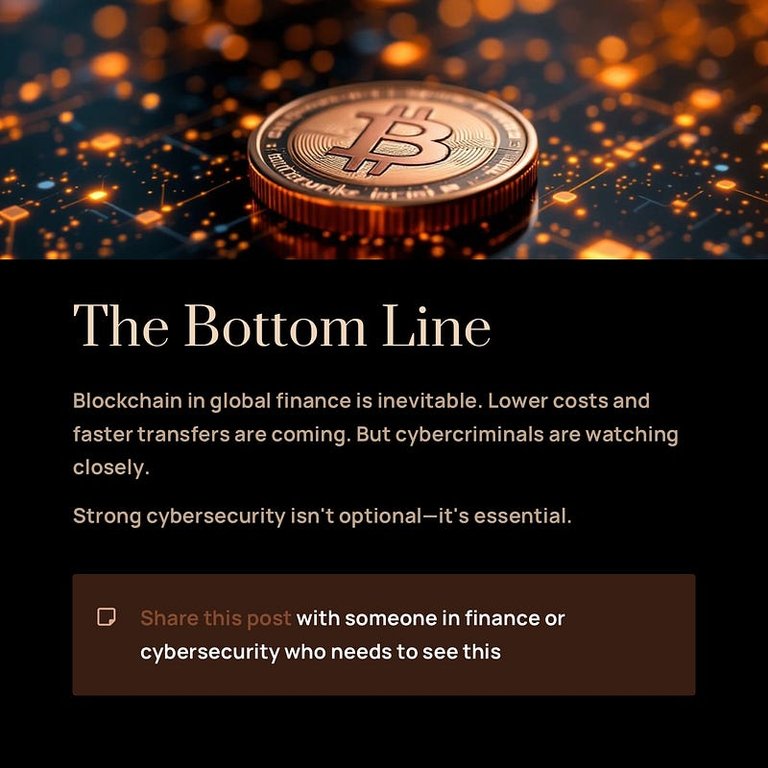

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) and over 30 banks servicing 200 countries, have announced they will develop a blockchain global shared digital ledger to support global payments. SWIFT will integrate the blockchain with legacy systems and continue innovating to deliver more capable financial services.

I am a fan of blockchain technology, the most famous instance being Bitcoin, and with its rise in the traditional finance industry, we must prepare for a greater focus by cybercriminals.

The good news is blockchains have some inherent security and resilience benefits, but the downside is that the technology is relatively news in the global finance sector. One mistake or vulnerability could have severe repercussions and be a windfall for attackers.

This is why many of these organizations have been ruthlessly testing such systems for years before deciding on a major deployment. Cybersecurity will need to adapt to extend our umbrella of digital trust to include these systems.

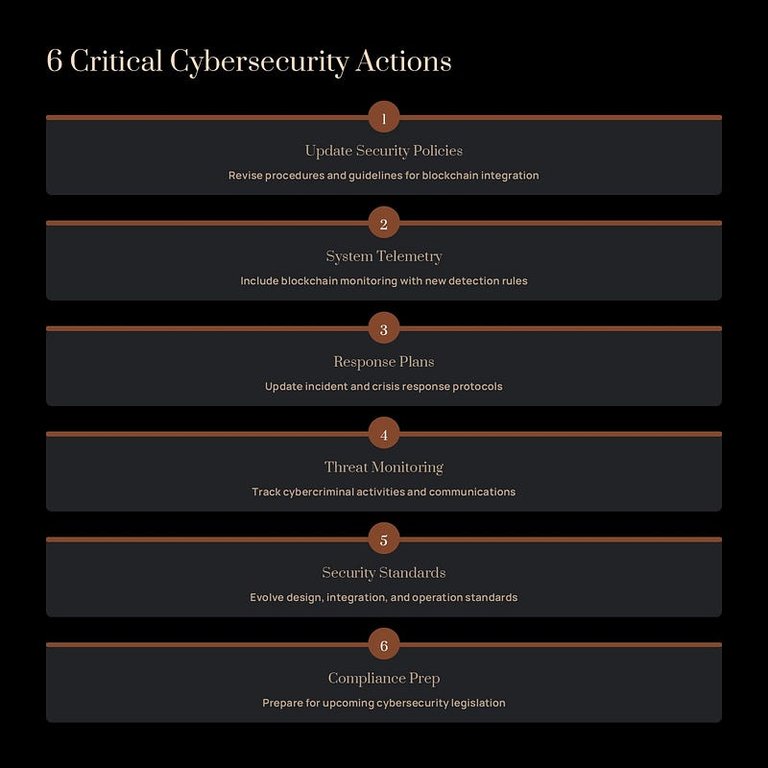

That means:

Updating security policies, procedures, and guidelines.

Inclusion of system telemetry into our alerting systems with new detection rules.

Updating our incident and crisis response plans and tests.

Active monitoring of the threat agents’ activities and chatter.

Evolving the security standards for the design, integration, operation, and updates of blockchain technologies.

Preparation for compliance to the cybersecurity legislation and standards that will eventually occur.

Blockchain technology will bring great benefits to the financial sector, including lower costs and faster cross-border transfers, but it will become a target for cybercriminals. Cybersecurity must play a strong role in its architecture, development, and operations to protect financial assets, customer privacy, and intuitional reputations.