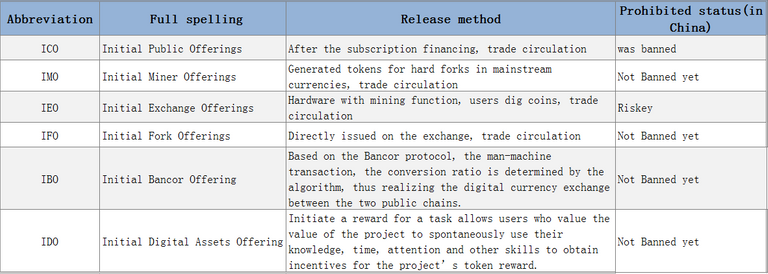

It has been 1 year since that ICO has been banned in China from September 4th of 2017. What digital currency issuance methods were born after ICO was banned?

We have mainly started from three aspects of digital currency to understand the nature of digital currency value and its relationship with blockchain and the token economy. In the process, we interspersed one or two distribution methods of digital currency intentionally or unintentionally, but digital currency has been developing constantly, and its distribution methods are more than these two. Therefore, today we will put together all the current distribution methods and help you understand them (for the sake of understanding, this article refers to digital currency, tokens, etc. as digital currency).

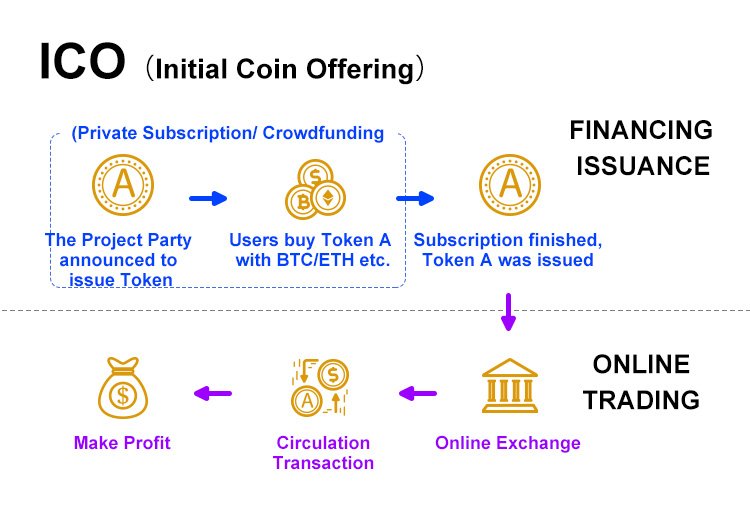

01 ICO (Initial Coin Offering)

Before talking about ICO, let's take a look at the IPOs (Initial Public Offerings) that we are familiar with in real life.

It means an initial public offering, which refers to a joint stock company sells its shares to the public through public disclosure for the first time. For the company, IPO is to help the company's future development through helping companies to get fundings, further develop the market, expand production, etc.

The ICO, Initial Coin Offering, is derived from the IPO concept. It refers to the blockchain project issuing new digital currency through crowdfunding, but the subject matter of the project issuer is changed from securities to digital currency. The assets that the buyer used to subscribe from the national currency to the common digital currency such as Bitcoin and Ethereum.

In general, the steps for a complete ICO project are as follows:

Simply put: "I want to issue a new token" - "You come to buy the new token" - "to trade with the new token"

But whether this "new token" is valuable depends on whether the blockchain project behind it is valuable. If it is a fake project that is not reliable, it is very easy for the project to fail or the project party to cash in. In this case, the token becomes a garbage coin, and the investor will lose money.

Because of the various risks mentioned above, coupled with the frenzied domestic investment environment and the lack of awareness of a large number of naive investors, on September 4, the central bank, the Internet Office and other seven departments jointly issued the announcement on "the prevention of financing risks of token issuance", in which ICO is characterized as unauthorised illegal public financing, and the cleanup and rectification of the ICO platform and the organization of the withdrawal of ICO tokens were required.

It was the end of ICO.

