The history of lending dates back to ancient times. Today, lending is an integral part of the economy. The possibilities of lending are used by state corporations, businessmen and ordinary citizens. The prevailing form of lending in modern market conditions is the monetary form of lending. It involves the transfer of a certain amount of money for use for special purposes with the condition of further repayment of this amount after a certain time, as a rule, with payment of interest for use. It seems that this is an ideal scheme, where both parties benefit: the bank makes a profit, and, for example, a novice businessman receives money for his start-up. However, this does not always happen. The fact is that the traditional financial system is centralized in the hands of large financial institutions - monopolists, which largely control all financial transactions, they set the rates of lending to borrowers and the interest income of creditors, thus depriving the market of healthy competition and decreasing the quality of services. In addition, there are a number of other problems: first, often high interest rates on a loan drive the borrower into difficult conditions, which can lead to the fact that at some point it becomes unable to pay the loan; secondly, the very procedure for obtaining a loan involves a lot of paperwork, which in turn makes the process not quick and gives you the opportunity to hide the truth about the borrower's real possibilities for repaying the loan; Third, in the case of the borrower's inability to repay a loan to a bank, it can be difficult to get back his money. Taking into account these and similar problems, the team of professionals developed a project in the field of lending. The name of this project is Distributed Credit Chain.

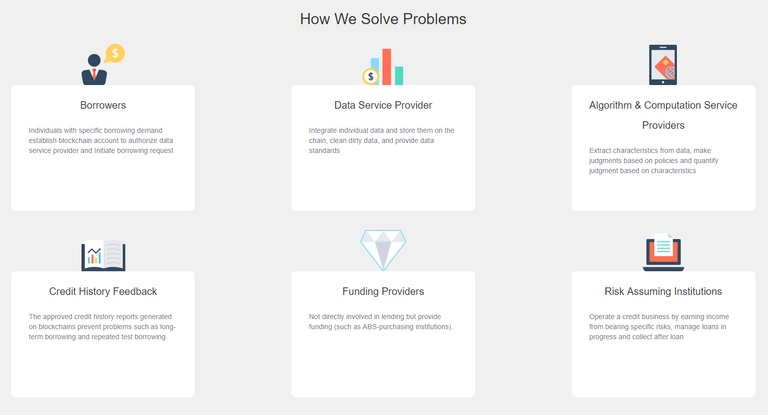

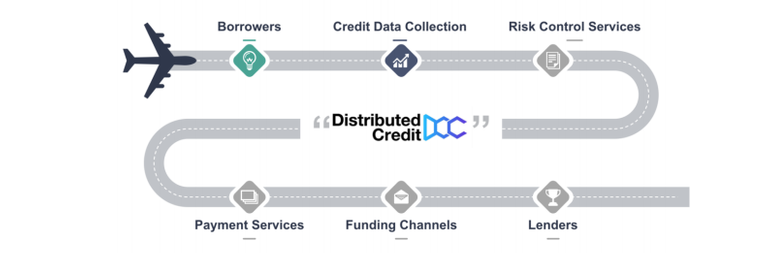

DCC is a literally distributed credit chain that is a decentralized platform using Blockchain and smart counter technology. DCC does not directly participate in lending, but it gives credit organizations the right to use this opportunity. First, the customer registers and enters their personal data on the DCC platform. These data are sent for processing, and come back in the form of a finished report. After that the client can choose any service that is necessary for him in the sphere of crediting, after which a digital contract is made between him and the lender.

The project has a number of advantages, which should be said:

- The project seeks to reduce the monopoly of large financial institutions in the credit sector, which will lead to an increase in healthy competition and the emergence of new companies, and lower interest rates.

- Decentralized thinking. Construction in the financial sphere of a new communication model of cooperation between regions, economic sectors, subjects and accounts.

- Thanks to Blockchain technology and the use of smart contracts, full transparency is achieved and personal data security is ensured. You also will not have to deal with paperwork.

- The distributed banking system transforms the structure of debt, assets and intermediation, which will lead to the fact that traditional banking management will become decentralized, which, in turn, will increase business efficiency.

Personal data is transmitted to the information agency for processing. The risk of information leakage is minimized, as these data can only be transmitted to individual representatives of credit institutions upon request. The more inspections an object receives, the more extensive its credit history becomes and for creditors this causes additional confidence, which reduces their risks. The credit history is created in the DCC system, which shows the entire life cycle of a person from applying for a loan, reviewing documents, repaying a loan, information on debts, and so on.

Thanks to the Distributed Credit Report (DCR), the profit from lending to information intermediaries will be significantly reduced, this profit will go to both parties: the financing and the needy for credit. In addition, the DCR mechanism will be quite inexpensive for credit institutions.

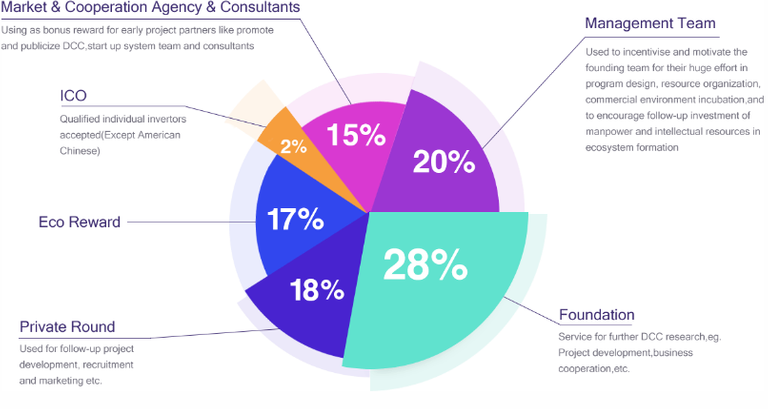

DCC issues its own token (DCC), which corresponds to the widely distributed ERC20 standard. The need for a token is expressed in using it in the internal financial operations of the platform. It is noteworthy that some amount from all operations inside the platform will be accumulated in the form of rewards and paid to borrowers who will repay the loan on time, which is also a good incentive to use this platform.

DCC token distribution:

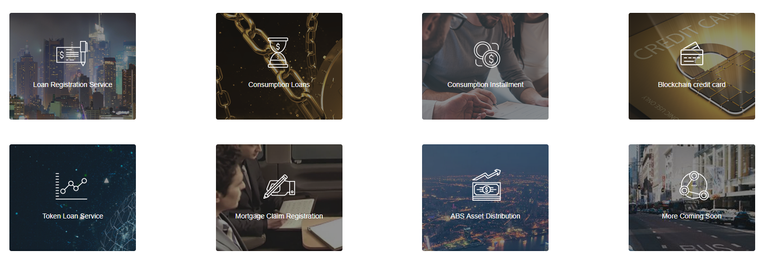

The DCC project can be used in many other areas of financial activity. Many of these areas are already actively developing and being developed.

If we summarize all of the above, then we can conclude that the DCC project is very promising and innovative. Its main goal is to reduce the monopoly of financial institutions in the credit sector, to establish healthy competition for all participants in the sphere, which will also help to reduce interest rates on loans. Using Blockchain technology and smart contracts allows you to collect and store personal data of borrowers in one place, ensuring their safety. The DCC project created ideal conditions for both sides: the lender and the borrower.

If you want to know more information about this project, please follow the links below:

Website: https://www.dcc.finance

Facebook: https://www.facebook.com/DccOfficial2018/

Twitter: https://twitter.com/DccOfficial2018/

Telegram group: https://t.me/DccOfficial

White paper: https://www.dcc.finance/file/DCCwhitepaper.pdf

My bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2089995

Мне кажется, что кредитование всегда будет актуальным, поэтому эту платформу ждет успех!

Да, абсолютно с Вами согласен!