continues to allege the USDT was used to purchase bitcoin to inflate the crypto market, spurring the 2017-2018 bull market and subsequent bust.

In a statement sent to CoinDesk after this article was published, David Leibowitz said, “As someone who has been invested in bitcoin and the growth of the cryptocurrency ecosystem, I believe that bad actors in this space have stunted development and consumer confidence.”

Market manipulation?

In response to a request for comment, Bitfinex/Tether spokesperson Joe Morgan sent CoinDesk a statement published over the weekend, which stated that the companies expected a lawsuit based on “an unpublished and non-peer reviewed paper falsely positing that Tether issuances are responsible for manipulating the cryptocurrency market.”

It went on to add:

“Tether and its affiliates have never used Tether tokens or issuances to manipulate the cryptocurrency market or token pricing. All Tether tokens are fully backed by reserves and are issued pursuant to market demand, and not for the purpose of controlling the pricing of crypto assets. It is irresponsible to suggest that Tether enables illicit activity due to its efficiency, liquidity and wide-scale applicability within the cryptocurrency ecosystem.”

In a statement, Roche said, “There was an enormous amount of work put in by the lawyers of our firm, particularly by Joseph Delich, to research the facts related to the conduct outlined in our complaint. I look forward to working with my team as the litigation plays out.”

Allegations that Tether has been used to manipulate the cryptocurrency market have circulated for more than a year. In a study published last June, researchers with the University of Texas at Austin said bitcoin’s price rose after the “the Bitfinex exchange use[d] tether to purchase bitcoin when prices are falling.”

The U.S. Department of Justice is reportedly looking into the allegations, though it is unclear if the Department has drawn any conclusions at this time.

However, another study published last September by University of Queensland professor Wang Chun Wei found that while “tether grants were potentially timed to follow bitcoin downturns,” the actual correlation was “not statistically significant.”

CNBC Crypto Analyst Suggests Bitcoin Price Will Rally Higher

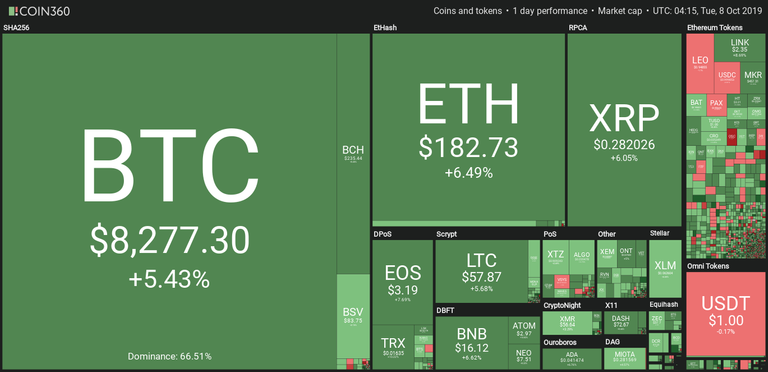

The $8,000 mark seems to be an important price point for crypto’s market leader, Bitcoin (BTC). Since its breakdown from $9,400, the digital asset has lost and regained the $8,000 level several times, sitting at $8,300 at press time. Much of the time, altcoins follow Bitcoin’s lead in terms of price, making the digital asset’s activity a strong indication of the current market state as a whole.

After a stark $1,700 drop in price on Sept. 24, Bitcoin and the rest of the cryptocurrency market seem to have taken a few steps back regarding the overall trend, which showed significant exuberance in June 2019. According to popular crypto-Twitter analyst Big Cheds, the upcoming days are likely bearish for the crypto space in the short term but the analyst remains bullish over the long term.

Reveal spoiler

Big Cheds predicts a price reversal

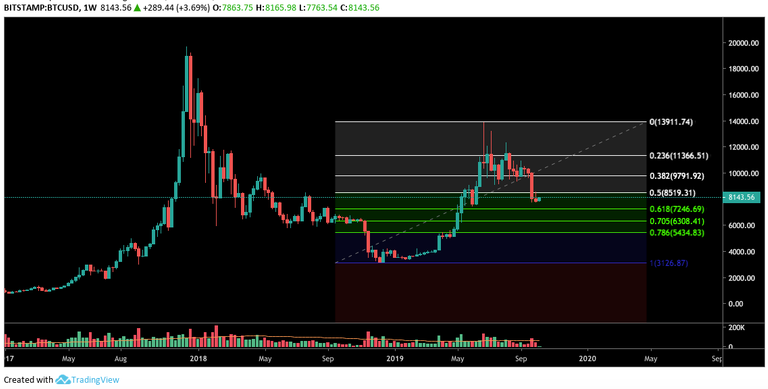

Big Cheds pointed out that on Oct. 6 Bitcoin closed out another weekly candle with a tweezer bottom. This candlestick pattern occurs when two price candles have lower or upper wicks that align to form the shape of tweezers, a common cosmetic tool.

