While Congress has not made a lot of movement towards crafting legislation around cryptocurrencies, regulators continue to act.

Below is an overview of the different US authorities that have, or could begin to implement regulation or enforcement actions relating to cryptocurrencies.

SEC

The Securities and Exchange Commission (SEC) gets most of the attention in headlines these days, and that is not without reason.

They carry the power to craft rules, issue interpretations, bring criminal charges, freeze assets, and impose fines. They have not shied away from these powers. Interpretation on ICOs, Charges and freezing actions, Statements of Warning.

The SEC actions and announcements have been felt throughout the industry. ICOs have almost entirely stopped in the US and are generally closed to US residents. Projects like, Neufund, which aims to be The New York Stock Exchange of crypto assets has taken great steps to insulate themselves from US Investors and regulators.

CFTC

Still, with the SEC stealing all of the spotlight, it is easy to miss what other regulators are doing in the space. I think a lot of folks heard about The Commodities and Futures Trading Commission (CFTC) for the first time recently when SEC and CFTC chairs made a joint statement to Congress. But the CFTC has some important powers too. They were able to issue a $75,000 fine against Bitfinex.

They were also the agency that made the way for The Chicago Board Options Exchange (CBOE) and the Chicago Mercantile Exchange (CME) to begin trading Bitcoin futures when the granted LedgerX permission to register as a Swap Execution Facility and a Derivatives Clearing Organization for Bitcoin-based swaps.

One of the reasons for all of the agencies getting a hand in the pot is the lack of clear guidelines for how to classify this asset. The CTFC believes that virtual currencies are commodities, and as such fall under laws like the Commodity Exchange Act (CEA). Unfortunately, that would mean that cryptocurrency transactions would need to be traded on a commission-regulated exchange. Unless of course, an exception applies. Luckily, the CTFC has hinted that in fact, the "actual delivery" exception may apply to these transactions, therefore removing the need for commission-based exchanged.

We will see about that.

FINRA

While the Financial Industry Regulatory Authority (FINRA) is not actually a governmental body, this non-profit entity is responsible for setting rules of licensure for dealers and brokers. It is technically overseen by the SEC, but does have some room to operate without impingement.

FINRA has been content to follow the SEC's lead so far, but they could play an important role in the future of cryptocurrency markets. By opening up or restriction how and who can get licensed to broker crypto deals.

FinCEN and OFAC

The Financial Crimes Enforcement Network (FinCEN) and The Office of Foreign Assets Control (OFAC) deal with regulating and enforcing criminal financial institution laws, like Anti-Money Laundering (AML) and Country-Terrorist Financing Compliance.

It is likely that an organization (or an individual) that administers or facilitates crypto-asset transactions will be classified by FinCEN as a Money Services Business, putting that entity under the jurisdiction of the Bank Secrecy Act (BSA). You may have noticed your favorite exchanges starting to add fine print to their login pages that they "adhere to all ALM requirements."

The linchpin is whether the crypto-asset is considered a "foreign currency." While there is plenty of space for esoteric debate, FinCEN has made it clear that they intend to include crypto in that definition. It is also worth noting that there is no minimum transaction amount that triggers these regulations. Meaning, an individual trading crypto at a local MeetUp may in fact need to register with FinCEN and report suspicious activity.

While they may not be sending moles to infiltrate your Blockchain-enthusiast group just yet, they are making moves. This past July, they fined BTC-e over $110 million and $12 million against the man was “allegedly” overseeing the operation, Alexander Vinnik.

These fines were levied not because of evidence that BTC-e or Mr. Vinnik were engaging in criminal activity, but because they ran an exchange and failed to comply with the registration, protocol, and reporting requirements of FinCEN. Other people were using BTC-e to commit crimes and that is why they were hit with an nine figure penalty.

OFAC enforces very specific economic and trade sanctions. For example, trade embargos against North Korea, Cuba, and Iran and lists of individuals with whom US citizens are barred from doing business with.

