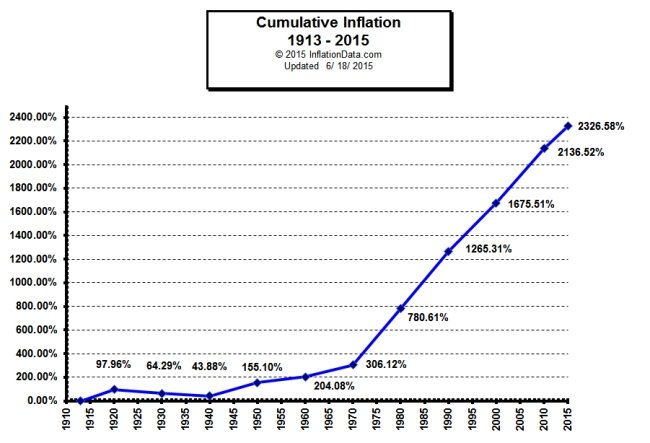

Since inception the money all Americans use went down in value drastically.

source : http://inflationdata.com/articles/charts/cumulative-inflation-decade-1913/

source : http://inflationdata.com/articles/charts/cumulative-inflation-decade-1913/

Now the question is how many more years can this last before we have Venezuela 2.0.

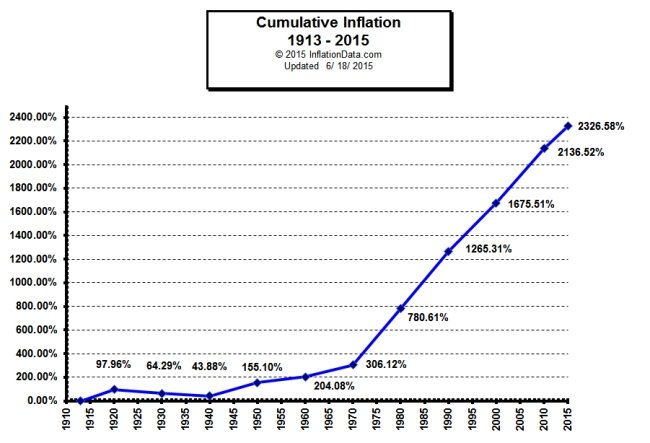

Since inception the money all Americans use went down in value drastically.

source : http://inflationdata.com/articles/charts/cumulative-inflation-decade-1913/

source : http://inflationdata.com/articles/charts/cumulative-inflation-decade-1913/

Now the question is how many more years can this last before we have Venezuela 2.0.

i'm no fan of monopolistic central banking control of currencies, but i have to say that the U.S. is likely very far away from a currency crisis like Venezuela. The Fed parasitically siphons purchasing power via money creation, and they've loaded up on an historically unprecedented balance sheet, but they're doing this nonsense on top of the world's most productive economy.

Plus, even though debasing currency via perpetual inflation siphons purchasing power, they've been doing it at a lower rate than overall growth, like a smart parasite that knows how to keep its host alive. Yes, that graph above looks dramatic, but growth has been more so, which is why we haven't ended up like Venezuela.

Couple inflation with severe economic micromanagement like Venezuela, then, sure, we'll see a similar outcome. We may be trending in that direction, but still quite a ways off.