Welcome to the daily crypto news :

Volcker Might Have Said Yes to a Digital Dollar – If He Knew What It Was;

Ethereum Builder ConsenSys Shutters India and Philippines Operations;

2019: The Year Washington, Silicon Valley and Beijing Faced Off Over Crypto;

New York Regulator Details Changes to Contentious BitLicense;

Bitcoin Exchange BitMEX Faces $300M Investor Lawsuit Over Lost Equity;

Volcker Might Have Said Yes to a Digital Dollar – If He Knew What It Was

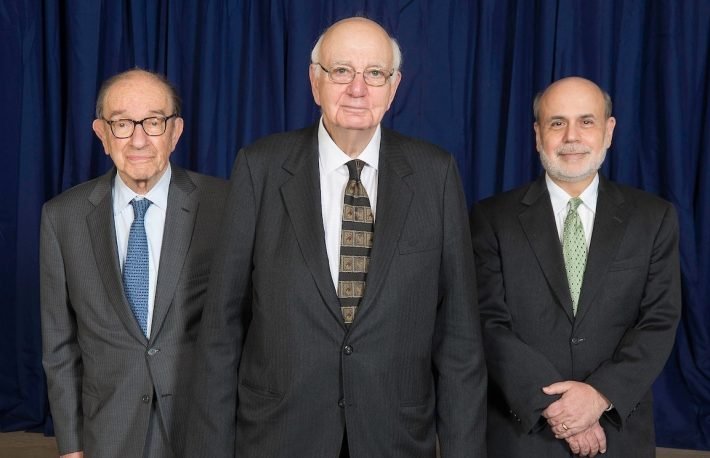

What would the late former Federal Reserve Chair Paul Volcker have thought about digital currencies issued by central banks?

The short answer is nobody knows; Volcker never really got steeped in the fast-developing world of crypto.

"Bitcoin? What's that?" Volcker replied when asked about the largest cryptocurrency by a Quartz reporter in April 2013. "I'm too old to know anything about that."

The question is worth asking, though, since Volcker, who died this week at 92, is regarded as perhaps the most effective and credible Fed chief of the past half century.

Volcker led the U.S. central bank from 1979 through 1987 and is known primarily for jacking up short-term interest rates to as high as 20 percent to short-circuit double-digit inflation. The aggressive move helped to push the U.S. into recessions in the early 1980s, driving the unemployment rate to nearly 11 percent from 6 percent and drawing outcry and pushback from corporate executives, unions and lawmakers. But by the mid-1980s, the inflation rate dropped back below 2 percent, and the economy resumed its growth.

Read more.......

Ethereum Builder ConsenSys Shutters India and Philippines Operations

ConsenSys, the ethereum blockchain development company with over 30 hubs around the globe, has shut down key operations in India and the Philippines, CoinDesk has learned.

ConsenSys chief Joe Lubin informed the teams via email that they would be closed down, people familiar with the situation said.

A member of the seven-person team in India confirmed the closures of the local office and the Philippines operation but referred further questions to the main office in Brooklyn, N.Y.

"A total of 11 roles were eliminated in India and the Philippines due to a realignment of the sales and services team in those countries," said ConsenSys spokesperson Kara Miley, offering no other details.

The cutbacks follow a round of layoffs late last year that saw about 13 percent of ConsenSys' then-1,200-person staff let go (it's down to about 1,000 now). The venture studio grew rapidly during the last crypto bull run when the price of ethereum tokens reached over $1,000 but began refocusing priorities in the depths of crypto winter.

While the India and Philippines operations employed fewer than a dozen people combined, they worked on high-profile initiatives.

Read more.......

2019: The Year Washington, Silicon Valley and Beijing Faced Off Over Crypto

This post is part of CoinDesk's 2019 Year in Review, a collection of 100 op-eds, interviews and takes on the state of blockchain and the world.

Noelle Acheson is director of the CoinDesk Research team and producer of the Institutional Crypto newsletter. She joined CoinDesk in 2016. Galen Moore is a senior research analyst at CoinDesk Research, focused on developing metrics and analysis for crypto asset investors. Christine Kim is a research analyst for CoinDesk. She focusses on producing data-driven insights about the cryptocurrency and blockchain industry.

2019 has been a historic year for cryptocurrency and blockchain technology.

Global state leaders such as President of the People’s Republic of China Xi Jinping and the President of the United States Donald Trump have made public statements addressing the dynamics of this revolutionary tech. Traditional tech companies such as messaging app giant Telegram and social media giant Facebook have made bold promises to integrate crypto into their line of products and services.

Read more.......

New York Regulator Details Changes to Contentious BitLicense

The New York Department of Financial Services (NYDFS) is getting specific about how it will update its controversial virtual currency license.

Announced Wednesday by Superintendent Linda Lacewell at a breakfast held by Crain’s New York, the proposed guidance will modify the approval process for listing new cryptocurrencies. Under the current regime, NYDFS approves every cryptocurrency offered within the state on a case-by-case basis with individual exchanges.

The guidance released Wednesday includes two specific updates the public can comment on: Any coins the regulator approves for listing in New York can be listed by any exchange that operates in the state, as long as they provide notice to NYDFS; and the regulator will publish a model framework for coin listings that exchanges should model their versions around.

"It's more than time to take another look at the virtual currency regulation given the passage of time, changes in the industry, maturation, sophistication and new business models," she said. "What tweaks and changes can we make should we make because, while it is our obligation to regulate, we only want to have enough regulation to get the job done and not a drop more."

Read more.......

Bitcoin Exchange BitMEX Faces $300M Investor Lawsuit Over Lost Equity

A former JPMorgan derivatives trader is suing one of the world’s biggest cryptocurrency exchanges for $300 million after it allegedly failed to deliver his equity.

According to filing with the Superior Court of the State of California in San Francisco dated Dec. 4, Frank Amato and RGB Coin are now pursuing action against BitMEX, its CEO Arthur Hayes and owner HDR Global Trading.

Investor: BitMEX prevented recognition of entitlement

Amato says he was among the first seed investors in BitMEX in 2015, contributing $30,000 on the understanding he would later receive equity in the company. Amato alleges that this has not happened as of the present day.

Following Amato’s initial investment, the exchange purportedly received another $30,000 from startup accelerator SOSV, which would trigger Amato’s contracted equity conversion. However, the filing states that Hayes “sought to conceal information” from Amato specifically to “prevent recognition of his equity.”

Read more.......

Congratulations @sharetosteem! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!