Conducting a transaction with a person or organization on OFAC’s list can carry significant civil fines and even criminal liability. Compliance with these prohibitions falls squarely with the organization facilitating transactions. While not directly required, you may have noticed that exchanges have started to implement Know Your Customer (or, KYC) procedures to prevent flagged individuals from gaining access to their platforms.

Then There is the Taxman

Both the Internal Revenue Service and state tax authorities (where applicable) are looking at taxing crypto-assets and transactions. Back in 2014, the IRS announced its position that it will treat crypto and virtual currencies as property, not as currency, for taxation. This does provide some guidance. However, a lot of tokens do things that other kinds of property don’t (e.g. forking), and it is not clear how those events will be treated for tax purposes.

Still, the lack of definitive guidance has not stopped the IRS from pursuing enforcement actions. There is ongoing Federal litigation in California regarding their request for Coinbase customer information (US v. Coinbase, Inc., 2017 U.S. Dist. LEXIS 196306 (N.D. Cal. Nov. 28, 2017)).

Most recently, the new US Tax Law changes a “loophole” that allowed crypto trading to be non-taxable until converted into fiat or used at a point of sale for goods or services. This was known as the 1031 like-kind exception. The new law states that 1031 exchanges now only apply to real estate transfers. Therefore, this means that every cryptocurrency trade is a taxable event under the capital gains tax.

Lost yet?

What a mess.

Unfortunately for us, this will probably not get straightened out until Congress decides to act. They don’t have a great track record lately of moving things along very quickly. Or, if they are quick, they tend to be sloppy.

I’ll keep my ear out for rumblings and let you fine people know what I hear.

Until next time, be blessed.

~Sam

If you have an itch to go deeper, or maybe you are specifically looking for advise as a lawyer, then check out this article. It is not free, but I found it incredibly comprehensive and covers most of what I covered here, but with greater detail and some tips.

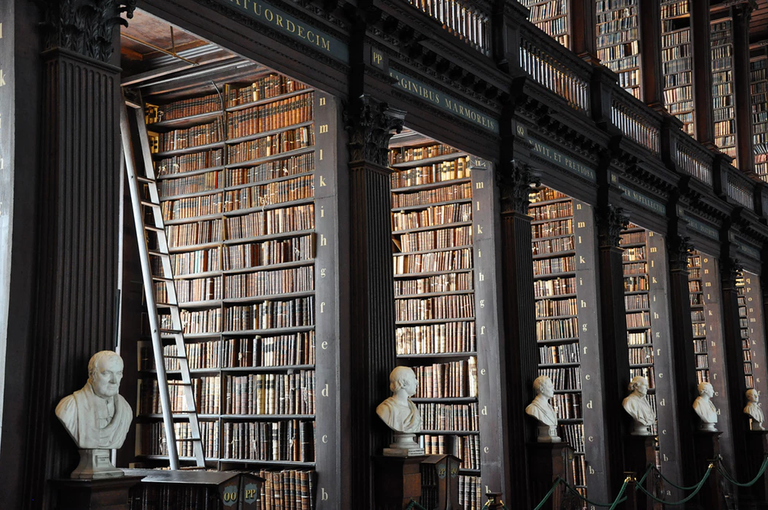

Image Source: Library, FINRA, Red Tape

Recent Posts:

Steps of Healing #4: Birthdays are Worth Celebrating

Steps of Healing #3: Fireside with You

The Weight of Quiet: 15 Minute Free Write

YSunday Soul Tap #3: Into The Wilderness

Like most of you, I have been trying to build my Steemit account and community. It can take a lot of work to get started, but you are not without resources!

Steem Follower

Greetings! I am a minnow exclusive bot that gives a 5X upvote! I recommend this amazing guide on how to be a steemit rockstar! I was made by @EarthNation to make Steemit easier and more rewarding for minnows.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Sam Simkins from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

This post has been upvoted & resteemed by @Tesouro, for more details see this post

This has received votes from two accounts, @thundercurator and @entrepreneur916 to give you your 300%+ upvote of 0.06+.

That being said…

Investors who delegate SP to @thundercurator are entitled to 75% of @thundercurator income after curation. Get on-board early and grow with us!