| Dear Hiveans | Liebe Hiver | Queridos Hiveanos |

|---|---|---|

| This is part II of my favourite excerpts of Homer's and Sylla's book "A History of Interest Rates". Part I is here. I got very much information and interesting concepts from this book. But I've read books that were more fun to read. | Dies ist Teil II meiner Lieblingsauszüge aus dem Buch "A History of Interest Rates" von Homer und Sylla. Teil I ist hier. Ich nehme sehr viele Informationen und interessante Konzepte aus diesem Buch mit. Aber ich habe schon Bücher gelesen, die mehr Spaß gemacht haben. | Esta es la parte II de mis extractos favoritos del libro de Homer y Sylla "A History of Interest Rates". La parte I está aquí. Obtuve mucha información y conceptos interesantes de este libro. Pero he leído libros más divertidos. |

FOURTEENTH CENTURY

During the 14th century, the medieval commercial expansion culminated. As a result of severe calamities and economic maladjustments, the economy of Europe during the second half of this century either grew more slowly or contracted. This was a century of humanism and also of economic and political progress in many areas and fields of enterprise. But it was also the century of the Hundred Years’ War and of the Black Death. This plague carried off one third to two thirds of the population in parts of Europe.

The decline in population was especially pronounced in towns. It was accompanied by a rise in wages and a sharp and sustained fall in important agricultural prices. Civil discontent and social struggles occurred in France, England, Flanders, Germany, and Italy. Discontent among apprentices and journeymen led to strikes. Local protectionism and urban attempts to exclude competition hampered trade. Land values and rents fell in France and elsewhere. The German expansion into the Baltic area had reached its limits. An authority on the period says that “in the larger part of Europe the prosperous level of 1300 was not reached again before the 16th or 17th century.”

In the course of the Hundred Years’ War both the king of England and the king of France defaulted on their debts. Most of the big banks in Italy broke, and this led to reforms: in 1374 Venetian banks were forbidden to trade in speculative commodities; in 1403 they were required to hold two fifths of their assets in public debt; bank examiners were appointed.

THE RENAISSANCE FIFTEENTH CENTURY

The 15th century was a century of economic transition. Its opening decades saw a continuation of the past century’s wars and disorders, agricultural depression and local restrictions on free and prosperous trade. Yet, this century later saw the rapid rise of humanism, science, the arts, and worldwide discovery. Printing was invented. Royal power began to reassert itself and point the way toward modern nationalism. This was the century of Louis XI of France, 1461 – 1483; Henry VII of England, 1485–1509; and Ferdinand and Isabella of Spain, 1474–1504. In 1480 Ivan III freed Moscow from the Mongols. In 1453 the Turks finally captured Constantinople, but in 1486 Diaz of Portugal rounded Africa and opened the way for new trade routes to the Orient. In 1492 Columbus discovered the New World. The population of Europe still did not grow. Epidemics recurred early in the century. Towns struggled for advantage by monopolistic and restrictive measures. There were 64 tolls on the Rhine and 77 on the Danube in Austria alone. The mining of metals was depressed until near the end of the century, when technological improvements brought an impressive revival. Agricultural prices continued to decline sharply in a number of places and for certain commodities on which records were kept.

… The victories of the Turks and the interruption of the Oriental trade route through the Mediterranean led to the discovery of alternative trade routes. This ultimately deprived the Italians of their central trading position. Nevertheless, in this century Italian prosperity continued at a high level. Between 1430 and 1480, the Medici Bank at Florence was by far the greatest financial organization in Europe, with branches throughout Europe, the Levant and North Africa. It was the chief bank for the Curia. Many other Italian banks had large capital and a worldwide business. Venice kept ahead of Genoa and was the first seaport of the Mediterranean.

The structure of trade and industry changed. Europe now had great capitalists possessed of large and diversified interests. These men were not local merchants; they were no longer dependent on the restrictive regulations of the town burghers. They could move their operations from place to place: to the country or to other towns. They began to operate on credit on a large scale and to speculate. They supported royalty and financed wars. The manorial economy of the early Middle Ages had thus been transformed by degrees into a pecuniary economy in which money and credit played a central role. While land had once been synonymous with wealth and power, now all men wished to possess money. Gold, not trade, became the object of exploration. The doctrine Pecunia nervus belli gave new power and dignity to the banking profession. War had become an industry requiring financial management. The mercenary soldier could be hired by any town or prince who possessed the necessary cash or credit. Foreign policy often turned on financial considerations. Forced loans to the Crown were still the rule in France and England. These often paid no interest. They sometimes took the form of tax anticipations.

SIXTEENTH CENTURY

This dynamic century was dominated by the power of the newly great monarchies. England, France, and Spain struggled for economic or military supremacy in Europe, and for control of the Atlantic. This was the century of the Reformation, the century when the New World was first exploited and new routes to the Orient were developed. It was the century of Francis I of France, 1515–1547, and his wars with the Holy Roman Emperor, Charles V, 1516–1556; the century of Henry VIII, 1509–1547, and Elizabeth I, 1558–1603, of England; and of Philip II of Spain, 1556–1598, and his Armada, 1588.

