Ever lost money on an investment? How about half of it in three days?

If you’re like the many people who recently started trading cryptocurrencies but have never invested in a liquid asset before — particularly something as volatile as a penny stock or leveraged ETF — then the sudden correction to start off 2018 was likely your first schooling in market savagery.

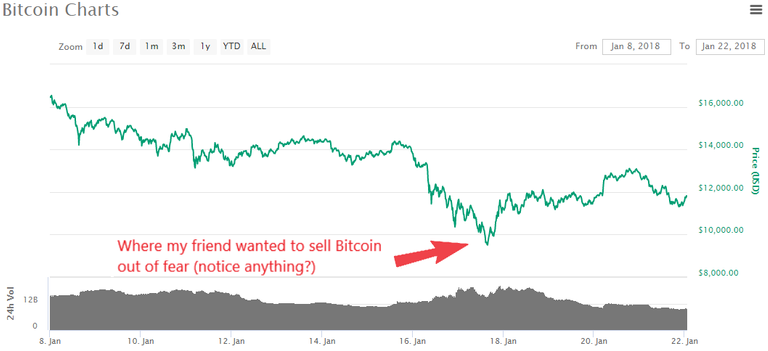

The first rule of buying crypto may very well be “don’t invest more than you’re willing to lose”. If there’s a second rule, perhaps it should be: “If you see any chart that looks anything remotely like this…

… get ready to watch it come crashing down.”

Say what you will: “nothing lasts forever”… “whatever goes up must come down”… “all good things come to an end”… the bottom line is that buying on a parabolic upswing is risky at best, and a colossal mistake at worst.

Personal experience

I understood this from the day I bought my first ETH (followed by several other coins). Although the profits kept piling up, I knew it was only a matter of time until the market would take a rapid turn for the worse. When it did happen, on January 8, the timing should have been so obvious — and yet it still caught me a bit off guard.

But I have traded many "risky assets" over the last decade. And if there’s one thing I’ve gained through all those gut-wrenching ups and downs — because it’s certainly not wisdom — it’s the ability to maintain emotional stability. That means not getting too excited when you’re up, not getting too depressed when you’re down, and not letting either situation interfere with your personal or professional life.

Thanks to this, I can sleep just fine in the midst of a crypto bloodbath, go a whole workday without checking in on my portfolio (if I really wanted to 😉), and have enough discipline not to make any rash decisions. This last one is key, because for me, losing discipline means tampering with my limit orders or impulsively buying/selling something, and that has always inevitably been a bad call.

When panic sets in: a classic mistake

A number of my friends and colleagues recently bought into crypto despite having no investing experience; I’ll bet most of them have never even bluffed a poker hand. So as you can imagine, they've been sweating it out this January. However, it’s one thing to be worried — as you should be when money starts circling the drain— and another thing to panic and run for the exits, especially in a market known for its high risk and volatility.

I have a friend who purchased Bitcoin last year at an average price of about $8000, in addition to some altcoins. He long claimed that whatever happens, he'd be HODLing for the next five to ten years. But after several days of hard losses this January, he told me that he was getting nervous and thinking about selling some of his positions so his profits don’t turn into losses.

It appears that people like my friend were not only unprepared to deal with such dramatic rises during their HODLing period, but also didn't expect such sharp drops. I gave him some thoughts (not advice!) on why he shouldn’t sell, justifying it with some observations about trendline support, market psychology, and this YouTube video.

This is pretty much how I wrapped up our conversation: “I feel you. I’m tempted to sell, too. But history tells me that if I’ve got the urge to sell something out of fear, and I do it, I’ll end up regretting it and just have to buy back in at a higher price. Don’t be like me.”

Lo and behold, just 12 hours later, the market had bounced back off its latest lows, with most coins up anywhere between 20-50%.

Of course, the chart doesn’t end there as the market continues to ride through what may be considered a consolidation period.

I'm not trying to say that my experience has made me more capable of making smart decisions — it did keep me from making some bad mistakes, but I nevertheless failed to cash out some profits before the precipitous drop. My point is that I'm psychologically prepared to deal with being wrong and handling huge blows to my portfolio.

