The Experiment:

Instead of hypothetically tracking cryptos, I made an actual $1000 investment, $100 in each of the Top 10 cryptocurrencies by market cap as of the 1st of January 2018. Think of it as a lazy man's Index Fund (no weighting or rebalancing), less technical, more fun (for me at least), and hopefully still a proxy for the market as a whole - or at the very least an interesting snapshot of the 2018/2019 crypto space. I’m trying to keep it simple and accessible for beginners and those looking to get into crypto but maybe not quite ready to jump in yet.

I have also started a parallel project: on January 1st, 2019, I repeated the experiment, purchasing another $1000 ($100 each) into the new Top Ten cryptos as of January 1st 2019. Spoiler alert: I'm down on the 2018 Experiment as much as I'm up on the 2019 Experiment, so I've basically broken even at this point.

The Rules:

Buy $100 of each the Top 10 cryptocurrencies on January 1st, 2018. Run the experiment two years. Hold only. No selling. No trading. Report monthly.

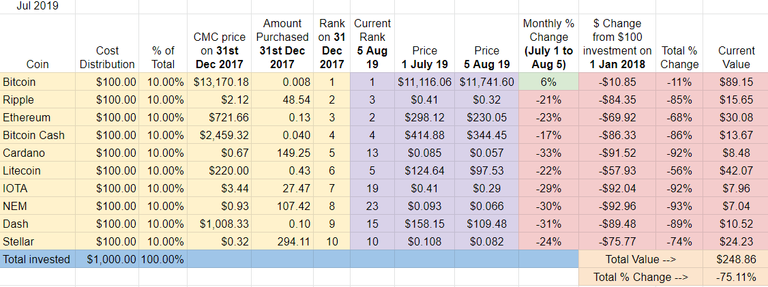

Month Nineteen - Down 75%

July certainly felt like a bloodbath (look at all of that red), but by month's end, the 2018 Top Ten were only down about 4% on the month, which is nothing for crypto. Although modest, this decline signals the end of the five month upward streak.

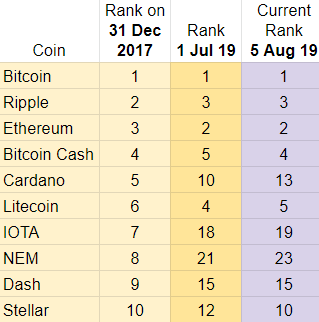

Ranking

Lots of movement again in July, and again most of it downward. After briefly revisiting the Top Ten, Cardano gave up its position and then some, sliding all the way back to position #13. NEM continued its slow and steady fall now at #23 and IOTA, at #19, is now in real danger of falling out of the Top Twenty. Litecoin and Bitcoin Cash switched places with each other (again) and Stellar reclaimed its spot in the Top Ten, rising two slots from #12 to #10.

NEM, Dash, IOTA, and Cardano are the 2018 Top Ten dropouts - they have been replaced by EOS, Binance Coin, Tether, and BTCSV.

July Winners - Bitcoin was the only crypto to finish the month in positive territory, up +6%.

July Losers - Cardano lost -33% of its value and dropped three spots in the rankings. Tough month for ADA to say the least. Tough month for Dash too, down -31% in July.

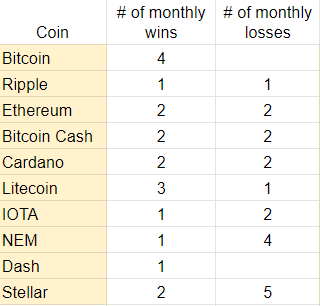

For those keeping score, here is tally of which coins have the most monthly wins and loses during the first 19 months of this experiment. Most monthly wins (4): Bitcoin. Most monthly loses (5): Stellar. All cryptos have at least one monthly win. The only two coins never to lose a month? Bitcoin and Dash.

Overall update – No cyrpto close to Bitcoin as it inches closer to break-even point. NEM, Cardano, and IOTA in the cellar.

Bitcoin followed up a strong May and June with a solid +6% July. It is now down -11% since January 2018 and is approaching the break-even point. Litecoin is a very distant second at -56% since the experiment began.

NEM is still the worst overall performer (down -93%) followed by IOTA and ADA both down -92%. My initial $100 investment in NEM is worth just $7.04.

Total Market Cap for the entire cryptocurrency sector:

For the first time since February, the total crypto market cap decreased, losing about $13B in July. The overall market cap remains over $300B and Overall the 2018 Top Ten experiment has crossed the -50% threshold and is down "only" -46% at the moment, a level we haven't seen since June 2018.

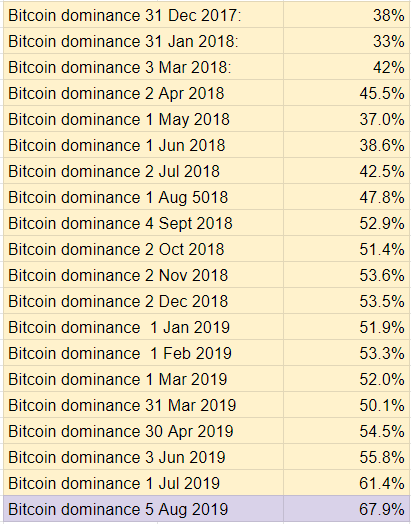

Bitcoin dominance:

Bitcoin dominance saw another large leap in July and now stands at almost 68%, easily the highest point so far in the experiment began in January 2018.

Overall return on investment from January 1st, 2018:

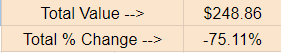

My Top Ten 2018 portfolio lost about $50 in total value this month. This decrease broke the five month streak of increasing total value, which was a record in the experiment.

If I cashed out today, my $1000 initial investment would return about $249, down -75%.

Implications/Observations:

In contrast to the 2019 Top Ten Experiment where Litecoin is the top performer of the year, it's all BTC with the Top Ten 2018 Experiment. Altcoins again lost ground against Bitcoin which now represents over 2/3rds of the value entire crypto market. Although the 2018 Top Ten's streak of five consecutive positive months was broken, BTC's streak is now up to six straight months of growth. And once again this month marks a record high in Bitcoin dominance, 68%, the highest since the experiment started in January 2018.

And Bitcoin continues to increase its overall lead. After nineteen months, it is now 45% ahead of second place Litecoin in terms of return on initial investment.

The experiment's focus of solely holding the Top Ten Cryptos continues to be a losing approach. While the overall market is down -46% from January 2018, the cryptos that began 2018 in the Top Ten are down -75% over the same period. That's close to a 30% difference, the widest gap of the experiment so far.

At no point has this investment strategy worked: the initial 2018 Top Ten have under-performed each of the nineteen months compared to the market overall.

I'm also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. The S&P 500 is now up +9.7% since the beginning of 2018. My initial $1k investment into crypto would have yielded about +$97 had it been redirected to the S&P.

Conclusion:

Even a down month for crypto couldn't stop Bitcoin, which has seen six straight months end with gains. How much higher can it go in terms of dominance and when will we see the alts make a move?

Thanks for reading and for supporting the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports. Keep an eye out for my parallel project: where I repeated the experiment, purchasing another $1000 ($100 each) of a new set of Top Ten cryptos as of January 1st 2019.

May Recap

April 2019 Recap

March 2019 Recap

February 2019 Recap

January 2019 Recap

December/2018 Final Report

November Recap

October Recap

September Recap

August Recap

July Recap

June/Half-time Report

May Recap

April Recap

March/Q1 Recap

February Recap

January Recap

- The Second Steemit Sole Survivor Contest

- A Walk Through A Hidden Redwood Grove in Southern California

- A Walk In Oak Canyon Nature Center - Anaheim, CA

- @checky Tribute Post

- My Steem Origin Story - eoj

- Proof there is indeed life after HF20

- Share Your World - @eoj

- The Get to Know Me Challenge - Top Ten Posts by @eoj

- A Lakeside Walk in Pokhara, Nepal - A Wednesday Walk

- Street Art in Pokhara, Nepal - A Lakeside Walk

- Steemit Survivor Contest UPDATE - 20 STEEM Grand Prize - IT'S ON!!!