The population of Europe resumed its rise, and the economy of Europe began again to expand rapidly. Capital wielded increasing power. Commodity prices rose sharply. Between 1550 and 1620, in fact, prices in northern Italy rose about 2 1⁄2 times; this is called the price revolution and is attributed by some to the influx of American gold and silver.

SEVENTEENTH CENTURY

17th-century European finance was a study in contrasts. The wars, the excessive loans, the inflations, and the defaults of the late 16th century brought the Crowns of Spain and France, and with them their great Italian and German bankers, to financial ruin. At the same time in a remote northern corner of Europe, the new Dutch Republic won its independence from Spain, achieved a trading empire, and developed the high modern standards of state credit. England, a century later, successfully adopted the Dutch principles of national debt and learned how to use a sound credit structure for national purposes. The 17th century is often classified by historians as “modern.” From the point of view of credit markets, however, it is convenient to review it as the last of the Renaissance centuries. Only a little before 1700, when Dutch financial principles were brought to England by William III and his Whig supporters and were there greatly improved upon, did the history of modern banking and credit really start.

The presentation of interest-rate history must now be modified in one essentially modern respect: financial events and interest rates must now be arranged according to national boundaries. No longer was Europe financially international. No longer did Italian bankers dominate an international money market and shift their balances at will to or from Italy, Spain, France, Germany, England, and the Netherlands. Credit conditions had never been uniform throughout all the geographical regions of Europe, but the earlier distinctions were based less on nationality than on local economic and financial circumstances. In the 17th century, financial history became nationalized. Spain, recently the most powerful of European states, sank into financial decrepitude in spite of her empire in the New World and in spite of inpouring gold and silver. Spanish state bankruptcies occurred about every 20 years: 1607–1627–1649. Spain’s imported gold and silver were pledged in advance to Genoese bankers. While the pledged Spanish gold and silver flowed to Genoa, Spain sank to a copper standard of currency.

In 1665, Colbert, the new finance minister to Louis XIV, again reformed French finances. He greatly increased revenues and reduced the rentes arbitrarily or paid them off at low rates. He set a maximum interest rate of 5%, saying that high interest rates created unemployment and retarded trade. He also said that “a banker should behave toward a finance minister like a soldier toward a general.”

- Interesting view.

Until the 1690’s England, although making great commercial progress at home and abroad, had no central bank and no organized money market. The 17th-century financial history of Holland contrasted strikingly with the dismal succession of defaults by the rulers of great powers. The new Dutch Republic was a union of the northern provinces of the Spanish Netherlands. Her successful war of liberation from Spain lasted from 1568 to 1648 — 80 years. In spite of the war, the period 1600–1650 was the golden age of Dutch arts and literature. Because Spain closed Lisbon to Dutch commerce, the Dutch found their own way to the Far East and to the New World and displaced the Portuguese. The Dutch East India Company was founded in 1602, and the Dutch West India Company was founded in 1621. With such extensive trade Holland became the commercial center of Europe. Amsterdam replaced Antwerp, which was still under Spanish rule, as a financial center. In 1652 and 1665 the Dutch Republic fought wars with England. The Dutch fleet even sailed up the Thames and destroyed one of the suburbs of London. In 1672–1678 France invaded Holland. The Dutch saved themselves only by opening the dikes.

| Incredible what a little country like the Netherlands could achieve with financial savvy. | Unglaublich, was ein kleines Land wie die Niederlande mit finanziellem Geschick erreichen kann. | Es increíble lo que un pequeño país como Holanda puede conseguir con inteligencia financiera. |

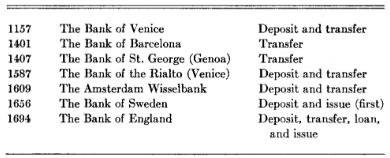

Deposit banking existed throughout the Middle Ages, but in a form at first more resembling ancient banking than modern. Bankers were private merchants. In Italy they were subject to official rules and regulations. They carried on all of the banking activities of antiquity and these included most of the modern banking functions in rudimentary form. There were even a few official or quasi-official banks organized very early. Dates of origin and the functions of these banks were as follows:

THE TREND OF INTEREST RATES

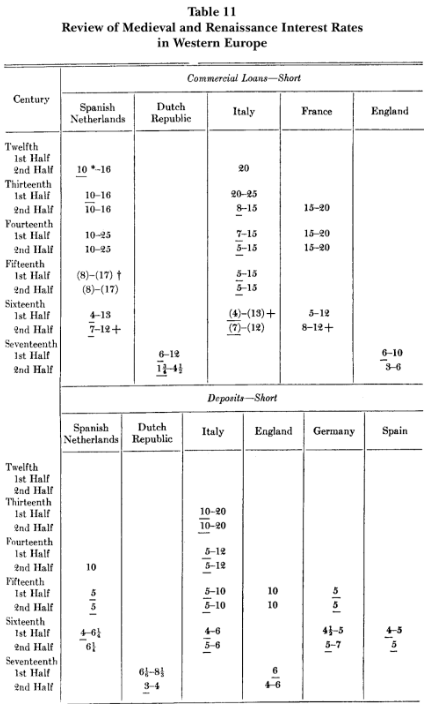

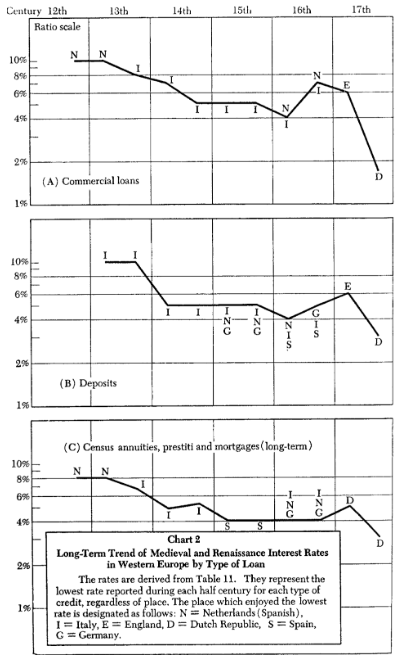

Table 11 supports the opinion often expressed by economic historians that interest rates declined during much of the later Middle Ages and Renaissance. The earliest short-term rates quoted were somewhat higher than the last and highest of the western Roman legal limits. They were not too different from early Greek rates and were within the range of Babylonian rates, although the credit forms were very different from ancient credit forms. The later Renaissance rates were well within the range of modern rates and the lowest were far below modern rates in periods of credit stringency. As most of Western Europe throughout most of this period was in effect one money market dominated by Italians, very little weight should be put on variations of bill rates from place to place. The Italians dominated the Netherlands bill market, and, therefore, differences in quotations between Italy and the Netherlands may be accidents of reporting.

THE ORIGIN OF THE FUNDED DEBT AND OF THE BANK OF ENGLAND

England was transformed financially as well as politically by the Revolution of 1688. Under the reigns of the Tudors and the Stuarts, no money or investment markets comparable to those of Antwerp, Lyons, and Amsterdam had appeared in London. On the Continent during the 15th and 16th centuries the Italians had played a leading role in developing a complicated system of private international banking. During the 17th century the Dutch had developed effective state finance based on confidence in a popular government’s ability to pledge the resources of a town, province, or nation. It was now England’s turn to achieve financial leadership. Within the first few decades of the 18th century, England improved upon the Italian banking techniques and upon the Dutch principles of funded debt. The city of London learned how to mobilize the savings of the people for commercial and for national objectives. … Owners of cash could deposit it with London goldsmiths. The goldsmiths issued receipts for the cash. Presently these receipts became payable to bearer: this was the birth of the modern bank note.

For England the 18th century was a century of growing economic and political strength at home and abroad. Constitutional parliamentary government and a limited monarchy were gradually accepted by both political parties. The challenge of the Pretenders of the House of Stuart and the associated challenge of the French Monarchy were laboriously but decisively defeated. When Queen Anne, 1702–1714, was succeeded by George I, 1714–1727, this accession of the House of Hanover marked the final acceptance of the Revolution of 1688. By the time of the French Revolution in 1789, England had achieved what was essentially the modern parliamentary system. The nation was governed by a cabinet responsive to the wishes of the enfranchised voters.

The Treaty of Utrecht, 1713, ended the war with Louis XIV, who renounced the Stuarts. Nevertheless, there were attempted Stuart invasions of England in 1715–1716 and in 1745 – 1746. There was a war with Spain in 1717–1720, another war with Spain, the War of Jenkins’s Ear, in 1739–1748, the War of the Austrian Succession in 1740–1748, and the Seven Years’ War in 1755–1763. By 1763 England was for the time being at the summit of her power. She had acquired Canada, Florida, Gibraltar, and many other foreign possessions; she had established her position in India. There followed 50 years of crisis and disaster: the loss of the American colonies in the War for Independence, 1775–1783, the shock of the French Revolution, 1789, and the wars with France, which continued intermittently from 1793 until 1815.

EUROPE IN THE EIGHTEENTH CENTURY

A study of interest rates on the continent of Europe in the 18th century must center on developments in France and Holland. Italy had long since lost its financial importance and financial markets had never developed in Spain. Germany was still an aggregation of separate nations, each with its own tariff barriers and its own currency. Although Prussia and Austria had become powers of great strength, many of their financial customs were still medieval.

