As we get old, we all understand that politics in our "democratic" world in only about populism and politically correct (a more developed type of populism). But if we watch at how our modern democratic countries works we see that all of them have opted for the same kind of tax on personal income: the progressive taxation.

In a few words the more you earn the highest percentage of what you earn is confiscated by the state. This is particularly interesting, because this is populism at the n-th power.

An strange analogy

Humans doesn't let things happens around them without changing their behavior, but we interact with all the boundary condition in order to make it possible to satisfy our personal desires. So humans move and, particularly they have two way of moving that could interest us. The 'move your money' or the 'move your ass'.

The 'move your money' is typical of wealthy people, unlike the 'move your ass' that is open to anyone at every scale (we see what is happening in the middle east).

If we concentrate to the 'move your money people' we realize that the impact of this moving money outside our economy is very debilitating for our economy and we blame those guys (when we discover them, of course).

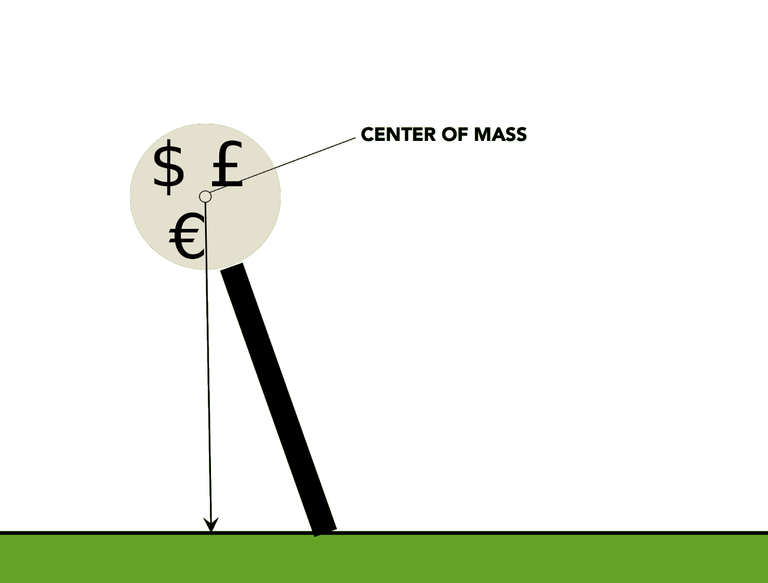

But this people is almost always forced to move. Imagine a pendulum, there are two equilibrium position for a pendulum subject to gravity: the upper position and the lower position. One is called unstable equilibrium, the latter stable equilibrium.

The difference is very simple. If we move the pendulum from the stable equilibrium, it will come back to that same position. If we move the pendulum from the unstable equilibrium it will never come back and it will direct to the stable equilibrium.

Our taxation on income

Consider our taxation, without considering all the escapes that can be found in every tax system, just because the politics are there to be corrupted and the lobby to corrupt. So let's consider it for how it is.

In our example we can imagine a tax system with three rate, the 10%, the 20% and the 40% rate, that they activate at 20k€, 40k€ and 60k€. We compare these rate on two people with different income.

The first person, the poor, is a civil worker, his works is giving him a taxable income of around 22k€. He will need to pay 0€ on the first 20k€ and 200€ on the second 2000. He know that the 2000 are taxed higher, but he does not complain too much. He prefer to complain on the fact that there are no jobs and that all the company are living the country.

The second person, the rich, is an engineer with a manager position and he earn 70k€ per year. His taxation is a bit more painful. He pays 0€ on the first 20k€, 2k€ on the second 20k€, 5k€ on the third 20k€ and the incredible amount of 5k€ on the fourth slice the 10k€ that bring him to 70k€. For a total of 12k€.

These two people are living in the same country and they are subject to the same rights and responsibilities. The state provide them with what he continue to repeat is the best (and the only) education and the best (and the only) health care. The two people are paying a very different price for the same thing but nobody defend the rich guy, At the end is he rich, with all the problems we have...

When we enter in a restaurant you do not have two different bills of 120 € and 2€ for the same food, that type of restaurant will close very soon or he will prepare a shitty food cause all the clients will be the 2€ clients.

With the state is the same thing, the more the taxpayer pays the more it is highly probably that it loose his unstable equilibrium and he naturally tends to a stable one. Once it will be gone he will never return.

Other types of taxation on income

But this is the only way? The more you earn the more you pay and so the more you are tempted to leave and eventually never come back? At the end if we see the statistics all we can achieve with this system is that the healthy are fewer (with less money, probably with money elsewhere) and that the poor are more, until the moment where all the extreme taxation imposed on the richest part of the population doesn't have any impact on the rest of the country..

Lets see other possible type of taxation.

The Flat Tax

It has the advantage of clarity and it is really loved by a big part of the liberalism politician (if there are any), it flatten a lot the need to leave a country because of fiscal persecution, but still it is not perfect. Lets come back to our example and imagine if the two people were taxed with a flat tax of 20% starting form 0€ of income.

The 'poor' would have payed 4400€ and the 'rich' 14000€. We already feel better. At the dinner, for the same food the 'poor' pays 44€ and the rich 140€. If the problem is that the poor pays 4400€, because it is too much everybody should agree in lowering the 20% tax, that it would be a great idea.

Still this does not seem right, especially from a moral point of you, unless your morality is: 'do whatever you want to the rich, we do not care'.

The Regressive Tax

Personally I've never heard about this type of tax, but I figured out alone this solution thinking about how use the most important part of the 'rich' population: the will to invest and to earn even more, and also considering the amount of money that is flying oversees in the western world.

Imagine that we were in a place were people was not expecting to live on other people expenses. In this particular place the state says: "ok the more you earn, the more you pay, but I will ask you a lower percentage, cause you already payed for yourself and you are now paying for other people. Thank you btw!"

In that state the taxes rate divided by 2 every 20k€ starting from 20% and converging at 1% as a minimum tax rate.

The poor guy will still pay 4400€, while the rich guy will be in ecstasy cause he will have to pay only 4000€ on the first 20k€, 2000€ on the second 20k€, 1000€ on the third 20k€ and 250€ on the last 10k€, for a total of 7250€.

This system will have a particular benefit, the more you earn the less you have an incentive to leave the country or to pay less. Also it could be politically arguable that the 'rich' still pays for the poor so he is going to help.

Moreover very few people will not cheat on their records, because the more you do the less you have to worry.

But still at the restaurant for the same dinner one pays 44€ and the other pays 72.5€... It weird, it does not seem right. We could stay like this and eventually it will be better than now, and all the money that will not be wasted by the state they will remain in the system creating better companies or changing the world to a new technology.

If someone is rich because the competition states that he is able to do business, it will be better to let him invest his money and do more business than to give the money in the hands of politicians that will create enterprises that will fail soon.

The poll tax

Considered by Rothbard as the only justifiable tax, the poll tax is like a club participation, or the same price for the same food (as said before). It will have the enormous benefit that cheating will not have any meaning, so we could also take away some very expensive control.

The tax will also put an incentive to 'poor people' to work as much as they can, without relying on any help, but with a big advantage: they will live in a place where all the investment are, where the workers are scarce, because the offer of new jobs much higher and where they will be no 'poor anymore', or at least 'less poor'.

Who will help these poor people then?

Congratulations @maiopirata82! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

For more information about this award, click here