At times, tweezer patterns can be an indication of a reversal in the price of an asset. Candlestick patterns and formations generally possess strength based on their candle time frame length, with larger time frame candles holding more weight.

Closing out a weekly candle in the form of a tweezer pattern holds a fair amount of significance in terms of this pattern, seeing as weekly candles are one of the higher time frame outlooks.

The analyst noted the tweezer pattern occurred near the bottom arm of the weekly Bollinger Band indicator, which shows that Bitcoin’s price is relatively low. Big Cheds also said the above signs show oversold conditions, although he added that Bitcoin’s most recent weekly candle did not close with strength.

Big Cheds said:

“There is support here from July 2018 as well as May 2019, so it is not unlikely that we will see a short-term bounce. In addition there is a hidden bullish divergence with OBV’s lower low versus price, suggesting bullish continuation.”

Such support and divergence are clearly seen on the chart Big Cheds provided to CoinTelegraph.

Reveal spoiler

Altcoins decline and find a bottom

Since Bitcoin’s multi-month consolidation began, altcoins have suffered significantly, posting lower numbers by the day. Altcoins are largely reliant on Bitcoin’s price action and have been unable to gain momentum. To date, alt season continues to elude investors but some relief could be around the corner.

Regarding the current outlook of the altcoin market, Big Cheds noted bits of positivity matched with uncertainty. According to the analyst, “Alts, in general, have been improving, with several of them forming bottoming patterns, while others have been uptrending, including LINK, XRP, and TNT.” “That being said, many of them still are weak and look to continue further down, and I reject any categorization of alt season.’"

Reveal spoiler

The crypto market looks bearish and bullish

On a macro scale, Big Cheds believes the cryptocurrency markets will perform well. The “crypto market, in general, continues [to grow] as technology improves and we see exchanges adapting to fluctuating retail and institutional market,” the analyst said. “I am very bullish long term.”

On a midterm scale, regarding the cryptocurrency market’s performance over the next year or so, Cheds noted he has more of a neutral stance, slanting bullish. At present, however, the analyst is bearish in terms of crypto’s performance in the coming months, noting that the crypto space is no longer in a bull market in the short term.

Weekly Bitcoin price chart

As the largest player in the new and developing digital asset space, Bitcoin often dictates the strength of the entire market. On lower time frames, such as the daily and hourly candle charts, Bitcoin’s price situation looks less than ideal for continued upside momentum. Panning out to the weekly time frame, however, shows a case for both bullish and bearish outcomes.

Reveal spoiler

Bearish scenario

After months of consolidation, a strong market likely would have seen Bitcoin break out to the upside, which did not happen. The digital asset broke down in a strong move without providing a significant bounce or reversal. Bitcoin’s price also has not had enough strength to retest the consolidation pattern from which it broke down.

Additionally, Bitcoin’s recent price action appears slightly similar to the digital asset’s capitulation back in Nov. 2018, which was followed by further downward pressure, and eventually led to a severe lack of volatility.

Interestingly, as Bitcoin price broke down on Sept. 24, popular trader Tone Vays made the argument that no new retail funds had entered the crypto space. The lack of interest and funding from retail investors could be a reason for the lackluster continuation of momentum.

Bullish scenario

On the bullish side, the weekly chart reveals that Bitcoin has not yet touched the 0.618 Fibonacci retracement level. Such a level is often viewed as a prime level of interest. Looking at this view, recent downward price action seems fairly normal before another move up.

Bitcoin price is also near a multi-week support level around $7,500. Additionally, this correction may be, in part, the result of the parabolic price move Bitcoin sustained between April and July 2019.

The Silver Lining in Block.One’s SEC ‘Slap on the Wrist’

The only certain thing to say about the implications of any isolated Securities and Exchange Commission case is that it’s risky to assume it sets a precedent. That goes doubly for those in which a settlement is reached with no admission of guilt.

That hasn’t stopped loads of people in the crypto community armchair-analyzing last week’s news of Block.one’s paltry penalty from the SEC over its 2017 sale of EOS ERC-20 tokens. As lawyer Stephen Palley put it over at The Block, “some commentary was useful and a whole lot of it was, well, the kind of blather one expects.”

But that’s not to say one can’t or shouldn’t try to read some tea leaves out of a decision as stunning and historically significant as this one. And while, I’m no lawyer, I am going to go out on a limb and say that, on balance, there are elements in here that the crypto industry should be happy with.

Happiness is not the way many are feeling about this result. A host of crypto commentators are royally angry about it.

It seems many folks don’t like the Block.one crew. In addition to their disdain for the EOS’s blockchain’s governance challenges andthe worrisome centralization of its network in China, many people also felt that the whopping $4 billion raised in the ICO was, well, obscene. To them, that fundraise tally was the high point – or more accurately, low point – of an ICO mania period that many in the community, rightly, want to put behind them.

Block.one’s $24 million payment — with no admission of guilt, and a waiver allowing it to continue to legitimately raise money through future securities issues — represented a mere 0.6% of the ICO’s gargantuan raise. Lined up against up the $225,000 infines and disgorgement that blockchain-based storage provider Sia also agreed to pay in relation to its much smaller $120,000 unregistered securities sale, it just seemed so unfair.

Good lawyers are worth it – if you can afford them

Naturally, the announcement got people’s minds spinning. Why?

Was the soft penalty because Block.one had put geofencing in place and tried to keep its tokens out of the hands of Americans? Maybe. (Some argued that the $24 million fine is possibly about as much was raised from U.S. investors.)

Was it because the SEC now implicitly recognized that EOS has evolved into a decentralized platform and that the new, on-platform tokens into which the ERC-20 tokens were swapped, were not securities? Maybe. (Was this an application of the de facto “Hinman doctrine?”.)

Was there some other, unwritten deal kept off the public record? Who knows?

The reality is that the only reliable conclusion to draw from Block.one’s “victory” is that it pays to get good lawyers. Proof of that lies in the successful waiver request that Cooley lawyer Karen Ubell submitted on the company’s behalf, detailing the lengths to which Block.One has since gone to up its compliance game and do the right thing by the SEC.

As legal commentator Katherine Wu put it in a scribbled comment that was included in another one of her extremely useful post-decision annotation exercises, “Fuck man, their lawyers are good.”

One cynical conclusion to draw, then, is that the crypto startup community is now following the same norms as the Wall Street banks it seeks to dislodge. Here too, it seems, money buys protection, if not from the law per se but from the impediments to business that adverse rulings have on those of lesser means. It’s a melancholy thought for those who want this technology to lower barriers to entry and give scrappy garage-based startups a chance to change the world.

Clues in cooperation

But I also think the negativity slung at Block.one in this instance is excessive. There’s too much desire for schadenfreude in this industry; when people are looking for blood and it’s not delivered, their disappointment is palpable.

A more upbeat view is possible. And it’s also formed from the waiver letter. While its words are those of a Block.one lawyer, not an SEC representative, the letter’s details hint at what the SEC could be looking for from token-issuing entities. Here, it’s important to note that the Cooley letter came, in Udell’s words, after “settlement discussions with the SEC” – a line that Wu annotated with the observation that the two sides had “def been back & forth for a hot minute….” That suggests its contents captured agreed-to-elements that formed the SEC’s implicit quid pro quo for its light touch.

With that in mind, the part of the letter that jumped out at me lay in the section detailing Block.one’s cooperative position with the SEC – one adopted in stark contrast with the team from Kik, who have angrily refused to settle over their ICO and are going to court with the SEC.

It’s the section where the Cooley team highlights Block.one’s work on “technological mechanisms” regarding the token it plans to issue for its decentralized media project, Voice.

These include mechanisms aimed at cutting-edge “identity verification and transfer restrictions that could be used to support compliance with securities laws” in the future, and others that could “ensure that future tokens are only provided to individuals in jurisdictions where it has been confirmed that implementation of such token will be fully compliant with all applicable regulations.”

On all these matters, the letter said, “Block.one is initiating a process of consultation and discussion with staff of the Division, including the SEC’s Strategic Hub for Innovation and Financial Technology (FinHub).”

Signs of openness to innovation

There’s a positive takeaway here about the SEC. The Commission has been maddeningly on the fence, or at least stubbornly silent, on how or whether it should embrace some of the more innovative compliance solutions for strengthening security while reducing friction in science.

Yet here, in a way, we have evidence that the SEC is not only open to innovation but willing even to reward transgressors who help them get their heads around that innovation.

Regulators are an unavoidable reality for startups looking to use blockchain technology to disrupt the old order. Their best hope is not to ignore them, fight them, or try to evade them, but to help them work with the crypto community’s developers to employ some of the incredible cryptographic solutions now at hand to design a more inclusive, less friction-filled financial system.

Block.one might well have gotten less than it deserves. But its approach with government is worth following.