.jpg)

Foreward

Just prior to publishing this article we received the following screenshot of EOS Gravity, a Block Producer candidate in China.

.jpg)

Translation:

Zhangjiaming Question: As the largest Chinese community, Gravity is about to campaign for a main node for EOS. Would it consider a funding round / ICO of sorts? Say after that we then rent a facility and get a few server clusters, and then lend EOS?

Ocean: Right, initially no server clusters are needed, but a very high spec server would be needed, especially on the RAM front. What's the purpose of an ICO? I don't quite understand the logic. If Gravity ourselves acts as a main node, we would dividend out most of our revenue outside of necessary operating costs to the voters that support us.

We respect EOS Gravity. They are one of the most promising block producer candidates in the world and have been cultivating the EOS community in China for a very long time. They have done an amazing job of it and are expanding every day. We are very impressed with their team, organization, and their dedication to spreading EOS throughout China and the world. We hope that they are successful in their mission and we look forward to working with them. We also look forward to learning more about their plans which we are sure are extremely thoughtful. While this screenshot is likely only a fraction of what EOS Gravity stands for we at EOS New York firmly stand against voter dividends and will outline our reasoning in this post. For more information on EOS Gravity, check out EOS Go (https://forums.eosgo.io/discussion/155/emails-with-chinese-eos-gravity-group-10k-followers)

Introduction and Purpose

This is the second installment in the "Your Vote Matters" series. The intent of this series is to explain the importance of thoughtful voting for Block Producers. A good Block Producer will ensure the continuity of the EOS blockchain by always adding value back into the network. This will attract more developers and token holders, and ultimately increase the demand for EOS tokens. Block rewards are the primary tool that Block Producers have to add value. In this post, we intend to outline our framework for how we allocate block rewards and also discuss the damaging economic effects of voter kickbacks i.e. directly paying a token holder for their vote; and how this puts the interests of a single Block Producer or Token Holder ahead of the interests of the overall network.

At the time that this is published, the latest EOS.IO software does not provide EOS token voters with remuneration when they stake a token to vote for Block Producers. That is to say there are no direct payments to voters built into the software, nor is there a dividend-like payment for voting to be derived from the inflation pool. Rather, the token inflation mechanism built into the software rewards block producers for producing blocks consistently and in accordance with the governing software rules. These token-rewards are awarded to the top 121 producing and non-producing nodes, and the use of said tokens is at the full discretion of each Block Producer. This economic model may appear off-putting for many who have become accustomed to receiving rewards directly for their participation in network consensus. However, this model is beneficial to token holders and aligns the interests of the Block Producers with the long-term success of both the voters and the network itself. It does this by encouraging reinvestment in the network in various forms (e.g., infrastructure, dApp support) which we outline herein.

First, Some Recent History

The newer consensus protocols (i.e. Delegated Proof-of-Stake, Proof-of-Stake) of many networks today are designed to be more inclusive than the Proof-of-Work “might makes right” model of consensus. In many of these non-PoW blockchains, the average user or wallet owner takes part in achieving consensus and is rewarded directly for their contribution. For example, the PoS model employed by the NAV Coin network enables every token holder to be rewarded up to 4% per year for staking their tokens to validate the transactions on the network. This reward also serves as the network inflationary mechanism.

Networks are attractive to the individual when they directly reward the individual - who would have thought? By purposefully not including this feature in the EOS.IO software and through the wide-spread campaign to discourage paying for votes as a practice, many users believe that EOS is disincentivizing participation in its own governance structure. Why vote if you don’t directly benefit?

For the rest of the article we would like to remember this quote by Henry Hazlitt:

“The bad economist sees only what immediately strikes the eye; the good economist also looks beyond. The bad economist sees only the direct consequences of a proposed course; the good economist looks also at the longer and indirect consequences. The bad economist sees only what the effect of a given policy has been or will be on one particular group; the good economist inquires also what the effect of the policy will be on all groups.”*

― Henry Hazlitt, Economics in One Lesson: The Shortest and Surest Way to Understand Basic Economics (https://fee.org/media/14946/economicsinonelesson.pdf)

How EOS New York Will Add Value

As was stated in the introduction, the primary directive of a Block Producer is to ensure the continuity of the EOS blockchain on which it resides by always adding value back into the network.

