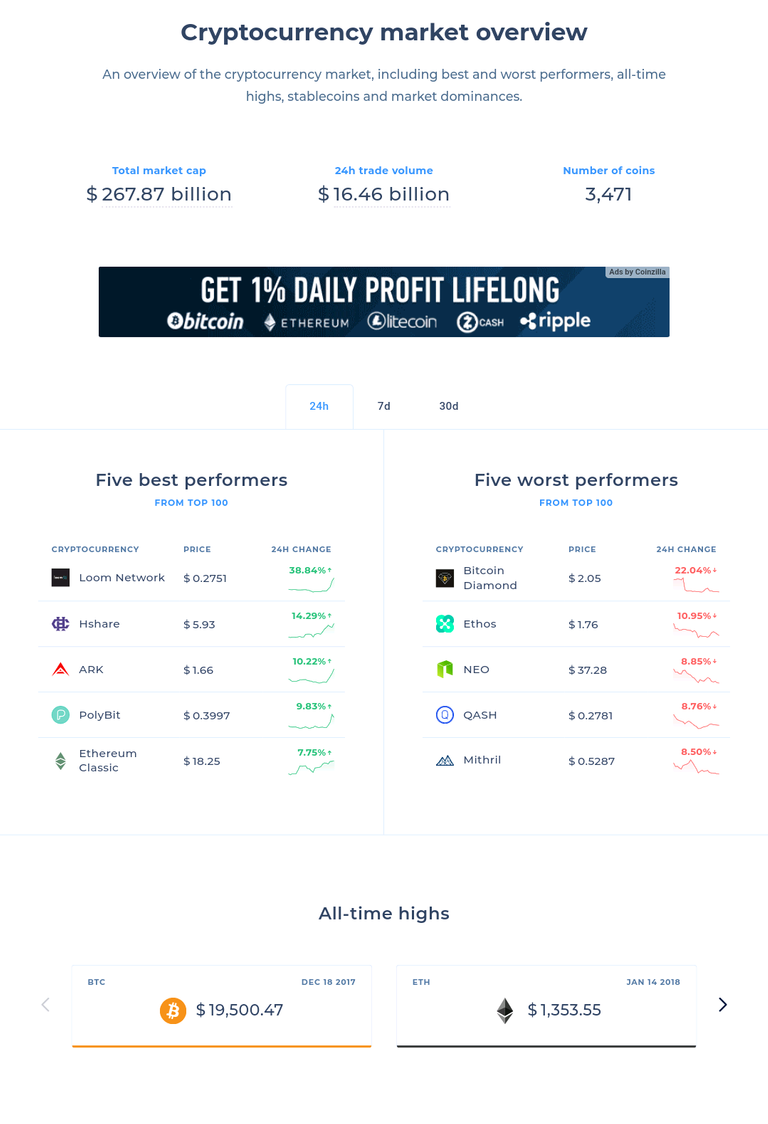

As per CoinMarketCap, there are as of now more than 1,600 distinctive cryptographic forms of money, and taking a gander at the diverse token deal sites - hundreds more have arrived. There are 3471 coins listed in coinranking.

"Cryptocurrency" itself was synonymous with "Bitcoin," as it was the main player in the space.

Bitcoin was made after the 2008 money related emergency, by pseudonymous cryptographer, Satoshi Nakamoto. Its creation at last began an expansive influence, rapidly disturbing various businesses by making blockchain innovation and virtual monetary forms more standard. Thusly, it likewise filled in as the motivation behind the back and forth movement of cryptographic forms of money that took after; corporate advanced changes; and market drifts that took after.

Since the making of Bitcoin, and the large number of digital currencies that fanned from it, the utilization of disseminated record advances ended up across the board. Bitcoin, albeit fruitful at getting to be 'computerized money' and an electronic store-of-significant worth, needed numerous highlights, which eventually left substantially more to be wanted for.

Ethereum is extraordinary compared to other cases of a famous digital currency stage, using brilliant contracts to take into consideration another time of decentralized innovation advancement: Blockchain 2.0. Ethereum turned into a fundamental piece of growing the digital money industry, as hundreds, if not a large number of cryptographic money ventures started as an Ethereum savvy contract.

These provoked sagacious speculators to put capital in an assortment of cryptographic forms of money, on a huge number of trades. On the other side be that as it may, the variety of digital forms of money accessible made it hard to track, exchange and screen the possessions themselves, which regularly exist over an assortment of trades, wallets, and foundation stages. Decentralized trades (otherwise called DEXs by the digital money network) have endeavored to revise this issue.

DEXs utilize keen contracts, with a customer open UI implied for distributed (P2P) cryptographic money exchanges that require no middle person parties, for example, trade servers or unified elements. DEXs have the ability to help many cryptographic forms of money, as opposed to the few seen on trades, for example, Coinbase. This has prompted a developing client base of these new sorts of trades, attracting numerous ICO and Ethereum erc20 financial specialists and brokers.

Albeit to some degree fruitful, numerous DEXs frequently do not have the best possible volume contrasted with other significant trades. This absence of liquidity can regularly prompt expansive spreads between the costs seen on customary trades and said DEX. Be that as it may, as the DEX business grows, as it has been over the previous months, it will be the obligation of the client to figure out how to exploit the end liquidity holes between the assortments of trades.

The regular advancement for this situation was the ascent of crypto portfolio following applications.

Blockfolio is thought to be a fairly famous application, with more than 1 million downloads in Google Play. Totle is a crypto administration apparatus that totals arrange books from decentralized trades onto its stage, giving its clients a chance to purchase and offer crosswise over DEXs, for example, EtherDelta, Bancor, Kyber and Radar Relay without giving up security or client protection, a tradeoff that clients of unified trades normally acknowledge.

Notwithstanding the developing number of one of a kind cryptographic forms of money, there has been a division that has been to a great extent kept out of the business: conventional securities. Stages, for example, Polymath are endeavoring to settle this avoidance by acquainting routes for organizations with make and use security tokens.

Securities tokens basically bring customary resources, similar to stocks, and REITs (Real Estate Investment Trusts) onto a blockchain, encouraging the exchange of conventional resources into another medium. Despite the fact that these are still in their beginning periods, numerous digital money specialists anticipate that securities tokens will be the following huge blockchain development, attracting customary foundations to understand the advantages of utilizing blockchain innovation.

Customary resources, for example, stocks, have turned into the fundamental focal point of trailblazers dealing with making securities tokens. Be that as it may, elective resources, (for example, mutual funds, private value and non-recorded REITS) have been to a great extent hid away from plain view with an end goal to bring 'genuine' resources onto the blockchain.

OpenFinanceNetwork (OFN) bolsters the elective resources industry by speeding up the exchange of the elective resources through its exchanging stage. Its stage offers securities token exchanging, giving expanded availability and unwavering quality to more customers. OFN works with businesses, overseers, banks and other money related foundations to guarantee the dependability required for a security token exchanging stage.

The exponential development of the crypto showcasing is simply beginning, and it's intriguing to perceive how we catchup to it.

Hello. Great post! I just upvoted you and follow you! Can we be friends? I interested cryptocurrency, bounty and trading.

Coins mentioned in post: