What are Bonds?

So, first of all, what are bonds?

They are debt investments, meaning that an investor loans money to an entity, which can be either corporate (corporate bonds) or governmental (treasury bills/bonds). The borrowed funds are to be returned after a predetermined time period (1 year, 10 years, 30 years etc.). This is called the maturity date.

Furthermore, the face value of the bond, or the initial price is equal to the amount of money being loaned. In addition, the funds are borrowed at a variable or fixed interest rate (also called a coupon).

These instruments are also called fixed-income securities – and they represent one of the main classes of securities, alongside equities (stocks) and cash equivalents (cash or instruments that can be converted into cash immediately).

Types of Bonds

The corporate or governmental entities can use bonds in order to raise money that will help advance projects. Please note that corporate bonds are inherently a riskier investment, as the probability of a company to default on their debt is much greater than that of the government going bankrupt. Moreover, as a general rule, the higher the interest rate on a bond, the riskier it is.

Bonds can be of the following types:

- Zero-coupon bonds – no interest rate payment is issued, but it is issued at a discount

- Convertible bonds – may be converted to stock through an embedded call option (no time to discuss options here, but Google is your friend 😊, perhaps that will be another article)

- Callable bonds – the issuer can call back the bonds if the coupon rate drops sufficiently

Credit Quality

One of the principal characteristics of a bond is that one of the main price determinants is credit quality – which is determined by third party ratings agencies. These agencies can ascribe a score such as AAA, AA, BBB.

As an example of how these agencies can mess things up (and of how much faith people put in these ratings), note that The Great Recession (the 2008 financial crisis) was mainly caused by top AAA ratings being given to subprime mortgage backed securities, including many which had risky adjustable-rate mortgages in their composition. But more on this topic at another time, I am trying to write an article, not a book 😊.

Yield

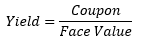

The yield is the return provided by a fixed income investment. The yield for a certain payment (i.e for a certain time period) is equal to:

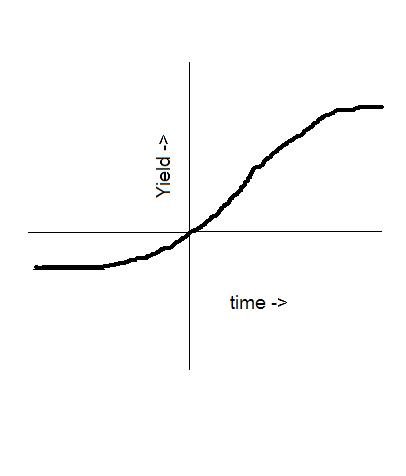

It is mostly affected by the time to maturity and can best be described by the yield curve. This curve shows interest rates of bonds with equal credit quality, but different time to maturity dates. It represents the yield-to-maturity of a certain class of bonds, such as U.S. Treasury bonds.

If we take the present value of all of the bond’s cash flows and apply the same discount rate (the yield) such that those cash flows are equal to its price, we obtain the yield-to-maturity. The yield curve typically slows upward, since investors need to be compensated when they take the extra risk of longer-term bonds (as shown below; think of yield as a percentage, time can be in years).

When a bond’s yield rises, its price falls. Conversely, when the price rises, the bond’s yield falls. Moreover, the yield is affected by the maturity date – the longer the time duration, the higher the yield.

Think about it, if we as investors own a bond that pays 5% interest (yield) and interest rates increase by 1%, newly issued bonds can provide a 6% interest payment, so naturally, the price of the previously issued bonds will fall.

Interest Rates and Inflation

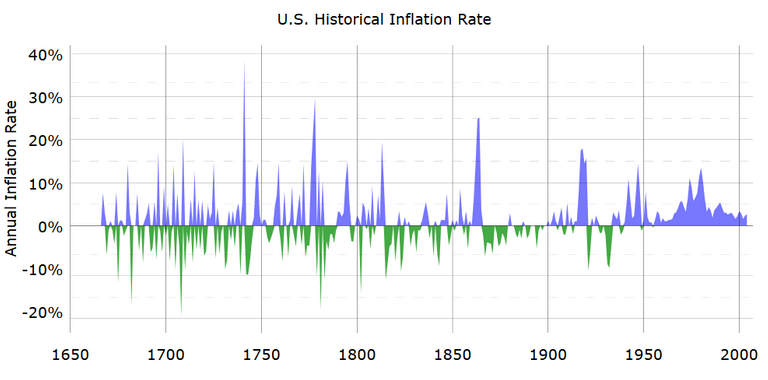

Inflation is the bond’s archenemy, because it destroys the purchasing power of future cash flows – since those are payed in the currency affected by inflation. If higher inflation is expected by the market, bond yields and interest rates will rise, so that they make up for the loss of purchasing power.

Interactions between short and long-term interest rates generate expectations of inflation. Central banks are the entities who set short-term rates. Supply and demand determine pricing for long-term bonds – which, in turn, sets the long-term interest rates.

If the central bank has set the interest rates too low, inflation expectations increase – long-term interest rates increase relative to the short rates and the yield curve steepens.

Conversely, if the central bank sets the rates too high, long-term interest rates and inflation expectations decrease and the yield curve flattens.

Congratulations @avrdan! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP