Overview

The year of 2018 has been a wild ride for the Cryptocurrency markets consisting of mostly bearish activity across the various coins and tokens being traded. February and April had some nice movements but most recently, May and June have been very bearish, with the overall market capitalisation trending downwards continuously. The question on everyone’s minds and particularly for those who are holding through the bear market rather than trading is, ‘where is the bottom’? Well, there are several ways to look at it and several factors to consider.

Global Charts

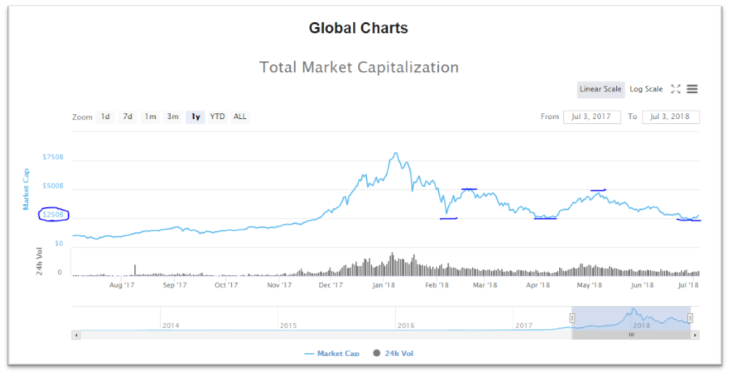

As most of us know, Bitcoin is the leader in the Cryptocurrency markets and it often governs the price action of most other coins as we have seen in the past with many coins following almost the exact same trends. Analysing Bitcoin is a great way to determine market cycles, but we should also consider the global charts for the total market capitalisation across all Cryptocurrencies as per CoinMarketCap, as this gives an accurate representation of how the Cryptocurrency markets are travelling as a whole.

Assessing the global charts as presented above, there are several things that can be analysed to identify a market reversal. The predominant indicator that I was watching personally was the support level at $250B. This had been tested before and had been proven to be a good support. In April 2018, the market held this support before making a significant move to almost $500B. As of July, it appears that the support may hold again as indicated and this would signify a potential uptrend for the markets for at least the next month.

Top Cryptocurrencies

Over the past 24 hours, the markets have seen a significant jump. Assessing the top 12 Cryptocurrencies by market cap, it is evident that there has been a nice bounce. Most coins are up in double digit percentages with NEO leading the alt-coins. This comes at a great time after Hitesh Malviya recently announced the top 10 alt-coins to buy in July here.

Wall St Cheat Sheet

Thus far, the bounce we are seeing is looking very positive. Although, its important to consider that the market may still drop further yet. Because of this, I will also analyse some other factors including the Bitcoin price and the psychological Wall St Cheat Sheet.

The Wall St Cheat Sheet has proven to be effective at analysing the psychology and price action of market cycles for various asset classes. Since a lot of markets are emotionally driven, it can be quite accurate. The three key points on this chart which are relevant have been indicated above by the blue circles. The Bitcoin charts have recently correlated with this cheat sheet very well and it is something that has been discussed widely in the community.

Bitcoin Charts

As seen on the Bitcoin chart, many of the reversal points correlate with those on the Wall St Cheat Sheet. This latest bottom which occurred at around $5,900 USD is potentially the ‘depression’ stage of a market cycle. Since we have held support there and seen a nice bounce to $6,600 USD in the short-term things are looking good.

As seen above, the 5800-5900 level held very well putting in somewhat of a double bottom reversal. This was followed by a surge of volume then a bull flag. The bull flag broke out and surged again, with a new flag beginning to form.

Conclusion

At this stage, it looks like the bears have run out of steam and the bulls are pushing the price up periodically. This is nice as the uptrend is creating a stair-step like pattern. We should watch the charts closely over the next week or two to see if the trend continues or another dump occurs.

One thing to keep in mind is the recent tether minting event and the large amounts of Bitcoin being shuffled around, as this indicated potential bulls gearing up for a buy in.

I am positive about this movement and hopeful that the trend can continue. Obviously, there are many influencing factors, and no one knows for sure what will happen. I hope you have enjoyed this analysis. Trade responsibly and don’t get FOMO. I hope you all bought the dip as these opportunities don’t come along very often.

Follow my other work on YouTube: https://youtube.com/c/thecryptogod