Bitcoin is running back up to the doubling curve, but there are a few signs we'll be coming back down soon. The first one is simply: September. Semptember is just a bad month for crypto. October is okay. November and December are often amazing. I'm just running down the clock at this point.

We haven't had a real bull run in over a year (Bakkt pump/dump). Recovering from the COVID flash-crash doesn't count, although it was very interesting to watch it recover so quickly. With this in mind, and considering the halving event in mid May (along with all the other fundamental developments) we are quite ripe to touch ATHs at the end of the year. Although I imagine such an event will trigger immediate panic selling. People do crazy things when every coin in the network is in the green. If history from 4 years ago repeats, the recovery will be swift.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|

| $800 | $1600 | $3200 | $6400 | $12800 | $25600 | $51200 |

Once again we see how accurate the doubling curve has been over the years. It's actually incredible how often the price bounces off the exact number over and over again.

We are approaching that potentially epic 4-year pocket. You know, that one where the ENTIRE YEAR of 2021 is a bull market that never quits. Sure, we'll have 30-40% drops in Q1, Q2, and Q3, but the ascension upwards always seems to catch everyone off guard. Buy the dip (but more importantly sell a tiny bit on the peaks so you can actually buy the dip).

20-point system

Everyone has a tenancy to trade in an over-emotional manner. We make a decision, and then we go all in. Tell me, how often does that actually work out for you and leave you with no regrets? I can say from experience that trading like this has always left a sour taste in my mouth.

I'm looking to create a 20-point trading system where each point represents 5% of the money we're willing to gamble with. When we have the unrelenting urge to buy/sell, I'm going to stick with moving in/out of the market by 1 point at a time (3 max). This style of trading will be much more akin to cost-average trading, which is something sorely needed in a market so volatile.

DAI!

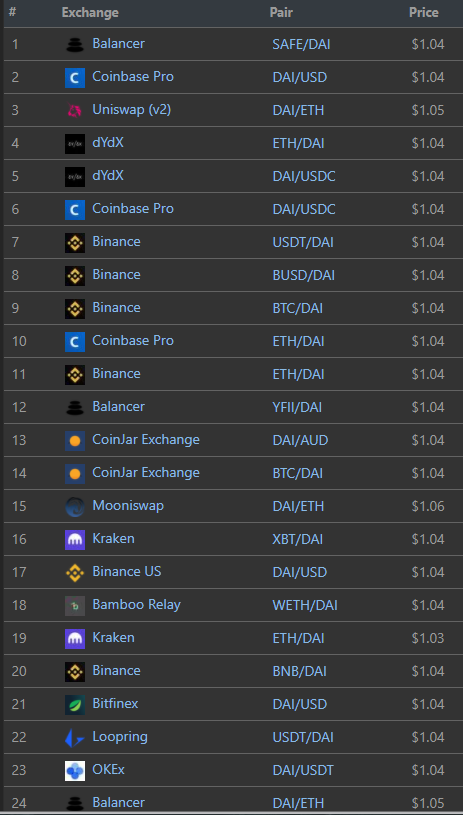

So I was looking at DAI and noticed it was trading at $1.04. Traditionally, this is very bad. It means demand for stability is at record highs and everyone is willing to pay a 4% premium on this stable coin. It usually means a crash is incoming.

However, there are some extenuating circumstances in this case. For starters, the exploitative stability fee is still 8.5%. 8.5% interest on loans that are basically 200% overcollateralized. So embarrassing.

On top of that mess, DAI is the most decentralized stable-coin in existence with the most liquidity and it's plopped front and center on the Ethereum blockchain. With the advent of the DeFi bubble, users have figured out they can yield-farm with DAI stable coins, which gives it a lot more demand and pushes the price up.

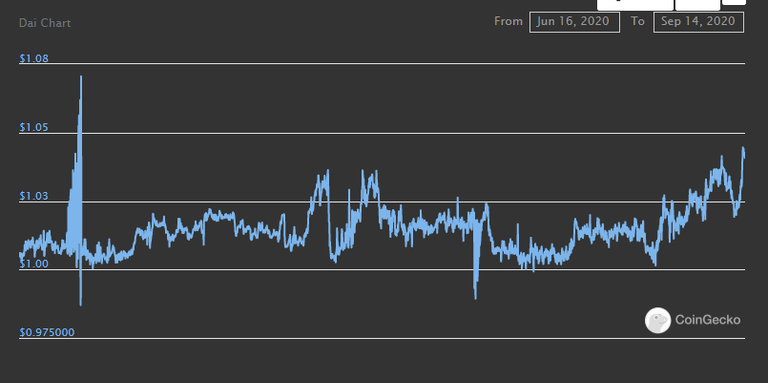

This is confirmed by the charts, showing that DAI has pretty much traded higher than $1 for over 90 days. It's rather embarrassing that the MakerDAO hasn't voted to reduce interest rates, further complicating the issue with the obvious conflict of interest there. MKR governance token gains value the higher the interest rate is. Silly.

The justification to increase interest rates was due to DAI trading under $1 for quite some time. What's the justification now? Unicorns and rainbows?

As I've already pointed out the interest rate is a totally pointless mechanic that only serves to hamstring adoption. Maintaining the peg is easy by manipulating the collateral required to create loans. If Hive were to fix HBD by using the bank accounts as collateral for HBD loans this is how we can undercut the entire system and scoop huge communities into our own.

So I decided to take a look at the markets pegging DAI to $1.04 to make sure there isn't any funny business... and look what I discovered!

WHEN THE F did BINANCE LIST DAI?

https://www.binance.com/en/support/articles/0948e020b7534a469f38ae95b0255782

Binance

2020-07-23 04:04

Fellow Binancians,

Binance will list Maker (MKR) & Dai (DAI) and open trading for MKR/BNB, MKR/BTC, MKR/BUSD, MKR/USDT, DAI/BNB, DAI/BTC, DAI/BUSD and DAI/USDT trading pairs at 2020/07/23 2:00 PM (UTC). Users can now start depositing MKR or DAI in preparation for trading.

Yep

This has actually been a huge embarrassment for Binance for quite some time. They really took their sweet time on this listing, and I believe that's due to the competition it creates with their own stable-coin. Well, I guess that's no longer an issue.

Conclusion

DAI and MakerDAO are practically begging Hive to take their business and community away. They are absolutely terrible at pegging DAI to $1 because of the massive conflict of interest regarding the governance coin determining interest rates. Lower your interest rates, jackasses!

If Hive were to swoop in and provide collateralized loans via HIVE/HBD from the bank accounts everyone would want a piece. All we have to do is charge 0% interest and modify the peg with how much collateral is required to create HBD. Such a range could fluctuate greatly from 125%-1000% and beyond. No one will care about high collateral requirements if we aren't charging any interest and they can yield-farm with the outputs. I can't even imagine how much Hive would get permanently locked away given a development like this.

#dreambig

Maybe one day.

I want to see that experiment on HIVE!