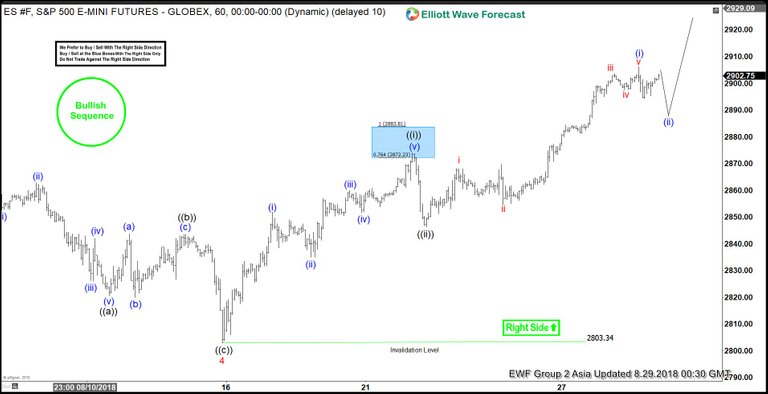

S&P500 Mini Futures ticker symbol: $ES_F short-term Elliott wave view suggests that the decline to $2803.34 low ended Minor wave 4 pullback. The internals of that pullback unfolded as Elliott wave zigzag correction. The lesser degree Minute wave ((a)) ended in 5 waves at $2820.5 low. Then the bounce to $2843.50 high ended Minute wave ((b)) bounce as a Flat correction. Down from there, the index completed the Minute wave ((c)) in another 5 waves at $2803.34 low.

Up from there, the rally higher is taking place as impulse structure with lesser degree cycles showing sub-division of 5 waves structure in each leg higher. It’s also important to note here that index is already into new all-time highs & both the sequence & right side tags are calling index for more upside. Above from $2803.34 low, the minute wave ((i)) ended in lesser degree 5 waves structure at $2874 high. The pullback to $2846.25 low ended Minute wave ((ii)). A rally from there unfolding in another 5 waves structure within Minute wave ((iii)) with lesser degree cycles in Minutte wave (i), (iii) & (v) expected to unfold in 5 waves structure. We don’t like selling the index and expect buyers to appear in 3, 7 or 11 swings against $2803.34 low in the first degree.

S&P500 Mini Futures 1 Hour Elliott Wave Chart