A general conversation about the cryptocurrencies looks like the below:

" - Hey mate, have you heard about Bitcoin?

- Yeah sure, that is the biggest cryptocurrency in the world, right? "

Now this is about to change.

Rapidly growing market

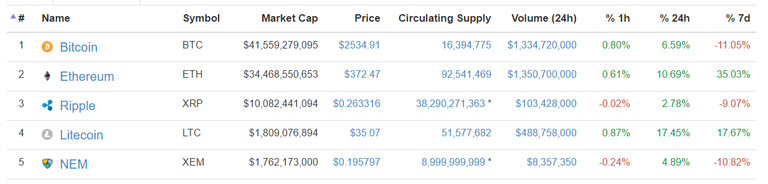

Earlier this year, a new phenomenon has started, which ultimately leads to a stage where Bitcoin will no longer be the "One and only" subject. The market had started to recognize the real value of other cryptocurrencies and it has not stopped since than.

Even tough the media is full with Bitcoin reaching new heights, the other currencies are moving quickly as well. Taking one step further, what actually happens is that the Blockchain Technology is being recognized and a great deal of investment has arrived to the sector. As a result, that the most important factor in the Crypto market is not the price of Bitcoin, but more obviously the Total Market Capitalization of the all the Cryptocurrencies.

The race

As we are no longer talking about just Bitcoin, but the Blockchain Technology itself, the technology and the development behind each coin has become more and more important recently, creating a race between the currencies.

Bitcoin is still the most known and publicly widespread, however, the limitations of its technology has caused some serious uncertainties about its future. This, and the debate about the resolution of the limitation has served as a fuel for the other cryptocurrencies to gain more and more space.

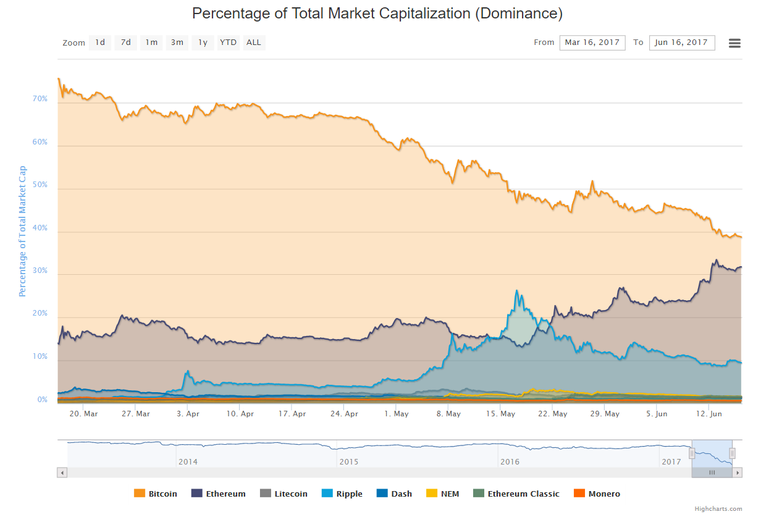

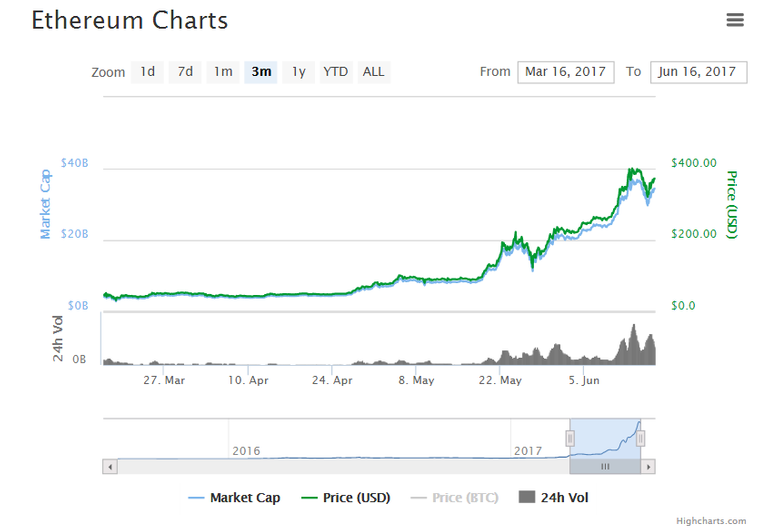

The most successful competitor is Ethereum, which is just about to reach and overcome the market capitalization of Bitcoin.

Ethereum has already overtake Bitcoin in the trading volume, which represents the conversions from Fiat currencies (USD, KRW, EUR) and the conversions from other Cryptocurrencies (BTC mainly).

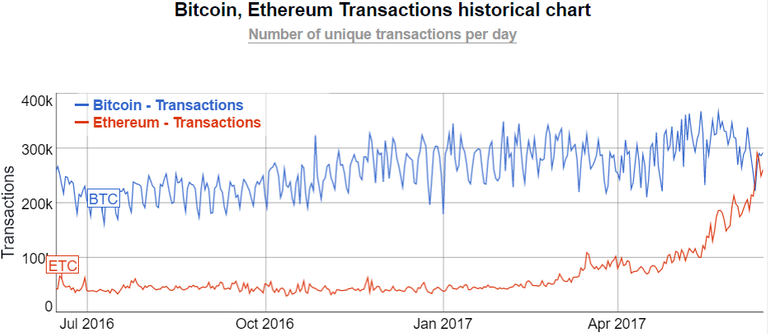

Furthermore, Ethereum has also reached the same number of transactions in its Blockchain, that Bitcoin is processing - which is one of the main factors in the valuation of the cryptocurrencies.

The "Blockchain Debate"

So what is wrong wit Bitcoin?

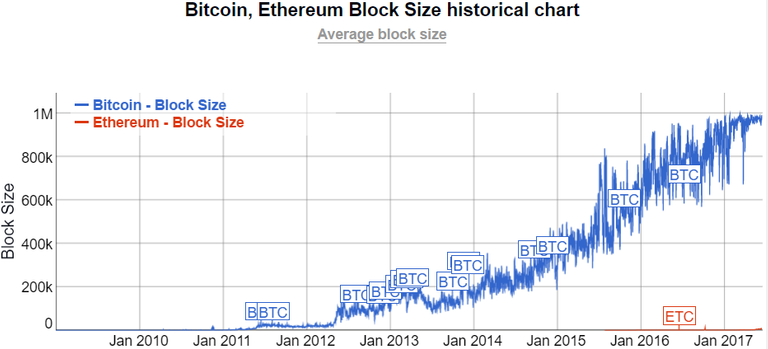

As seen above, the daily transactions in the Bitcoin system cannot go much higher than 300k. This is due to the fact, that the maximum Block size (every 10 minutes a Block is created which contains all the transaction data of that period) is fixed as 1MB in the code behind Bitcoin, which has already been reached. This results in an overloaded system, where more transactions are created by the users than the system is capable to process.

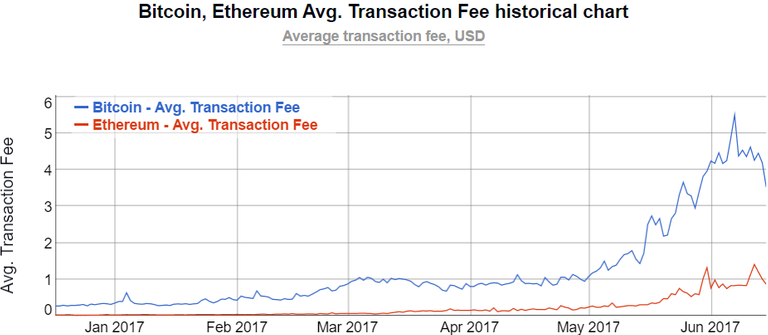

In the system, there is also a possibility to create an order of the transactions by a voluntary fee which can be added to a transaction. The higher fee offered, the earlier the transaction will be processed. As a result, the transaction fees are rising and reached around 5$ on average per transaction. So Bitcoin is not that cheap as it used to be.

There more possible solutions to handle this issue, however, the majority of the participants have to agree on the same direction - and they do not appear to be on the same page.

Digital cash - Segregated Witness Adoptation

Based on the first solution, the number of transactions can be increased without limits and the transaction fees can be lowered through including a third party in the transaction process. This is supported by the idealist and the core development team, who see Bitcoin as the ultimate low-cost medium of payment in the world - as digital cash.

Digital Gold - Increased Blocksize

As an other solution, the current limit of 1MB Blocksize can be increased to 2MB by a change in the code, which is a temporary solutions where the fees eventually would rise again when the higher limit is reached again. This solution is supported by the mining companies who are running the Bitcoin systems, because they are the ones who are receiving the fees for the transactions. The higher fees and lower transaction numbers would make Bitcoin to function as a store of value where only higher amounts are being processed less frequently - as digital gold.

Uncertainty

To decide which way to go, the majority of users have to agree. For obvious reasons, the mining companies does not want to cut themselves from the fees.

The debate between the above participants have been going on for a while, however, a formal decision has not been made. It is due to this summer, but the uncertainty around it is not good for Bitcoin - as it has never been good for any investments earlier.

As seen above, the market is already moving on to other solutions with stronger consensus between the developers and participants.

The Rise and Rise of Ethereum

In addition to the solution that is already better than Bitcoin, the developers of Ethereum are also providing a much certain roadmap for the future development of the transaction handling process.

This certainty and stability is being recognized on the market - not to mention the possibilities how Ethereum can achieve much more than Bitcoin.

This leads to an other article in the future about Ethereum, but in the meantime here is an introduction of the Founder, Vitalik Buterin:

(Disclosure: I did not go deep into technological details because there are much better materials elsewhere, so please do your own research if needed regarding Ethereum, Bitcoin, Blockchain technology, etc.

This article is not supposed to be an investment recommendation, and I do not receive any kind of compensation from publishing it.

Source: Coinmarketcap, Highcharts, Ethereum.org, Bitinfocharts, CoinTelegraph)

A great article you have written here. This has deepened my knowledge on the Bitcoin / Ethereum race that is happening. Bit weird that no one is mentioning Zcash in the same breath as it is outperforming Ethereum this past week. Have fun out there and good luck with your future posts.

Thanks rymlen,

Yes I totally agree, ZCash also has its place in the market. Maybe my next article will be something like "How Zcash made it to the top 5".

Very informative even after six months the trend can actually be seen on how the blockchain arena is progressing, the technologies behind ethereum are superb and we can only see better services and products as the blockchain arena matures