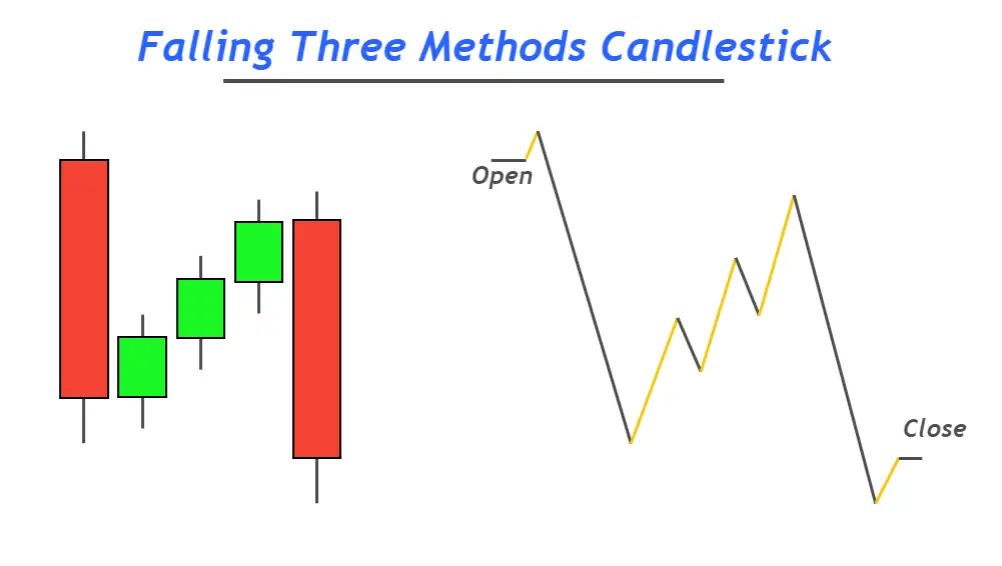

The Falling Three Candlestick pattern is a well-known bearish continuation pattern that traders and investors use to predict future price movements in a downtrend. This pattern consists of five candles, where the first and the last candles are long bearish candles, while the middle three are short bullish candles that stay within the range of the first candle.

This pattern is a reliable signal that the existing downtrend is likely to continue, as it shows that sellers are still in control despite the brief consolidation period. The first candle, a long bearish candle, confirms the direction of the downtrend, and the short bullish candles represent a temporary pullback or hesitation in the market.

The fifth and final candle, a long bearish candle, closes below the lows of the first candle, indicating that the bears have regained control of the market, and the downtrend is likely to continue. This pattern is considered a reliable bearish continuation pattern as it confirms that the bears are still in control of the market.

Traders and investors can use this pattern to enter short positions or add to existing short positions. It is essential to confirm the pattern's validity by analyzing other indicators, such as volume and price action, to avoid false signals.

Conclusion

the Falling Three Candlestick pattern is a bearish continuation pattern that traders and investors use to predict future price movements during a downtrend. It is essential to use this pattern in conjunction with other indicators to avoid false signals and make informed trading decisions.