During this last century of the French monarchy, the Crown struggled unsuccessfully to improve its financial methods and thus to retain its power at home and its empire abroad. The century began with the defeat of Louis XIV by an effective coalition of foreign states; it ended with the French Revolution and the victories of Napoleon. France was involved in the War of the Spanish Succession, 1701–1714; the war with Spain, 1718–1720; the War of the Polish Succession, 1733–1738; the War of the Austrian Succession, 1740–1748; the Seven Years’ War, 1756–1763; the War for American Independence, 1778–1783; and the wars of the revolution, from 1792, which merged into the Napoleonic Wars. By the end of the century France had lost most of her colonial empire, but had temporarily gained a dominating military position on the continent.

… Between 1774 and 1789 the total government debt tripled; half of it was in rentes, half was unfunded; interest amounted to half of the budget. By 1789 half of the rentes were perpetual, the rest for a life or for two, three, or four lives. In spite of disordered finance, the government had retained its ability to borrow throughout much of this century. When it could no longer borrow, the revolution followed fast. A crop failure in 1785 and an industrial crisis in 1787 were followed by the revolution in 1789.

| If public debt becomes unsustainable, a default and public unrest will follow fast. What does that mean for our times? 🤔 | Wenn die Staatsverschuldung nicht mehr tragbar ist, werden ein Zahlungsausfall und öffentliche Unruhen schnell folgen. Was bedeutet das für unsere Zeit? 🤔 | Si la deuda pública se vuelve insostenible, se producirá rápidamente un impago y malestar público. ¿Qué significa esto para nuestro tiempo? 🤔 |

ENGLAND IN THE NINETEENTH CENTURY

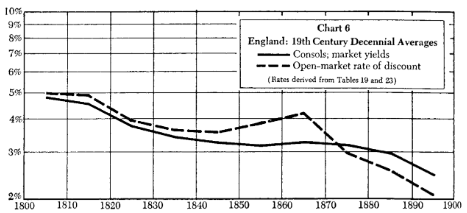

In England the 19th century was one of rapid economic growth, of hard money, and of declining interest rates. The Industrial Revolution ran its full course. Railroads and factories transformed the economy, and the population quadrupled. Commerce increased fourteenfold. Specie payments were resumed soon after the end of the Napoleonic Wars, and the gold value of the pound was maintained throughout the century. Commodity prices ended the century far below their high wartime levels at the beginning of the century and also below the peacetime levels prevailing directly before and after the Napoleonic Wars. Market yields on British consols started the century at 41⁄2–6%; they were never above 4% after 1830, never above 31⁄2% after 1850, and were below 21⁄2% throughout the final decade of the century. This decline in yield exceeded 60%, and the appreciation in the price of the funds far exceeded 100%.

After Waterloo, 1815, this was a century of relative peace. British wars were small, brief, and victorious. There was war with China in 1839–1842, the Crimean War with Russia in 1854 – 1855, the Indian mutiny in 1857, another war with China in 1857–1858, the Afghan War

in 1878, the Zulu War in 1878–1879, the intervention in Egypt in 1882, and, finally, the longer Boer War in 1899–1902. The British navy, however, saw no fleet action for almost one hundred years. British supremacy was generally acknowledged.

| Hard money, declining interest rates and rapid economic growth going hand in hand. No surprise here. | Hartes Geld, sinkende Zinssätze und schnelles Wirtschaftswachstum gehen Hand in Hand. Das ist keine Überraschung. | Dinero duro, tipos de interés a la baja y rápido crecimiento económico van de la mano. No es ninguna sorpresa. |

… The early years of this peace were eventful for English money and capital markets. A severe economic depression began in 1815 and brought falling commodity prices, falling interest rates, and unemployment. Its trough was in 1816. The note issue was thereafter reduced, interest rates rose briefly, and specie payments were resumed in 1821.

… In the 1830’s there was continued industrial expansion accompanied by speculation in United States land and United States companies, a brief start at a railway construction boom, and a further fall in interest rates. Prosperity was interrupted by the effects of the American crisis of 1837. After a period of stagnation, the great railway construction boom of the 1840’s got under way. Even the Bank of England bought railway debentures. Interest rates declined further; 3% consols briefly crossed par, up over 100% since the lows of the Napoleonic Wars. Another financial crisis in 1847 brought a sharp rise in interest rates and very severe bankruptcies. It was followed by the revolutions of 1848–1849 on the continent of Europe, which had adverse effects on European markets. In 1849 a period of heavy gold imports to London began, which

arose from new discoveries in California and Australia. Commodity prices rose. Interest rates at first declined and then advanced. Large sums were loaned abroad. Britain financed railways in Europe and North America, and stock speculation became widespread. British supremacy was now unquestioned.

The crisis of 1857 has been called the first worldwide crisis and the first that was purely economic, without political or natural cause. Many United States banks failed or suspended, and there was a run on the Bank of England. A depression in 1858–1859 was followed by the stimulation and disturbances associated with the American Civil War. There was prosperity in 1862–1863, a cotton famine in 1864, rising interest rates, speculation and boom until 1866. In that year Overend, Gurney & Company, the leading London discount firm, failed. This unexpected event led to panic and another “Black Friday.”

The next few years, 1867–1873, marked a turning point in 19th-century political and economic history. The United States was united and on its way to becoming a world power. Germany emerged from the Franco-Prussian War of 1870–1871 as a great power. The opening of the Suez Canal in 1869 signalized the vital concern of England in the affairs of the entire globe. There was furious industrial activity and the building of new railroads. In the United States, 24,000 miles of railroads were built in four years. Germany expanded rapidly. Gossip had it that colliers were drinking champagne. In 1873 there was an American crisis, a German crisis, and 24 changes in Britain’s bank rate. In London and New York company shares crashed, and bankruptcies in America involved $225 million. A period of stagnation followed. Commodity prices declined for 20 years, until 1893. Interest rates declined almost steadily from 1866 to 1897. At times there was deep depression, such as 1879 and after 1882.

A commodity price index rose during the war from 100 in 1790 to 166 in 1801 and to a high of 200 in 1814. Thereafter, it declined to 130 in 1816, 103 in 1826, and 93 in 1830. Prices were even lower by the end of the 19th century. … In 1820 Parliament set a mint price for gold. Before the war the gold standard had been unofficial, but now it became explicit.

- Quity volatile times...

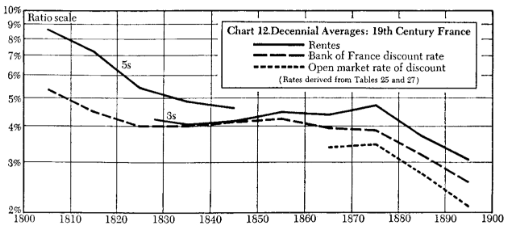

FRANCE IN THE NINETEENTH CENTURY

The year 1815 divided the 19th-century financial history of France and of most European countries into two parts. The years before 1815 were marked by wars, intense pressures on financial resources, and high interest rates. The years following 1815 were marked by comparative peace, a hard currency, industrial development, and declining interest rates. Toward the end of the century interest rates became very low in almost all of the principal trading nations of the Western world, including France.

The political history of France during the 19th century revealed little of the political stability enjoyed by England. France’s interest rate history was also far more erratic than England’s. Napoleon’s empire, 1804–1815, was followed by the rule of the Bourbons, 1815–1830, the revolution of 1830, the rule of Louis Philippe, 1830–1848, the revolution of 1848, the Second Republic, 1848–1852, the Second Empire of Napoleon III, 1852–1870, the disastrous Franco-Prussian War of 1870, and then the Third Republic. Each large rise in long-term interest rates coincided precisely with each of the revolutionary changes in regime, that is, 1830 – 1831, 1848–1849, 1870–1871. After each political crisis, stability, peace, and low interest rates quickly returned. In spite of political instability and two major military disasters, the 19th was a century of orderly finance and great economic growth for France. The nation ended the century with a world-wide empire, a powerful military establishment, an efficient banking system, great financial resources, and a modern industrial plant and system of railroads - almost all financed by the savings of the prosperous and frugal French people. French savings were even sufficient to help finance the industrialization of her gigantic ally Russia.

The 1820’s were a period of prosperity and growth. … From 1827 to 1832 there was a period of business depression, in the midst of which occurred the Revolution of 1830. From 1833 to 1837 there was rising prosperity, railroad construction, the formation of many companies, and a great increase in securities listed on the Bourse. In 1837 there occurred a collapse; the price of railroad securities dropped sharply, but the price of rentes continued to rise. Prosperity returned in 1842. Railroad construction reached boom proportions in 1845 with huge speculation on the Bourse. In 1846 a series of crises began with crop failures and led to unemployment, the first increase in the discount rate at the Bank of France since 1820, financial stringency, a sharp fall in the price of rentes, and finally the Europe-wide revolutions of 1848. Under the Second Empire, 1852–1870, prosperity returned.

… However, the rentes were not importantly depressed until the disastrous defeat of 1870 – 1871; this was followed by a few years of very high interest rates. After 1872 the last three decades of the century saw stability, peace and the same remarkable decline in interest rates which occurred in England and in most other industrial countries. There were periods of hard times, such as 1883 and 1896, but no financial crisis, no very high discount rates, and no depressed markets for rentes. This was for all Europe a period of growth and of nationalism; it was an age of steel and mass production. Industrially, France ended the century far behind England, but France was catching up rapidly. Germany and the United States, however, were catching up even more rapidly.

