Investopedia link: https://www.investopedia.com/terms/l/laffercurve.asp

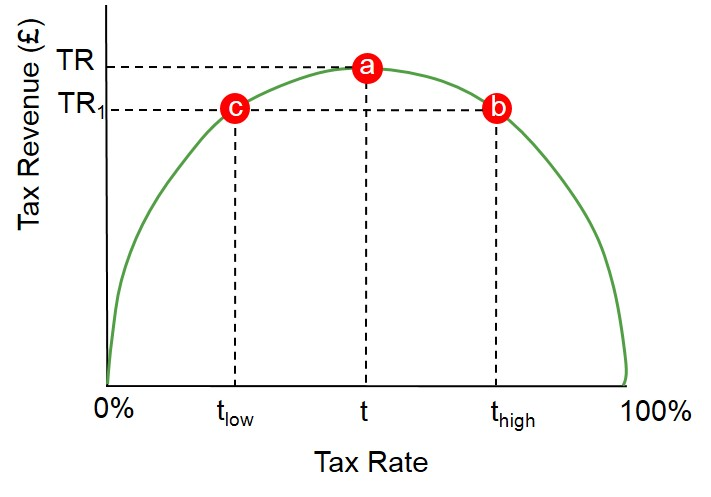

Tax rate CUTS cause MORE revenue to government all the way down to 18%.

Any average of tax rates that is above 18% causes LESS revenue to government. It is ONLY if you get the average rates BELOW 18% that you manage to actually reduce revenue to government.

Everyone in economics in DC knows this. Government KNOWS THIS. When they talk about raising taxes, be it on the rich or anyone else, they are NOT doing it to get more revenue, and pay more bills, and support more people with benefits. 18% would DO that.

But they want 40, 45, 50%. They KNOW this will result in LESS revenue, but they want it... because it is PUNITIVE and will cause the middle class to flinch and take fewer chances and do less. And to LIVE with less.

Tax increases are to DENT the MIDDLE CLASS. That is all they do, and that is what government WANTS when it raises them. If it wanted max tax revenue, it would just set rates at 18% across the board.

But they don’t want more revenue.

They want more harm to the middle class.