IMG SRC [Image is my own creation]

At this point, I've seen countless documentaries on the 2008 financial crisis. One thing I'll always love about them, is seeing all the major news anchors of the time. Through all of the lectures, documentaries, and articles, the main thing I've learned about the crisis is that it really was complicated and depending on how you want to spin it, you could realistically place the blame on a multitude of parties. I'm not here to place any blame, though. I'll aim to be as objective as possible when I refer to the events of 2007-2008. As with many of my reflections, this will be sporadic, but I'll try my best to welcome you into my mind.

Emphasis on Housing

I find it interesting (daunting even?) that the market medium of the 2008 crisis was the housing market, upon deeper thought, there's a very good reason for that. I don't think a bubble in any other market would have had the same effect as the housing bubble did because housing is a necessity. That very thought pattern is also to blame for the recession itself, as affordable housing was the subject of major policy at the time. This thought begs a few questions on the issue of government interference in "free" markets, but expressly necessity good markets. The following is an excerpt from a policy brief I wrote last fall (I may adapt and post it in the near future) that I think belongs here:

"On a 2009 episode of the EconTalk podcast, Clifford Winston talks about his book, Market Failure vs. Government Failure. The book deals with the practice of government intervention in market failures. His conclusion is that governments shouldn’t be so quick to intervene: “It is certainly the case that markets do fail--we do have pollution, congestion; but there are other cases where it's hard to find evidence of the kind of market failure that would justify government intervention. More troubling is the lack of evidence of government interventions, whether justified or not, significantly turning things around.”

Government Intervention

What Winston is getting at describes what happened in 2008 well. The recession was inevitable, but its severity may have been mitigated with less government intervention. Consider the efforts to "fix" the economy during and after COVID. First, sending out stimulus checks? probably not the best idea... I understand that a lot of people needed some help, but why not let the free market address those kinds of market failures. I think the prevalence of ghost kitchens is a good example of entrepreneurs filling a need in that respect. Second, the Fed getting their dirty little fingers entangled in the inflation that was caused by the stimmy checks. Now, I haven't quite decided what option would have been better, but I can say confidently that raising rates incrementally was not the best move. Should they have just done nothing at all and let inflation run its course? Possibly. Should they have just done one, maybe two big increases? If their goal was to stop inflation, then yes, most definitely. Both options wouldn't have resulted in a "soft landing" that we hear about so often, but I think the outcome would have been better.

It seems we are unable to live in a country where government market regulation does not exist at all (which is probably for the best), but what if we took a rather counterintuitive approach and barred the government from intervening in necessity markets? The consequences of such a plan could be dire: if you can't afford a home, you simply cannot have one – this could result in many multi-generational households, or a healthy renters market. The other thing that heavily influences the housing market is interest rates which are ~intimately~ related to the Federal Reserve. While not technically part of the federal government, the Fed certainly has an effect on free markets. So how do we tackle that? Should the Fed not be allowed to change its repo rates? Realistically, I think it should, but not for liquidity or inflation reasons. Instead, it should set rates to make money for the Federal Government, just like a private company; If the Fed wants to make money, then they need to offer competitive rates. (there is a slough of other issues here and I quite simply cannot think through all of them to be confident in the preceding argument, so just take it in stride).

The Free Market Tradeoff

The recurring theme (I've bolded the text I'm referring to) through all of this points to what a free market is really good at: finding equilibrium. It is often said that there are two economists, those that favor equality, and those that favor efficiency. I tend to favor efficiency, and that can be a hard pill to swallow at times. Why? Lets look at that bolded text and what the efficient outcomes would be:

I understand that a lot of people needed some help, but why not let the free market address those kinds of market failures. Stimulus check wouldn't be sent out, many people would fall into extreme poverty, death would probably occur (hyperbole), definitely mass income inequality.

Should they have just done one, maybe two big increases? Fed does one huge interest rate increase, and the economy comes to a halt, but it only lasts for what, 10-15 months? After that we see another big boom and everything is back to normal – none of this prolonged "soft landing" bs.

if you can't afford a home, you simply cannot have one This one is pretty self explanatory, but not having a place to live (which would inevitably happen to many Americans) is pretty inhumane,].

If the Fed wants to make money, then they need to offer competitive rates. If the Fed can't operate as a competitive lender, it has no place in the market and should fail, just like any other bank. Let me reiterate that: If [insert bank here] can't operate competitively in the market, IT SHOULD FAIL.

Sometimes, I do not care much for the Federal Government

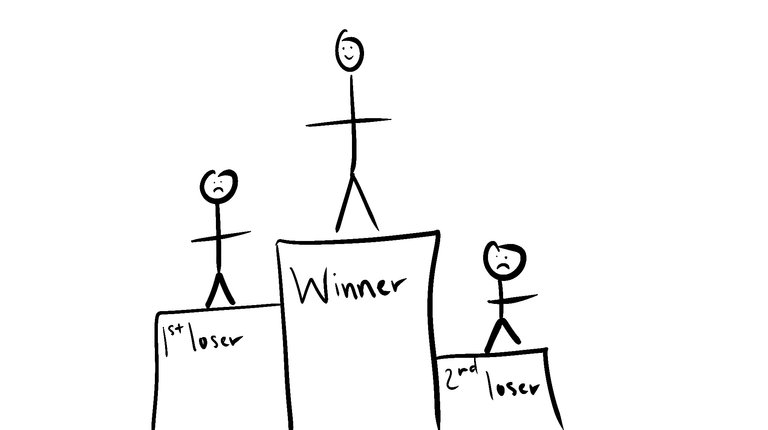

A free market has the ability to operate incredibly well and efficiently, but it requires that there are winners and losers. To ensure you aren't a loser, all you have to do is ensure that you're competitive. All too often the Government wants to "protect" the people by giving a loser another chance when they've already shown that they don't deserve it (AIG, Citi, Morgan Stanley, JP Morgan, B of A, US Bank, GM, Chrysler, etc.). All I'm saying is: a really rough 8-12 months could make way for a bountiful economy.