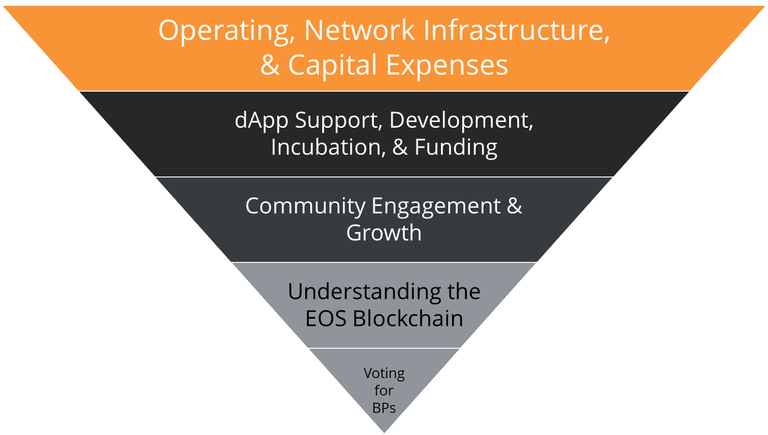

In order to continuously add value back into the EOS network, EOS New York proposes this inverted pyramid framework to guide how we allocate block rewards. (Note: our budgeting process and rewards allocations will be published with actual values at a later date once we can better project hardware specifications, network demands, and the operational expenses).

Operating, Network Infrastructure, & Capital Expenses

To maintain and increase network value, EOS New York needs to scale its network capacity faster than the token price or network usage can increase (https://steemit.com/eos/@eosnewyork/voting-matters-on-eos-token-price-volatility-and-its-effect-on-the-eos-io-network). We need to maintain multiple nodes, backups, all with staff monitoring the network around the clock. Upon launch, we will immediately begin assessing network statistics and executing on scaling plans through cloud expansion and looking toward owned or co-located data centers in the northeastern United States, among other regions.

dApp Support, Development, Incubation, & Funding

EOS itself has no value if nothing of value is built on top of it. Once there is a viable network that can be developed on, it’s the dApps that will drive value. EOS New York believes that it should be partly the responsibility of Block Producers to help identify “the killer dApp” ideas that are out there, present them to the community, and do what we can to ensure that they are built, launched, and supported on the EOS public blockchain.

Efforts that Drive Community & Adoption

Once dApps are live and the EOS blockchain is successfully growing, it should also be partly the responsibility of Block Producers to help provide the community with resources to organize. At EOS New York, even without the benefit of block rewards, we dedicate our time to Meetups as a way to bring people and ideas together (https://www.meetup.com/EOS-New-York/). In the future, as an elected block producer we will have the ability to organize events that are global in scale: developer ‘trade shows’, conferences, hackathons, and dApp pitch competitions. We hope to do this alongside our fellow Block Producers. We will also employ a multilingual community team to engage token holders across the world.

What about the non-token holder a.k.a everyone else on planet Earth? EOS evangelization should be partly the responsibility of the Block Producer. For example, explaining the differences between decentralized networks and why EOS is revolutionary to the uninitiated is difficult. Content production and distribution thereof to token-holders and non-token-holders alike will be a priority. Our co-founders background in marketing lends itself perfectly to executing multi-channel campaigns aimed at delivering the message of EOS.

Understanding the EOS Blockchain

Consortium blockchain economics are new concepts where research is needed. We will need to invest in developing a deep understanding of how this new arena effects how we as participants make decisions. It will be beneficial to the EOS ecosystem as a whole to fund research to better understand the tokenomics of our unique system of incentives, the economic benefits to the users, the seen and unseen costs to dApps and Block Producers, the organizational dynamics of DAOs and where decision making is beneficial in a decentralized manner (and where it’s not), and other interesting research areas.

It will also be beneficial to understand academic perspectives before making a proposed code change to the network or incentive structure(s) currently in place. Questions such as:

- “what are the behavioural effects we can expect from x change”

- “how may tokens be used differently?”

- “how may a buyer of tokens behave differently?”

- “why are non-EOS users not engaging the network at this time and what can we do to encourage adoption/ EOS rejector study?”

- “what would be the effect on network resources, voting, and adoption rates?”

...And other questions will be critical to investigate and answer. Are there ways we can shortcut future development and governance strategies by harnessing learnings on how these networks function in a society (or as a society)? We are approaching the academic world to accomplish this.

Voting For Block Producers

Finally, if there are resources left over, we will join other token-holders to vote for Block Producers that we believe will act as responsible stewards of the network. This does not mean collusion, or a network oligarchy. EOS New York maintains a strong set of values and will not sacrifice them for the sake of quid-pro-quo. We are also considering ways in which EOS New York can submit symbolic votes that merely show our support for a candidate but do not impact a BP’s vote total in a real way.

Adding Value to the Network

We believe each of the items we’ve outlined above accomplish the following:

- They increase the number of developers using the EOS main-chain

- They increase the number of token-holders using dApps on the EOS main-chain

- They increase demand for the EOS tokens

Now that we’ve established the ways that we maintain and grow the network value let’s establish exactly why we believe that voter kickbacks, or directly paying a token-holder for a vote, is economically damaging to the EOS network. Let’s go back to what Henry Hazlitt wrote, “The bad economist sees only the direct consequences of a proposed course; the good economist looks also at the longer and indirect consequences.”

We can quantify and measure the direct consequences of voter kickbacks; each token holder who voted for that Block Producer receives x tokens as payment for their vote. But it’s difficult to quantify the long-term effects of diverting those tokens away from value-add items because we may never see the economic output from them. Remember, individual token holders are under no obligation to provide value to the network, but Block Producers do and should proudly own that duty. A Block Producer’s actions are transparent, and their actions with those tokens are to be closely watched by voters so that we ensure they’re reinvesting those tokens for the benefit of the network.

In summary, Block Producer rewards are finite and every token that a Block Producer pays out for a vote is one less token to use for any of the value-add purposes we’ve outlined above.

The Broken Window Fallacy

To further illustrate our position let’s visit the broken window fallacy written by Frédéric Bastiat in That Which Is Seen, That Which Is Not Seen (http://www.econlib.org/library/Bastiat/basEss1.html).

A boy throws a rock through a shopkeeper’s window. The onlookers decide that the boy has done the community a service because now the glazier (window repair person) will need to be paid by the shopkeeper to fix the broken window. The glazier will then use this money to stimulate the local economy. This is what is seen. What is not seen is that the shopkeeper was going to buy a new suit from the tailor. Instead of a new suit we only have a replacement window, there was no net increase community wealth.

Thoughtful Voting

What about voter turnout? One might say that not paying for votes coupled with the 6-month token lockup required to vote for a Block Producer would disincentivize voting. Yes, but it specifically disincentivizes thoughtless voting. If one is being paid for one’s vote then the criteria with which one uses to inform their vote is weak, “who pays me the most?” will trump “who will do value-add services for the network?”. But a 6-month lockup encourages thoughtful voting from those who have the long-term well-being of the network in mind. Voter kickbacks threaten this model.

As we march onward toward a decentralized world we are able to afford to align the incentives of all involved, it becomes less about “Me” and more about “We”. Through responsible management of the public goods (i.e. the EOS network) we will all benefit. It is the responsibility, but not the obligation, of token holders to vote and without the expectation that they receive a direct payment, dividend, or another form of a kickback in return.

For the reasons outlined, EOS New York publicly commits the majority of its present and future resources to making the network valuable to the entire community, and not a select few voters through kickbacks.

We expect you the community to hold EOS New York, and all the other Block Producers, to the same high standard of adding value for everyone, not a select few.

How we accomplish the above will be outlined in our roadmap which we will release in the coming weeks.

Disclaimer: We purposefully did not broach the moral arguments against voter kickbacks. If you’d like to join in that discussion be sure to join us in Telegram ;)

Block Rewards are currently capped at 5% per year and act as the rate of inflation. The inflation rate is set by calculating the median inflation bid of the top 21 block producers.

Voter Kickback: A transaction consisting of no other component than payment in exchange for a token-holders vote.

EOS New York is a block producer candidate for the EOS.IO Blockchain

https://www.eosnewyork.io/

https://twitter.com/eosnewyork

https://medium.com/@eosnewyork

https://steemit.com/@eosnewyork

https://www.meetup.com/EOS-New-York/

A great article EOS New York, without doubt one of the most relevant topics in the EOS community. EOSphere stand with the same opinion and against the buying of votes from token holders and believe block producers need to demonstrate their value to the community by channeling their block rewards back into growing a positive EOS ecosystem.

Thank you! We love what you're doing!

I am seriously impressed by your deep involvement with the EOS community. You get my vote... if I get the chance to cast it (TBC) ;)

One question: How do you plan on determining the annual inflation % that you would vote for, and do you plan on communicating this to the community beforehand and/or getting their feedback on it?

Great question. Our bid will be public and it will be set at a level that is high enough for EOS New York to not just thrive at current levels but scale upward and outward rapidly. We would publish our bid beforehand to solicit feedback. Our hope is that we develop a BP model that runs efficiently in order to allow us to operate within a % inflation level that is amenable to the community.

I definitely agree on the paying for vote portion of the posts. I hope the resources that fall into the chain/economical studies ends up being a decent chunk. There will be plenty of BPs helping dApps, but I'm intrigued to see how network effects in EOS propagate from certain actions.

I generally agree, but would like to know your thoughts regarding returning investment to original investors in hardware, etc.

The way I see it, there might be a middle ground. I assume EOS NY has many shareholders, that prefer to use income to invest in growth vs returning capital to investors. I personally would vote for that over a group wanting to distribute gains back to investors, at least for the first many years. Crowdsourcing investors is OK by me.

If a BP is paying for votes, appealing to "greater token returns" minded folks, that might work at the beggining, but if network demands grow and they don't invest in growing their capacities, better alternatives will take their place and these "investors" will have locked up tokens without large paybacks.

In the end, it will come down to how wise the tokenholders who vote are. Kudos for standing on the longer term view...

We would like to be very clear... EOS New York in no way has accepted outside funding from anyone. We are completely self funded because we do not ever want to have what's best for the network and the community conflict with a VC who's expecting an ROI. If we were to ever take outside funding we would make that extremely public as we never want there to be a conflict of interest.

Edit: To be even more clear there is no one other than the founding team that legally owns any part of the organization or is entitled to anything at all.

Is it possible to allocate a small portion of the inflation to compensate the voters’ loss due to the tokens locked out for six months?

The price goes up and the price goes down. At this stage in blockchain, all tokenized assets are inherently risky and we cannot be in the business of compensating token holders for their losses at the expense of the value-add items listed above. The idea is that as we invest in each item in the pyramid presented the demand for EOS will increase and so will the value of every token on the network.

Look, if someone builds a whatsdapp on EOSIO then it’s a game-changer. Reward someone for building a decentralised Facebook and we win teh Internet!

We will absolutely support dApp creation in many ways as that is a fundamentally valuable aspect of the network.

Let's say a dapp is being supported by a BP. Now users and investors of the dapp know they are being supported by the BP. Those dapp users and investors vote for the BP who is supporting them. Couldn't this be a form of "paying" for votes? In cases where the dapp is an empty shell, this would be obvious to the community. How do we handle "paying" for votes in this way, that might not be as obvious. I might be over thinking things...