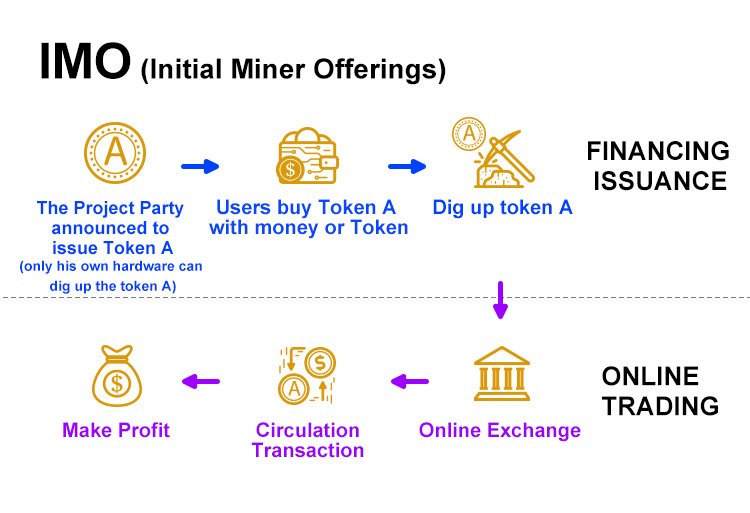

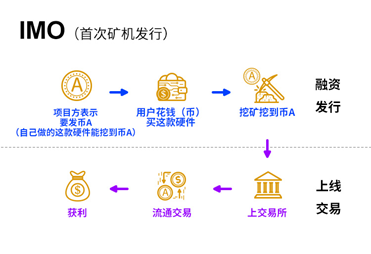

02 IMO (Initial Miner Offerings)

IMO, Initial Miner Offerings, issued a digital currency asset with a mining machine as the core.

Its process is generally like this:

A project party made a hardware by himself, saying that he wants to issue some kind of digital currency (called token A), and only his own hardware can dig up the token A;

Then he sells this hardware to the public (generally this hardware has other functions, such as storage, cloud computing services, etc.);

The users buythe hardware, and then begin mining, and the token A they dug are their own;

Finally, the token A also enters the trading circulation.

IMO is different from ICO, while ICO has a variety of digital currencies before it can use the mining machine to dig coins; but as for IMO, users buy the mining machine first, and then dig new coins through the mining machine.

Among the digital currencies issued by the IMO model, Thunder's "chains" (formerly "player coins" WKC) was best known. However, shortly it was criticized by the China Internet Finance Association in January this year, and the IMO model represented by Thunder is positioned as a disguised ICO.

Therefore, It was the end of IMO.

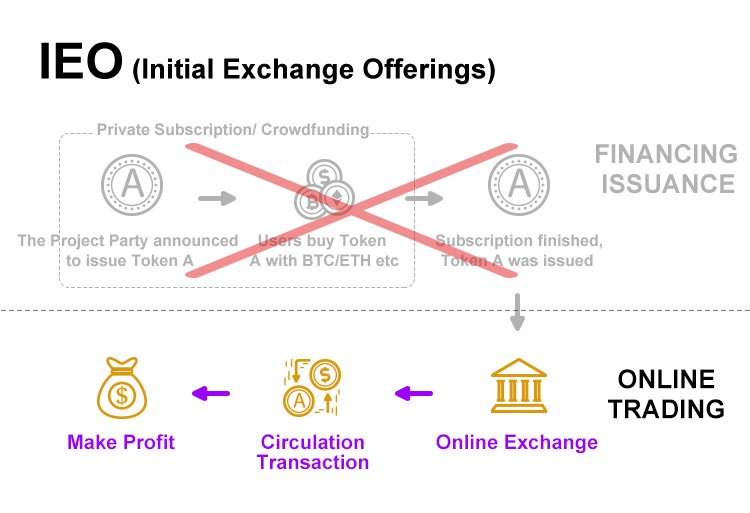

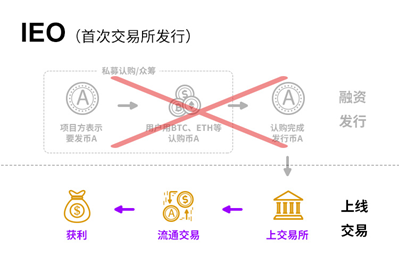

03 IEO (issued on the first exchange)

IEO (Initial Exchange Offerings), which issues digital currency at the exchange, is a relatively common distribution method recently.

IEO is actually easy to understood. It is equivalent to removing the ICO and IMO financing subscription process and directly putting the new digital currency on the exchange, allowing users to buy and sell transactions (as for why users are willing to buy these new tokens, you can review the previous classes in the Blockchain Lecture series).

For example, the HT of Huobi, the OKB of OKEx, and the hot airdrop candy (the candy is a token essencially, which will be discussed in detail in future classes) are typical examples of this model. HT and OKB have a strong exchange platform endorsement, and they are running very well at the moment; while other airdrop candy are mostly air coins, and there is no good project to support so that the final value will be zero.

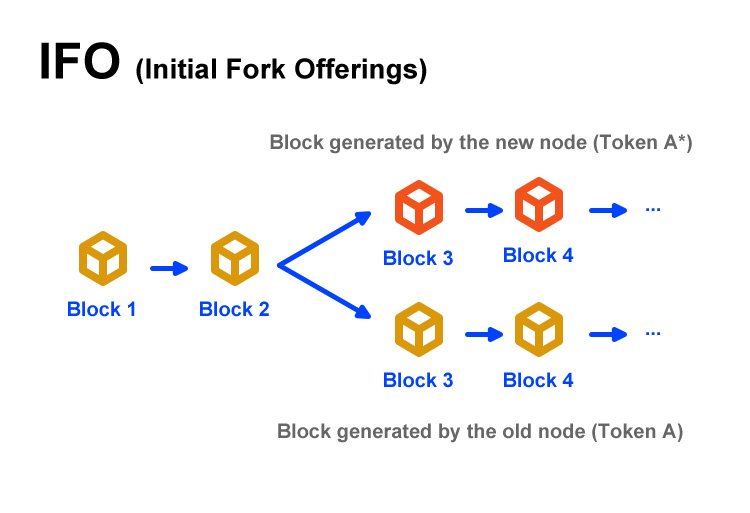

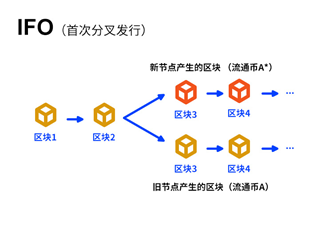

04 IFO (Initial Fork Offerings)

IFO, Initial Fork Offerings.

Unlike the previous three ways of issuing tokens, IFO is a fork based on bitcoin, Ethereum and other mainstream currencies (for blockchain fork, see [BlockChain Lecture] No.3). The person holding the mainstream currency such as bitcoin and Ethereum, can obtain a fork currency, which is a new digital currency.

For example, if I initially hold 10 digital currency A in the original mainstream chain, and then a team uses IFO to fork digital currency A. So I will have 10 new ones in this forked chain,i.e., the digital currency A, and other people who originally held the digital currency A will get the same amount of new currency A, after which the new currency A* will be traded and even exchanged.

As a result, IFO completed the task of issuing new coins.

05 IBO(Initial Bancor Offering)

IBO (Initial Bancor Offering), which is a relatively new type of digital currency issuance. It is based on the Bancor protocol (there will be a class to explain the Bancor protocol in the future). The man-machine transaction, the conversion ratio is determined by the algorithm, thus realizing the digital currency exchange between the two public chains.

It is equivalent to the credit-deficient entity to issue currency, and must have an anchor currency for credit grafting, such as the issuance of XX coins, which needs to be mortgaged by the central bank and then issued at a certain exchange rate.

In addition, IBO is different from lC0. The latter is to directly give money (coin) to the project party, while the former is to stake all your funds in the contract through Bancor, and the project party has no right to use them. However, if the project party wants to acquire a new digital currency, it also has to exchange with mainstream digital currency and robots, which is the same as the commom users. This exchange process is essentially the process of issuing new shares and entering the market.

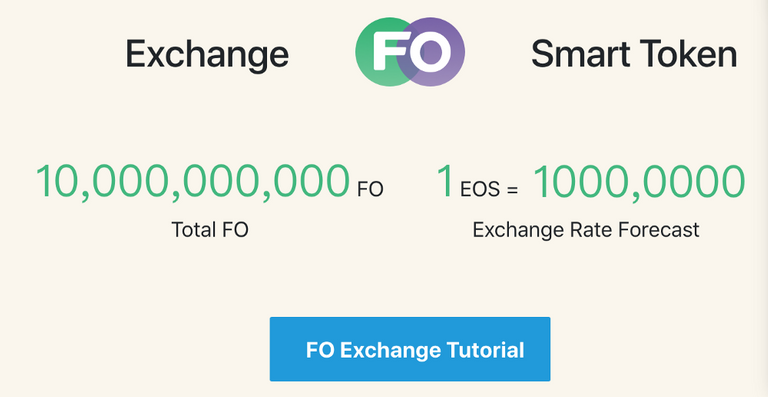

The typical example for issuing money in this mode is FIBOS, whose new token is FO, and the initial set of FO issuance is 10 billion, with the exchange rate 1 EOS = 1000 FO. The project has been exchanged for 850,000 EOS, that is, a fairly large amount of FO is circulating in the digital currency market.

06 IDO (Initial Digital Assets Offering)

IDO (Initial Digital Assets Offering), is known as the first digital asset issuance. The literal meaning is almost identical to ICO (Initial Coin Offering), but the business logic behind them is not the same.

