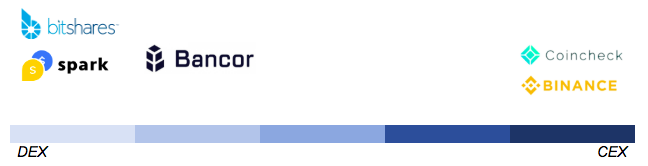

Not all decentralised exchanges are created equal. While there are many different DEXs that provide a safer trading environment when compared to a CEX, not all decentralised exchanges are created equal. That’s because between true DEXs and CEXs, there are pseudo DEXs that talk decentralisation but in reality still have centralised system designs. For that reason, we have created the DeCe Scale which positions exchanges across a spectrum from being entirely decentralised to gradually being fully centralised.

Understanding the DeCe Scale

DeCe stands for decentralised and centralised, and the scale positions all exchanges across a spectrum to show the degree to which they are decentralised or centralised. There are many clear-cut examples of DEXs such as the Bitshares DEX and SparkDEX, with equally clear examples on the centralised end of the spectrum with names such as Binance and Coincheck.

However, there are exchanges that call themselves decentralised yet don’t meet all the criteria of a true DEX. Often these “pseudo DEXs” include some of the structures a true DEX requires but fail to integrate all of the critical features. In doing so, pseudo DEXs can be misleading because they actually don’t offer a safer trading environment compared to centralised exchanges.

The criteria for a true DEX

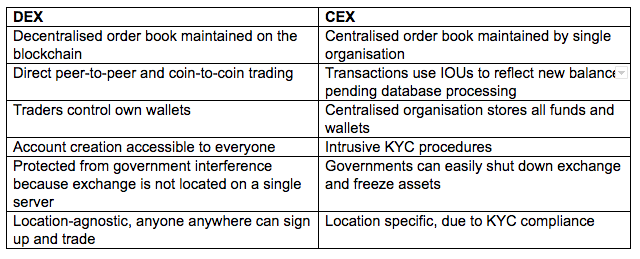

For a DEX to be considered fully decentralised it must meet the following list of criteria. To illustrate how different the experience is on a CEX, we have listed how it works in that environment as well.

DEX and CEX comparison table

The DeCe Scale

Translating the list of criteria to the DeCe Scale, true DEXs and CEXs are positioned on opposite ends of a spectrum, with pseudo DEXs placed in between.

DeCe scale

True DEX

On the DEX side, Bitshares and SparkDEX both serve as examples of fully decentralised exchanges that meet all the criteria listed above. Accounts can be opened by anyone to trade any cryptocurrency, and each user is in full control of their own funds and security.

We can’t say the same for the pseudo DEXs in the middle of the DeCe Scale, like Bancor.

Pseudo DEX

Supposedly a decentralised exchange, Bancor was hacked on July 10, 2018 and lost a total of $23 million in ETH, NXPS and BNT. Bancor mostly lost its own funds because user funds were held in their own wallets — as they should be, which kept their customers at ease.

But that story changed drastically when it turned out users were unable to draw down funds from their wallets because they didn’t have the keystore file. Bancor was even able to freeze all transactional activity which meant users could only extract their funds once Bancor was online again.

Despite its branding as a DEX, Bancor is certainly centralised in any ways exposing its users to the vulnerabilities that come with a centralisation.

CEX

On the CEX side, we see truly centralised exchanges with big and popular brand names. This is also the side of the spectrum where most exchange hacks take place.

Coincheck for example is fully centralised, and the vulnerability that comes with it was certainly proven when in January 2018, $535 million was stolen from Coincheck making it the single biggest crypto heist to date.

Binance is planning to move to the other side of the spectrum, after it announced it’s working on decentralising its exchange to offer greater transparency and security.

What we can learn from the DeCe Scale

Because the DeCe Scale shows the degree to which an exchange is decentralised, it also serves as a tool that illustrates the vulnerability of an exchange in terms of hacks.

Because of the way it is designed, a CEX is simply more exposed to exchange hacks, with a single point of failure just waiting to be exploited. Trading crypto on the DEX is simply much safer, especially if you follow the advanced tips for trading crypto safely.

When pseudo DEXs fail to include all of the criteria, they do not offer the greater benefits of a true DEX such as greater security, control, accessibility and, if designed properly, access to the global crypto trading marketplace. What’s more, by branding it as a DEX while not offering the security that comes with it, they are downright misleading.

As more exchanges like Bancor are exposed, we will add their names on the DeCe scale.

Stay tuned.

About Bitspark

Bitspark’s easy to use platform and app allows businesses and individuals to transfer money worldwide without banks. Having made the world's first cash-in cash-out Bitcoin transaction in 2014, Bitspark now services six markets across Asia and Africa utilising stablecoins across its product offerings.

Try Bitspark today and send money cheaper, faster and safer.

—

Follow us

Congratulations @bitspark! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: