Shôn Ellerton, Jul 07, 2017

The differences in investing in cryptos and normal equity stocks is becoming seemingly more and more blurred in my experience.

I don't know if it's just me, but it seems that the differences in investing in cryptos and standard shares are becoming increasingly blurred.

Now for those who have traded with cryptos and the stock market will be all too familiar in how to read the charts and will apply their knowledge on how to do so in their own particular way. One striking difference, of course, is that, for active short-term investors, trading with cryptos is extremely fast-paced and intensive which requires one to be glued to several monitors at a time watching the candlesticks at 5min intervals waiting for the buy or sell signal to come in.

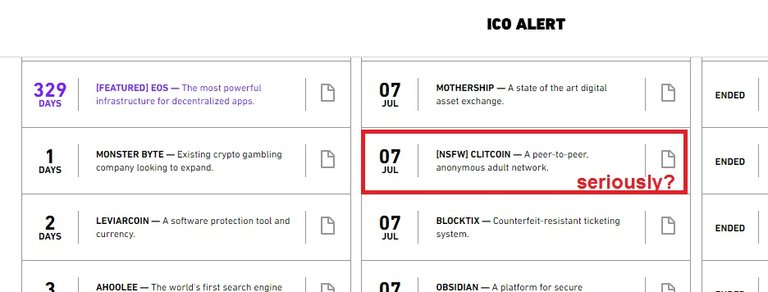

For those of you who do not know about cryptos, there's a lot more to it than simply Bitcoin. There are hundreds of the damned things, of which only a few have trusted and reliable histories; for example, Litecoin and DASH. These are called Altcoins; although, I'm having doubts whether heavyweights such as Litecoin or DASH should be considered Altcoins in the near future. With regard to newcomers, you only have to open the website www.icoalert.com and you will see some rather dubious startups, the most arresting being Clitcoin.

You certainly wouldn't open that website with someone looking over your shoulder! Fact of the matter is, that it will most certainly raise quite a bit of money at the token sale and even more money when and if released onto the exchanges! More often than not, most of these ICOs will spike and die a painful death, much like a penny stock.

Some of you may have heard about Ethereum, which is a protocol enabling anyone to develop their own coin (or token), which, in turn may promise the investor an actual share in the company, but there are many other protocols that have been or are being developed. For example, I recently invested a little something in an ICO (Initial Coin Offering) by Starta; a consortium whose mission is to bring Eastern European technology and services into the US market. Starta has based its technology on another platform called Waves. And then you have EOS (along with all its hype) and the non blockchain-based technology called Tangle by IOTA, promising to service microtransactions between devices in the Internet of Things (IOT).

Generally, I am a 'lazy' investor who prefers to do ample research on long-term prospects of a technology rather then relying on shorting, staring at candlesticks, EMAs and Fibonacci Retracement lines, praying that you've bought or sold exactly at the right times to make money. The lazy way is to pick something that you like and leave it alone, and then, look at it months later. Some of your choices may have stagnated but, at least some will have grown; hopefully. Over one weekend, I tried the 'active' investor approach, and amazingly, made some money (from a coin called Numeraire), but, my God, I found it stressful and downright antisocial. Not for me. It could have gone equally bad of course.

As for becoming more dividend and standard stock share-like, take, for example, Antshares. Antshares is a silly-sounding coin (along with an equally silly-looking logo) and has been given quite a bit of hype based on the speculation that it could become the 'China's Ethereum', but much much better, apparently.

Moreover, they are rebranding to something a little more professional called NEO; however, what Westerners perceive to be 'professional' can be quite different to what the Chinese perceive to be. I have an interest in Antshares and have invested in it but have exercised caution as anything to do with China relies on the whim of how their government feels at the time. When you buy an Antshare, you also have a dividend called an Antcoin based on how many Antshares you have. Every 15 minutes (I believe), a proportion of Antcoin will be given to you provided your Antshare is in the correct wallet.

Investing in cryptos is far from mainstream and definitely seems to be dominated by, dare I say it, the younger and geekier amongst us; although there are exceptions to the rule. Truth be told, it's not terribly easy to explain to someone outside of the crypto world how it all works. I believe that I am fairly well technically minded, but some of this stuff is inherently complex and I am in admiration for those who can create, program and understand this stuff.

So, in the future, will all IPOs be replaced with ICOs and will all startups have some sort of crypto token based on its own or another's technology? Who knows? But one thing for sure, the lure of cryptos has widened the spectrum of those who participate in the markets. The rollercoaster pace of cryptos has been a magnet for many new younger investers who may have never had the patience with the stock markets. With seemingly unlimited online resources, anyone can learn how to trade and read the charts; and I admire this, because, it's a whole lot better than those unfortunates who gamble their money away at the pokies or at the casino!

Nice post about investing @sellerto, upvoted! I’m trying to start a community about stock trading on Steemit. You can join our Discord channel SteemitStocks if you want to share your post and chat about stock trading. Would you also like to read my article about an undervalued oil exploration stock?