ICO is to build projects through the funds raised from users of mainstream digital currencies such as Bitcoin, Ethereum etc. IDO itself does not raise funds, but by means of launching a reward for the task, and users who value the value of the project will spontaneously obtain incentives for the project's token reward with their knowledge, time, attention and other skills.

We also talked about this way in the eighth class “token economy”, a typical example is Bihu. In Bihu, you can get coins when you register, like, or write articles. Your attention, appreciation and writing ability can be realized here as part of the interest of the platform. IDO distributes community building to users and lets everyone work together to build community projects.

Finally, let’s use a table to summarize today's content:

94一周年 | ICO被禁后又诞生哪些数字货币发行方式?

我们前面主要从数字货币的三个方面进行展开,了解到数字货币价值的本质,以及它与区块链、与通证经济之间的关系。在这个过程中,我们有意无意地穿插了数字货币的一两种发行方式,但数字货币一直在不断发展,其发行方式又何止这一两种。所以,我们今天将目前所有的发行方式都汇总起来,一起给大家讲透(为了方便理解,本文将数字货币、代币等统称为数字货币)。

01 ICO(首次币发行)

在讲ICO之前,我们先看看我们现实生活中较为熟悉的IPO(Initial Public Offerings)。

它意思是首次公开募股,是指一家股份公司首次通过公开的形式向社会公众出售它的股份。 对于公司方面来讲,IPO就是帮助企业进行融资,进一步发展市场,扩大生产等等以帮助企业未来的发展。

而ICO(Initial Coin Offering),首次币发行,就是源自IPO概念,是指区块链项目通过众筹的方式发行新的数字货币,只是项目发行方的标的物由证券变成数字货币,而买家用以认购的资产从国家法币变成比特币、以太坊等通用数字货币。

一般而言,一个完整的ICO项目的步骤如下图:

简单来说就是:“我要发新币了”-“你们来买新币”-“用新币去交易”

但这种“新币”是否有价值,取决于其背后的区块链项目是否有价值。 如果是些不靠谱的假项目,就极容易发生项目失败或项目方套现跑路等情况,代币成了垃圾币,投资者就会血本无归。

因为上述的各种风险,加上境内投资环境疯狂、大量小白投资者认知不足等问题,9月4日,央行、网信办等七部门联合发布《关于防范代币发行融资风险的公告》,将ICO定性为未经批准非法公开融资的行为,要求清理整顿ICO平台并组织清退ICO代币。

ICO黄了。

02 IMO(首次矿机发行)

IMO(Initial Miner Offerings),首次矿机发行,即以矿机为核心发行数字货币资产。

它的流程一般是这样的:

某个项目方自己动手做了一款硬件,说自己要发某种数字货币(叫为币A),而且只有自己的这款硬件才可以挖到币A;

然后对外出售这款硬件(这个硬件一般还有其他功能,比如存储、云计算服务等);

用户买来这款硬件,然后开始挖矿,挖到的币A都是自己的;

最后币A同样进入交易流通的环节。

IMO和ICO不同,后者是先有各种数字货币,才可以利用矿机挖币;但前者是先有矿机,然后通过矿机挖新币。

而以IMO模式发行的数字货币中,数迅雷的“链克”(原“玩客币”WKC)最为出名。但它好景不长,今年一月份就被中国互联网金融协会点名批评,并将以迅雷为代表的IMO模式被定位为一种变相的ICO。

因此,IMO也黄了。

03 IEO(首次交易所发行)

IEO(Initial Exchange Offerings),以交易所为核心发行数字货币,是最近比较常见的发行方式。

IEO其实很好理解,它相当于是将ICO和IMO融资认购这一过程去掉,直接把新的数字货币上交易所,让用户进行买卖交易(至于用户为什么会愿意买这些新币,可以看【区块链讲座】上一期的内容)。

例如火币的HT、OKEx的OKB,以及前段时间比较火热的空投糖果(糖果本质是一种代币,以后会细讲这个概念),都是以这种模式进行发行的典型例子。HT和OKB有着强大的交易所平台背书,目前运行的都很不错;而其他空投的糖果则大多属于空气币,没有好的项目支撑最后价值还是会归零。

04 IFO(首次分叉发行)

IFO(Initial Fork Offerings),即首次分叉发行。

与前面三种发行代币的方式不同,IFO是基于比特币、以太坊等主流币而进行的分叉(关于分叉,详见【区块链讲座】第3期),持有诸如比特币、以太坊等主流币可获得分叉币,即一种新的数字货币。

举个例子,比如我一开始在原来的链上持有10个数字货币A,后来某个团队利用IFO对数字货币A进行分叉,那么我在这条分叉链上就会有10个新的数字货币A,其他原来持有数字货币A的人也会等到相同数量的新币A,之后新币A*就会进行交易流通过程,甚至也可以上交易所。

