Source

Decentralized Finance is receiving a great deal of attention. The growth it saw in 2019 was astounding. This carried on into the early part of 2020.

Most of the Decentralized Finance (DeFi) applications are located on Ethereum. There is now over $1 billion in DeFi, much of it received in the last year.

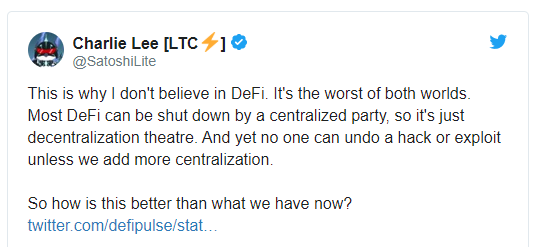

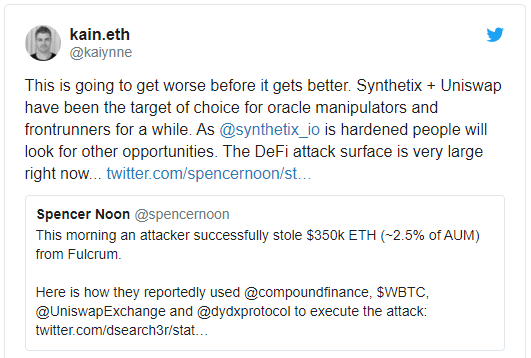

Charlie Lee, the founder of Litecoin, is not very impressed. He came out harshly against it. This was triggered by the attacks on the bZx Fulcrum protocol. During that attack, someone was able to trick the protocol into forking over $350,000.

Equally as disturbing is the attacker was able to use an "Admin" key to access over $600,000 in Bitcoin that was not taken.

Dlease provides decentralized financial services on the Steem blockchain. Unlike most of the DeFi that is out there, the keys are never turned over. This means that one is in full control of the asset at all times.

This is in stark contrast to what takes place on Ethereum. Most of those DApps require one to put up the tokens, similar to an exchange. In this situation all control of the assets are lost. The trust that comes from blockchain is now in the hands of a centralized entity. As the bZx episode once again shows, outside entities cannot be trusted fully. Hacks that occur put your assets at risk.

Dlease offers more protection since it is true peer-to-peer lending. Steem Power holders are not dependent upon Dlease for the security and protection of their asset.

Using staked tokens that are delegated is a much safer approach. The tokens are always in possession of the lessor while the lessee receives the utility and influence benefit.

Non-payment is also not an issue since the delegation can be revoked at any time. This protects the lessor from having to remain exposed to a bad agreement.

Cryptocurrency is repeatedly showing how true the mantra "not your keys, not your tokens" is. Dlease looks to provide solid decentralized financial services based upon peer-to-peer interaction.

Many feel the problems with DeFi are not going to improve any time soon. In fact, there is a line of thinking that says it will get worse before it gets better.

Unlike the counterparts on Ethereum, Dlease does not have these issues. Being a peer-to-peer system where token holders maintain control of their keys at all times makes it a much safer choice.

All this in addition to providing better returns than most of the alternatives.

Check out the Dlease.io FAQ and the comparison of Digital vs Real Estate leasing.

Visit https://dlease.io/market for the latest lease offers!

|  |

( Want an easier way? Use our SteemConnect proxy link! )

Disclaimer: This is a @steemvoter subscription payment post. Thank you to Steemvoter customers for allowing us to use your Steem accounts to upvote this post by virtue of your free subscription to the Steemvoter.com curation automation service. @steemvoter is proudly a @buildteam subsidiary and sister project to @dlease, @tokenbb, @ginabot, @steemsports, @btuniverse, techinvestor.io, @steemsports-es and @minnowbooster.

Ok, we have upvoted and reblogged your post to thousand followers.. Thank you very much to vote @puncakbukit as witness and curator.

Unless it's non-custodial its not De-FI in fact it's false advertising to claim that it is, the whole point is to not have a middle man! If they can't provide you with use of your own keys you're nothing more than a bank, just because you use blockchain as an asset class doesn't make you a de-fi

Its only custodial for the lessee, for the lessor (stake holder) they hold the keys at all times so the stake is always safe. The stake is the largest amount, the lease payment escrow is small in comparison. Example circa 3 mil in SP active leases exist atm but the escrow held between the old minnowbooster and dlease is less than 50k steem, that’s about 1.6% of the total value that isn’t 100% decentralised due to escrow.

might want to edit this one ;)

Good spot will fix that tomo

Congratulations @dlease! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!