In contrast, the shock and disappointment was more palpable among newbies who earned up to 300% on their investment within a month or two, but who had literally never heard of the term "correction" or realized how quickly they could lose money in this market.

How to live with the FUD

Whether you managed to sell your positions at all-time highs, have held through the FUD as I have, or made the probable mistake of selling your coins at rock-bottom, there is something we can all agree on: losing sucks. And when it happens, the most natural thing to do is ask yourself questions like...

- Why didn’t I take some of my profits off the table?

- Why did I buy that at its friggin peak?

- Why didn’t I leave some cash aside so I could buy on the dips?

- Why do I keep making the same mistakes over and over? (okay, maybe that’s just me 😝)

I’m neither an investment guru nor a technical analyst, but I don't need to be one to share this essential yet easily overlooked advice:

- Learn some basic charting patterns

- Perform due diligence before buying a coin; you might not be able to tell the difference between Proof of Stake and Proof of Work, but at least you can find out if everyone is calling it a scam (cough: Bitconnect)

- As you accumulate profits, consider rebalancing how much of your net worth is invested in crypto

- Don't try to time the market

- Don’t be too greedy — or too fearful

If there is truly one authentic, original, value-added piece of advice that I can give you, it’s this:

Follow @cryptovestor and subscribe to his YouTube channel. His direct, honest approach and his financial background make for videos that are times motivating, at times comforting, and always educational. He provides a well-informed perspective on the overall market, with a stated mission to "reduce the level of emotional decisions made in your investing."

Crypto Investor's videos have helped guide me through the ups as well as the downs, and therefore I'd say he has been fulfilling his mission. So if you’re looking to nourish your mind and soul with some great content, or simply want a stable and well-informed opinion to count on in this crazy crypto market, then look no further.

Do you have any other channels or Steemians that you’d recommend following? How do you manage your emotional stability in the midst of all these ups and downs? I’d love to hear your thoughts, feedback and suggestions!

Great post! I have to say it can be hard to hold onto your coins when you see you're down so much. But you do have to stay cool and not sell!

Thanks a lot for the feedback! Personally I always find it hard to sell when I'm down, and hard to hold on when I'm up -- and sometimes that's what you've gotta do. Followed you and hoping for some good advice ;)

I think trading cryptocurrencies is really best learned when experienced! We can read all we want and see how others have fared, but things would stick better when we experience them for ourselves.

I see all these very good traders, and I'm pretty sure they also had their mistakes when they started!

You're right... and for better or worse, the learning never ends. There are always new mistakes to be made -- and most people keep making the same mistakes over and over, and possibly never really learn.

I do, however, think that there are certainly rules out there that you should follow and not deliberately try to "experience" for yourself -- like practising first with small amounts, not investing more than you're willing to lose, not taking stock tips from random people, following pump-and-dumpers, etc.

I agree. It all depends on the person as well, I think, if he or she is able to "do the right thing" as soon as she steps into the crypto world.

There's still a lot to learn, even for myself! I've only recently started last year and I've already had lots of experiences, both good and bad.

Same here... good luck! I'm no expert, but always happy to share an opinion :)

I enjoyed your post. Trying to work my way to 1BTC with about $50...is it possible?

Hey, thanks for reading and for your comment. As for your question, you're basically asking whether you can turn $50 into $10,500 (the current value of 1 Bitcoin). That is a 210-fold increase and would require you to double your money 8 times over. Unless you're Michael J. Fox in Back to the Future, or you have a way to go back to 2010 and put $50 into Bitcoin, it's impossible for a person to get there by trading. (Anyone can correct me if my numbers are wrong.)

In my opinion, you're only chance of achieving that is by locking your $50 into a currency such as Bitcoin, and hope that it's value increases by 210x. However, that would require a target Bitcoin value of $2.2 million per coin! And since absolutely no one speculates that Bitcoin would ever get that high, the simple answer is no. The most wild speculations have valued Bitcoin at $1 million per coin within 5-10 years. That would get your value up to about $5,250 (which is currently about 0.5 BTC), and is still very improbable (and counts on your ability to wait 10 years without being tempted to cash out).

BTW I like the username ;)

Congratulations @telaviv! You received a personal award!

Click here to view your Board

Congratulations @telaviv! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!