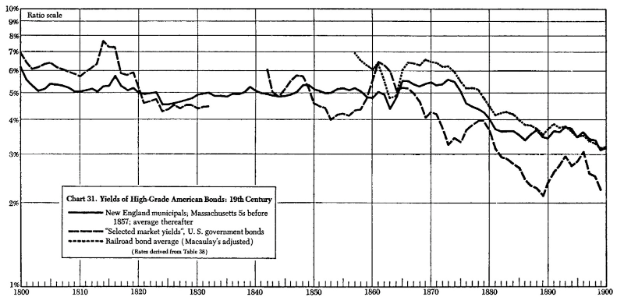

THE UNITED STATES IN THE EIGHTEENTH AND NINETEENTH CENTURIES

The American colonies were outposts of an old civilization. Their physical environment was primitive, but their political and financial traditions were not. Therefore, the history of colonial credit and interest rates is not a history of innovation but rather a history of adaptation. The colonists from England brought with them 17th-century English attitudes toward credit and interest. Commercial loans at interest were considered entirely moral and legal and a normal part of business life. Personal debt for consumption was frowned upon as imprudent.

- 😂

… Hard money was very scarce throughout the early colonial period.There was no domestic mining of gold or silver. European coins were brought over in small quantities by colonists, but were soon shipped home in return for needed manufactures.

… As a consequence, both barter and the use of commodities for money were common in the early colonial period. Indian shells were used for money. Later, certain staple commodities were declared by law to be legal tender in payment of debts: corn, cattle, furs in New England, and tobacco and rice in the South. Taxes were often payable in commodities at full valuations, and warehouse receipts for such commodities passed for currency.

… The extreme scarcity of specie led to many expedients, but not to a record of very high interest rates. High rates no doubt existed in commercial and personal transactions. But high interest rates were vigorously opposed by colonial law and custom and were therefore negotiated secretly and have not come down to us. Many very high rates will be reported from the Western frontier and from 19th-century money markets, but few from the colonial period. Instead, the colonies resorted to experiments with paper currency and bills of credit at legal rates of interest. In experimenting with paper money, the colonists were only following a European example. Bank notes became officially recognized in England in the 1690’s with the funding of the British national debt through the new Bank of England. In the 1720’s the South Sea Bubble in England and the Mississippi Bubble in France were both based on paper-money schemes.

The economic history of the United States in the 19th century is sometimes described in textbooks as a succession of excesses and calamities. Booms are pictured in terms of wild speculation, knavery, and irresponsible finance. These were regularly succeeded by panics, during which the financial structure collapsed and the fruits of lifetimes of sober toil were swept away. Then ensued hard times and depression; the nation groaned under unsalable surpluses. There followed expensive experiments by governments and new excesses by infatuated capitalists, new speculative excitement; the precepts of wisdom and experience were laughed at; and then followed another sad day of reckoning. After shivering through the story of an entire century of such economic follies and retributions, one might expect by 1900 to view the shrunken and dilapidated wreckage of the hopeful young nation of 1800. But lo and behold! The erstwhile agricultural outpost had become a giant among industrial nations, almost ready to assume financial, economic, and political leadership among the greatest nations on earth.

- Note to myself: read more about this time.

The War of 1812–1814 created financial stress and political misfortune, but it did not mark the end of this first period of prosperity. After 1815 Europe, newly released from conflict, continued to demand American produce. The “Era of Good Feeling” that followed 1815 came to an end with the panic of 1819. The postwar decline in European prices then finally spread to America. American staples dropped 50% in price, back to the level of 1792. Rents were cut in half, and commercial paper rates rose to 36% in Boston. By 1823 conditions were back to normal. Business fluctuations were thereafter moderate for a decade, with minor pressures in 1825, 1828, and 1831. In 1833 another boom began. The states pledged their credit to finance canal construction and turnpikes; railroad construction began in earnest; and there was speculation in Western lands. Commodity prices rose moderately. Government funds were transferred to private banks, and state bank notes flooded the country. Foreign capital poured in freely.

The crisis of 1837 was one of the country’s four great economic catastrophes. Its immediate causes were financial trouble in England, crop failures in 1835 and 1837, and a fall in the price of cotton. The government suddenly reversed its land policy and required prompt payment for public lands in hard money instead of state bank notes. Security prices declined and banks suspended specie payments.

Although specie payments were generally resumed in 1839, depression continued for years, banks continued to fail, some states defaulted on their public improvement bonds, and commodity prices fell. It was not until 1845 that a substantial business recovery occurred. Prices rose somewhat. The Mexican War of 1846 created no serious pressures. The European financial disturbances of 1847–1848 led to only a brief setback. Following the California gold strike of 1848, there was a period of great prosperity. Banking expanded and prices rose. There was another and greater land boom and railroad construction became massive. A brief panic on the New York Stock Exchange in 1854, accompanied by tight money and failures, did not spread out to depress the general economy.

The panic of 1857 was in part a reflection of economic disturbances in Europe. There was a sharp decline in security prices and 14 railroads went into bankruptcy. Money became very tight and banks again suspended specie payments. In 1858 recovery was rapid and the country was prosperous up to the tragic events of 1860–1861. During the first 60 years of the 19th century the population of the United States had increased from about 4 to 32 million, or eightfold…. The Civil War brought the usual economic stimulations and dislocations of a great conflict. War finance led to a suspension of specie payments and a huge emission of short-term government securities and legal tender notes. Paper currency depreciated so that $1 in gold equaled $1.30 in paper in 1862 and a high of $2.33 in 1864. With victory, gold was back to $1.50 in 1865, $1.30 in 1866, and $1.15 in 1871, but did not return to $1 until specie payments were resumed in 1879. … The business recession in 1865–1867 was brief. Railroad construction was resumed, and postwar prosperity assumed boom proportions and lasted until 1873. The panic of 1873 ushered in another major depression.

… In 1884 there was a sharp financial panic, during which call money went briefly to 3% a day; but there were no cumulative effects, and in 1885 business revived. The years 1887–1893 were years of prosperity and unprecedented railroad construction. The opening of the West was no longer the dominant stimulant to the economy, but the rate of growth was unabated. Speculation and promotions were on the grand scale. The panic of 1893 was marked by a collapse of the stock market and 600 bank failures. The Baring crises had led British investors to sell American securities and withdraw gold. The gold standard was considered to be in danger, and confidence in the Treasury position was undermined by the dissipation of the surplus.

… By 1897 commodity prices finally stabilized after 33 years of intermittent decline. Foreign demand revived. Gold reserves increased. Business improved, and a period of prosperity began that was to last until 1903, and in fact, with only small reactions in 1903, 1907, 1910, and 1913, until 1920. During the period from 1860 to 1900 the population of the United States increased from 32 to 80 million; this was twenty times the population of 1800.

During the period of the Napoleonic Wars, of which our War of 1812 may be considered a part, both British and American yields were in their high range for the century. Yields in both countries declined after 1815. After 1825–1830 American yields tended to rise sharply, while British yields declined further. This created a very wide differential from the 1830’s through the 1870’s, which, no doubt, encouraged heavy British investment in American securities. British yields rose only a trifle during our Civil War period, when American yields rose substantially.

- War is expensive. We will see that in the years to come…

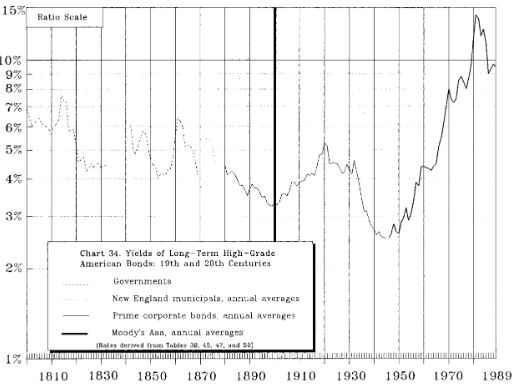

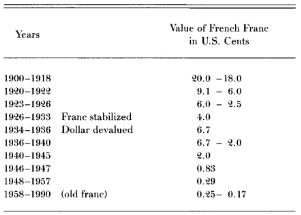

Europe and North America Since 1900

After the long decline in interest rates during the Middle Ages, a range of rates emerged in the 18th and 19th centuries for the best credits in the most advanced countries that until the 1960s usually proved adequate for the purposes of the modern world. Interest rates during much of the 20th century at times reached new lows and new highs; but most of the time they fluctuated in this traditional range.

In contrast, the quarter-century after 1965 witnessed a marked change of direction—if not a discontinuity—with these long-enduring developments. In these years, interest rates in all major market economies soared to levels unprecedented in modern history, as inflation raged and international monetary arrangements were revamped. Commodity price shocks led to a slowing down of the long post-World War II economic expansion and to stagflation, as the combination of stagnant real GNP and rising inflation came to be called. In a further break with the past, a host of financial innovations appeared and flourished. Among these in the United States were negotiable certificates of deposit, floating-rate bank loans, Euro-currency obligations, variable-rate mortgages, money-market funds, interest-rate futures, zero-coupon bonds, options traded on exchanges, NOW (negotiable order of withdrawal) accounts, foreign currency futures, mortgage pass-through securities, home equity lines of credit, cash management/sweep accounts, and Individual Retirement Accounts (IRAs). A new and increasingly sophisticated financial world came into being, but for all its sophistication it was not obviously more stable than the world it replaced.

The 19th century after 1815 has been described as a century of relative peace in Europe, economic growth, hard money, and declining interest rates. Of these attributes, only economic growth has been carried forward. The 20th century thus far has been a century of unprecedented warfare, economic growth, soft money, and erratic interest rates. Inflations, wars, and social changes have threatened, but have not destroyed, the centuries-old pattern of saving and investing in strong capitalist economies. The ability and desire of 17th-century Dutch burghers to provide for emergencies, for their families, and for their retirement by systematic saving and investing at interest has spread throughout the social structure of the Western world.

- !!!

During the 18th century and even more so in the 19th century, Great Britain occupied such a dominant position in world trade and finance that the London market appropriately received a large share of attention. It was even used as a norm for measuring interest-rate levels and trends in other countries. In the course of the 20th century, leadership in finance shifted to the United States. Britain, in spite of two desperate wars, a currency that has at times been devalued and nonconvertible, and a loss of empire, has retained an important role in international trade and finance. However, the United States, in spite of its greater self-sufficiency and its early desire to avoid international commitments, became the chief source of international capital and the largest market where savers met investors.

Yet the United States, during its period of world-wide financial leadership after 1914, did not aim at or achieve that financial stability based on hard currency that Britain achieved in the long period of her dominance. A larger degree of self-sufficiency and a tradition of populism led to overexpansion and devaluation and to emphasis on stimulating consumption rather than production, which permitted a world-wide spiraling inflation. In the midst of this inflation, the United States government in 1981 cut tax rates substantially but not its expenditures. As a result, large federal budget deficits persisted through the 1980’s, and the U.S. national debt more than tripled. At the same time, the United States made an abrupt transition from being the world’s largest international creditor to being its largest international debtor. Whether these recent trends will last and whether, if they last, they will prove to be consistent with continued U.S. financial leadership are open questions.

- more topical than ever

The organization of the Federal Reserve System in 1914–1917 permitted government to influence interest rates by methods that had long been used in Europe. … When the Federal Reserve System was planned, it was expected primarily to serve trade by providing a flexible currency through dealing in short-term business obligations. World War I soon followed, however, and a huge new government debt altered the structure of the money market and enhanced the political responsibilities of the Federal Reserve System. Over the next few decades, government debt replaced commercial paper in the portfolios of member banks and in the portfolios of the Reserve Banks. The New Deal, the Great Depression, and World War II augmented this trend. At the same time, very low interest rates to promote full employment became a political objective. … On balance, the influence of the Federal Reserve System in its early decades served to lower interest rates below what they otherwise would have been, both in periods of falling and in periods of rising interest rates.

… the 19th-century American concept that the national debt is temporary and must all be redeemable and redeemed at an early date has changed. Like the Europeans, Americans have become reconciled to a permanent national debt. They have come to measure its burden not in terms of principal but in terms of interest, its inflationary effects, and the undesirable competition (crowding out) it provides to private borrowers.

- 👍

The period from World War II to 1990 divides into two eras roughly equal in length but of marked contrast in economics and finance. From the war’s end through the mid-1960’s, the United States was preeminent among nations. The American economy experienced stable economic growth with minimal inflation, aided the recovery of war-torn Europe, led the Western alliance in keeping a lid on the Cold War, assisted the efforts of the less developed countries to raise their economic levels, and prepared to land humans on the moon. Talk of “the American century” was common. During the later 1960’s the American century began to unravel. The remainder of the period to 1990 would be one of an unpopular war in Asia, social dissent, political scandals, a more stagnant and unstable economy, monetary instability, large budget and trade deficits that returned the country to a debtor status internationally, and, above all, a great and protracted inflation of prices. All of these developments had profound and unprecedented effects on the interest rates.

… The greatest of all secular bear bond markets, which began in April of 1946, and probably ended in September 1981, carried prime long American corporate bond yields from their lowest recorded yields to their highest. The yield index rose from 2.46 to 15.49% for seasoned prime issues and up to 16.5% (industrials) and 18.0% (utilities) for high-quality new issues.

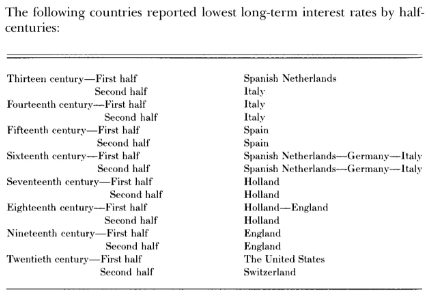

| Leading powers have the lowest long-term interest rates? | Führende Länder haben die niedrigsten langfristigen Zinssätze? | ¿Las principales potencias tienen los tipos de interés a largo plazo más bajos? |

Although predicting the future is hazardous, more than likely the bull market did end in 2003.

- No, it did not, but perhaps in 2021/22?

[…] few generalizations about emerging financial markets are warranted. But there can be little doubt that these markets, as their histories unfold in the years ahead, will become the laboratories of the future for testing hypotheses about the relationship of financial development, financial stability, and interest rates to economic, political, and social development.

| Yes, these market have become laboratories, and it will be very interesting to watch the consequences of the decisions of our irrational governments of the last 30 years. | Ja, diese Märkte sind zu Laboratorien geworden, und es wird sehr interessant sein, die Folgen der Entscheidungen unserer irrationalen Regierungen der letzten 30 Jahre zu beobachten. | Sí, estos mercados se han convertido en laboratorios, y será muy interesante observar las consecuencias de las decisiones de nuestros irracionales gobiernos de los últimos 30 años. |

Have a great day,

zuerich

I missed somehow the first part. This Is a very important topic, although here in Cuba for known reasons we don't have oiled that dynamic related to finance. Anyway everybody here—and everywhere—should advance in that knowledge because we are all potential migrants, so in one moment could be critical to succeed abroad where it matters a lot. Best regards from the Island.