As we saw previously, Bitcoin was the first virtual currency, giving the starting signal to other cryptocurrencies such as Litecoin, Ethereum, Bitcoin Cash, Ripple, Dogecoin, to name a few. The control of each currency works through a decentralized database, usually a chain of blocks (in English blockchain), that serves as a database of public financial transactions. However, there is controversy that cryptocurrencies have to be decentralized control or centralized currencies by central banks or another entity. The use of cryptocurrencies has serious drawbacks that in practice limit its dissemination. Perhaps the most important of these is legal uncertainty, since in many countries there is not too clear a regulation on the use of these digital currencies and there may be a certain degree of uncertainty about the legal consequences of their use. On the other hand, there is no body or government that imposes its use and thus guarantees at least a minimum level of acceptance, although it is required by laws of legal course.

Finally, the price of cryptocurrencies in the markets has been subject to a high degree of volatility, which in some way has reduced their status as safe haven currencies. Trending up in 2019 (though not without bumps), Bitcoin crashed in March 2020 losing 30% of its value and has been recovering in the months since. Generally, the entire period has been characterized by sudden falls followed by strong rises, thus consolidating the volatility of this currency.

- Bitcoin leads among the most common cryptos, followed by Etherum, Ripple, Dash, and Litecoin

This chart shows the cryptocurrencies with the highest market capitalization - source: coinmarketcap.com

Bitcoin and virtual currencies are an excellent alternative to fiduciary money (dollar, euro, pound, yen ...) that is currently handled, since over the years the influence of this monetary system has benefited, since that there is a progressive global increase of users by the computing community.

However, despite the fact that cryptocurrencies are a reality today, there are many people who are not informed about its operation, or doubt its security, to the point that there are people who have never heard of it. However, with everything and the widespread ignorance we cannot deny that as a result of the emergence of bitcoin, other cryptocurrencies have arrived that are here to stay, so it will bring great changes in the coming years at a global level.

Something that we should not overlook is that investing in both BTC and other cryptocurrencies carries its risks, so before investing your money you must inform yourself very well in which project you invest, in which platforms and even which wallets you decide to use to store the funds. acquired currency. Although there remain many difficulties and objections to its use, none of them has been able to prevent its dissemination, for better or for worse.

We can say that the changes experienced by the world economy seem to boost the use of cryptocurrencies, so there is no doubt that in the near future the use of virtual currencies will become even more global, especially in those countries whose currencies do not constitute a safe value for investors. This phenomenon is one of the great challenges of the new economy that awaits us, where more and more people will use cryptocurrencies as the money that is currently handled.

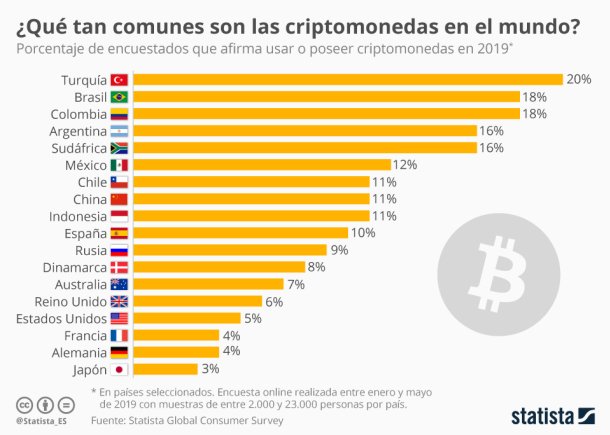

This graph shows how common cryptocurrencies are globally - source: Statista Global Consumer Survey.