- Giving Back: Nepal - Four Worthwhile Causes to Support

- More Street Art in Bangkok - A Walk Through Talat Noi, Bangkok

- The Stranger Than Fiction Digest - Edition One: Art Gone Wrong

- Personal Finance 101 - Part 1 - Step on the Scale, Get Organized, Feel the Pain

- Street Art in Bangkok - A Walk Through the Neighborhood

- WINNER ANNOUNCEMENT - Think you're well traveled? Name that.... TAIL!

- Giving Back: Thailand - Four Worthwhile Causes to Support

- Why I Disappear from Steemit on Sundays

- Well Off the Beaten Path - Restoration of Saat Tale Royal Palace - Nuwakot, Nepal

- It's July 4th - Happy Birthday America!

- Cox's Bazar Surf Report and the Father of Bangladeshi Surfing

- World's 50 Best Restaurants for 2018 Announced

- How to Overcome Screen Addiction - 5 Practical Tips

Talk about a reminder that there is cool stuff on here that I miss. Thanks for such a cool look at the markets and how they are doing. I have also entered this post in the Pay it Forward Contest Good luck and hope to see where this goes.

Hey @stever82, great to hear from you! Apologies for the delay, I didn't think anyone was paying attention to these updates anymore so didn't bother checking back until now (when I'm working on my latest update). Thanks so much for entering me into the pay it forward contest, that was very kind of you!

This post is supported by $0.31 @tipU upvote funded by @stever82 :)

@tipU voting service: instant, profitable upvotes + profit sharing tokens | For investors.

Thanks so much @tipU and @stever82!!!!

I watch the markets but do not have the money to play in them much. Thanks for the info and a look at how markets work!

Great, thanks for the comment! Glad you're enjoying the posts, definitely hope you get to play in the markets soon :)

Hola Hola @starthere! Bienvenido, me gustaria aprender mas sobre las criptomonedas, gracias por compartir tu publicacion, llegue a tu publicaion por @stever82, te presento en el concurso pay it forward, un maravilloso concurso patrocinado y organizado por @pifc y @thedarkhorse, te invito a participar

Muchas gracias @celinavisaez y me alegro de verte aquí en mi otro perfil. ¡Espero que todo esté bien!

Your post was featured in an entry into @pifc's Curation Contest:Week 70. Posts are selected because the entrant felt you are producing great content and deserve more attention (& rewards) on your post. As such your post has been upvoted and will be visited by other members of the PIFC Community.

We are always looking for new people to join our curation efforts. This is a great way to meet new people and become part of a community that focuses on helping one another.

Want to promote a post for free and have a chance to find some other great content? Check out this week's Pimp Your Post.

The Pay It Forward community also has a Discord Channel if you are interested in learning more about us.

A very belated but very sincere thanks for the feature @pifc!!!!

Wow, that first $1000 investment is sure taking a beating! Thank you for this research, and thanks to @stever82 for featuring your post in his Pay It Forward Curation Contest entry 😊

Nice to hear from you @lynncoyle1, I hope all is well!!!

You did what I think many of us want to try to do. It really is the best measure the market imo. Thanks for doing this and the feedback on what you learned.

You were featured in week 70 of @pifc's Pay It Forward Curation Contest by @stever82. @pifc is a Pay It Forward Community which believes in by helping others grow we build a stronger community. We run this contest each week, it is open to everyone. It's a great way to show off people you find that might need some more exposure, meet new people, and possibly win some SBI for you and your features.

My pleasure @tryskele. Thanks for stopping by and I hope all is well!