如此一来,IFO就完成了新币发行的任务了。

05 IBO

IBO(Initial Bancor Offering),这是一种比较新型的数字货币发行方式。它是基于Bancor协议(以后会有专门一期讲解Bancor协议),人机交易,兑换比例由算法来决定,从而实现两条公链之间的数字货币兑换。

它相当于信用不足的主体要发行货币,必须有锚定货币进行信用嫁接,例如XX币的发行,需要在央行抵押美元然后按照一定汇率发行。

另外,IBO不同于lC0,后者是将钱(币)直接给了项目方,前者则是通过Bancor将你的资金全部抵押在合约里,项目方无权动用。但如果项目方想获取新的数字货币,和普通用户一样,也得用主流数字货币和机器人兑换,这个兑换过程本质就是新币发行和进入市场交易流通的过程。

以这种模式进行发币的典型项有FIBOS,它的新代币是FO,并且最初设定FO发行总量为100亿,兑换比率为1 EOS = 1000 FO,目前该项目已经兑换到85万EOS,也就是有相当大体量的FO流通在数字货币市场上。

06 IDO(首次数字资产发行)

IDO(Initial Digital Assets Offering),称为首次数字资产发行。字面意思和ICO(首次发行币)几乎一致,但是它们背后的商业逻辑却不太一样。

ICO是通过主流比特币、以太坊等数字货币募集用户的资金进行项目建设,而IDO本身不募集资金,而是通过发起任务悬赏的方式,让看重项目价值的用户,自发地利用自己的知识、时间、注意力等技能来获得项目方的代币悬赏激励。

这种方式,我们在第八期【通证经济】中也谈到过,典型如币乎平台。在币乎,你注册就能得币,点赞能得币,写文章也能得币,你的注意力、鉴赏力、写作能力都能在这里变现为一部分币乎平台的权益。IDO,实际上就是把社区建设分发给用户,让大家一起来建设社区项目的发展。

最后,我们用一张表格来总结下今天的内容:

Some other articles we wrote

FIBOS| The recent strong performance of EOS price is actually because of this "sidechain"? https://steemit.com/eos/@eosunion/fibos-or-the-recent-strong-performance-of-eos-price-is-actually-because-of-this-sidechain-eos

EOSUnion Blockchain 101|09 Why is digital currency valuable? https://steemit.com/eos/@eosunion/eosunion-blockchain-101-or-09-why-is-digital-currency-valuable

EOSUnion| Understand "Ricardian Contract" in 5 minutes https://steemit.com/eos/@eosunion/eosunion-or-understand-ricardian-contract-in-5-minutes-5

EOSUnion BlockChain 101 | Token and Token economy https://steemit.com/eos/@eosunion/eosunion-blockchain-101-or-token-and-token-economy

EOS inflates 5% per year, 1/5 as BP reward, and where is the remaining 4/5? https://steemit.com/eos/@eosunion/eos-inflats-5-per-year-1-5-as-bp-reward-and-where-is-the-remaining-4-5

EOSUnion Supporting EOS Alliance https://steemit.com/eosunion/@eosunion/eosunion-supporting-eos-alliance

EOSUnion| Understand EOS resource allocation logic with 3 pictures https://steemit.com/eos/@eosunion/eosunion-or-understand-eos-resource-allocation-logic-with-3-pictures

EOSUnion Blockchain 101|The 4th class: What is the public chain, private chain and alliance chain? https://steemit.com/eos/@eosunion/eosunion-blockchain-101-or-the-4th-class-what-is-the-public-chain-private-chain-and-alliance-chain

EOS FAQ | The Most Complete EOS Resource Package, Super Practical!!! https://steemit.com/eos/@eosunion/the-most-complete-eos-essential-resource-package-on-the-whole-network-super-practical

EOSUnion Blockchain 101|What is the blockchain fork? After reading this article, I understand! https://steemit.com/eosamsterdam/@eosamsterdam/eos-amsterdam-eos-gov-telegram-channel-summary-august-10-august-12-2018-8-10-8-12

The Global EOS Eco Summit held successfully! https://steemit.com/eos/@eosunion/the-global-eos-eco-summit-held-successfully

Follow us

WeChat: eosunion

Steemit: https://steemit.com/@eosunion

Telegram Channel: https://t.me/EOSUnionChannel

Telegram Chat: https://t.me/EOS_Union

Email: [email protected]

Twitter: eos_UNION

Coins mentioned in post:

Congratulations @eosunion! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: