Have you ever questioned yourself about your time here in cryptospace? How long will you be able to be as immersed into all of this as you are now? Are you a speculator or a long-term holder? If you truly want to stay in the space for a time being, I will try to help you find the best cryptocurrencies for long-term hold. I will show you my current long-term portfolio which includes not only cryptocurrencies, but also different utility tokens. Maybe you will find something interesting for yourself, maybe you will find some cool coin missing from my portfolio. Remember that you cannot know if your portfolio will be the best one in terms of returns on investment in the long run. The best thing you can do for your long-term portfolio is to research cryptocurrencies yourself and try to minimize risks by choosing only the best.

Currently there are so many ICOs that my head is spinning. I really find it hard to choose projects where I can invest! That’s why the major part of my long-term portfolio consists of coins that were created before the initial coin offering craze.

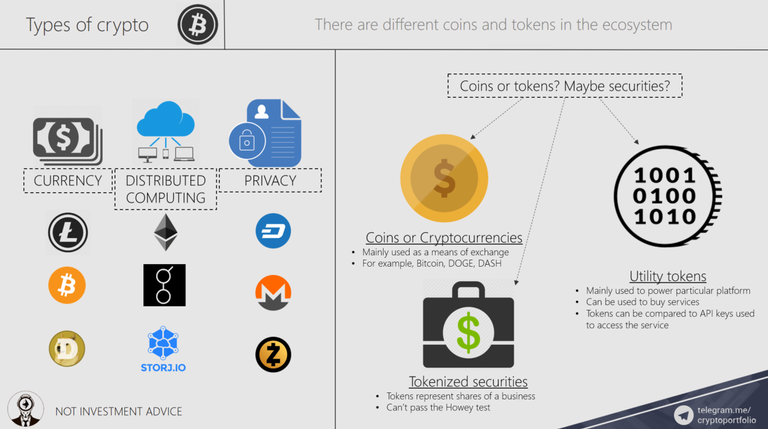

First of all, before we go any further let’s try to understand what kind of cryptocurrencies we have on the market. As you may already know, there are 3 different types of Cryptocurrencies.

First type is the Bitcoin and its forks. This type of cryptocurrencies has the only function, transfer of value from one wallet to another. That’s pretty much it.

Second type of cryptocurrencies is distributed computing cryptos. Ethereum is an example #1 here. With the help of Ethereum virtual machine, you can create smart contracts that will forever change the way our economy works in the near future. Other examples include Golem, Storj, SONM, and other interesting projects.

Third type of cryptocurrencies, privacy coins. That’s where it gets really interesting. The days when Bitcoin blockchain was anonymous are long gone, that’s why now we need much more radical cryptocurrencies that will be truly anonymous. DASH, ZCASH, and Monero were born because people understood the necessity of this kind of coins. Government tries to regulate and censor cryptocurrencies. Crypto enthusiasts look for other ways to keep government off their digital money. That’s where demand is.

Do you know the difference between tokens and coins?

Coins or cryptocurrencies are mainly used as a means of exchange. You transfer value from point A to point B. That’s it.

Then we have utility tokens. They are used to power platforms. On the platforms, you can buy different services using this utility token. Usually, tokens are compared to API keys that give users access to services. For example, if you have TIME tokens you can use Chronobank’s platform for voting and receiving rewards.

Finally. Are you sure that your token is not a security? Don’t wait for SEC to knock on your door and do your research before buying anything related to securities. If it can’t pass the Howey test, it is a security (more you can learn about Howey test and SEC regulation of ICOs here https://steemit.com/ethereum/@cryptoportfolio/sec-and-legal-dangers-of-investing-in-icos )

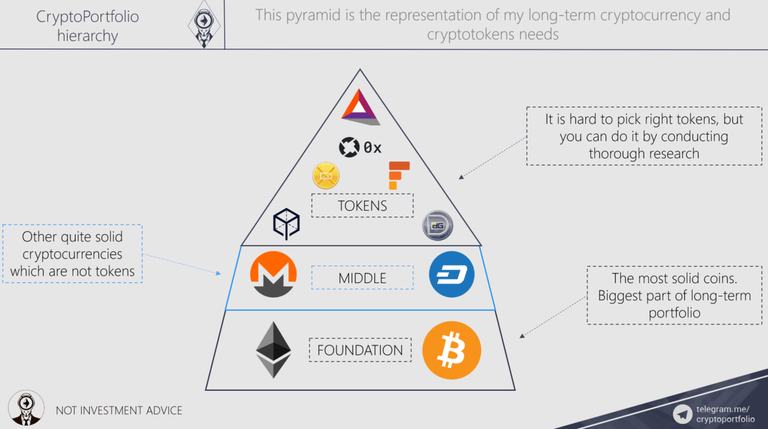

There exist a well-known Maslow’s hierarchy. Well, I have created my own, CryptoPortfolio hierarchy for my long-term portfolio needs.

First of all, we have foundation. It should consist of the most solid cryptocurrencies. This kind of cryptos should be able to survive the pressure of time. Is it hard to predict what cryptocurrency will survive from 2-5 years? It is not just hard, it is impossible. Here you can only use the judgement of the best experts in the industry and try to conduct your own research. Even after everything there is no certainty that this “foundation” coins will not disappear in a year.

Then you have to choose on the middle part of your pyramid. Usually I pick cryptocurrencies with their own blockchains. For example, Waves, Stratis, Dash, other privacy coins. Also, do not forget that Ethereum soon will adopt privacy feature of ZCASH. So, ZCASH importance really decreased recently and there is no point in choosing ZCASH as a significant asset for your portfolio.

Tokens go next. I choose them last because I expect A LOT of utility tokens to fail. Even considering this possibility of every token’s failure, I still chose to hold a very limited number of tokens. I will show you them on the next slide. This part shouldn’t take a lot of space inside your cryptocurrency long-term portfolio. Just try to buy the best ones and hold. I don’t recommend going on shopping sprees in the sphere of initial coin offerings. It is not simply dangerous for your long-term portfolio, it is suicidal.

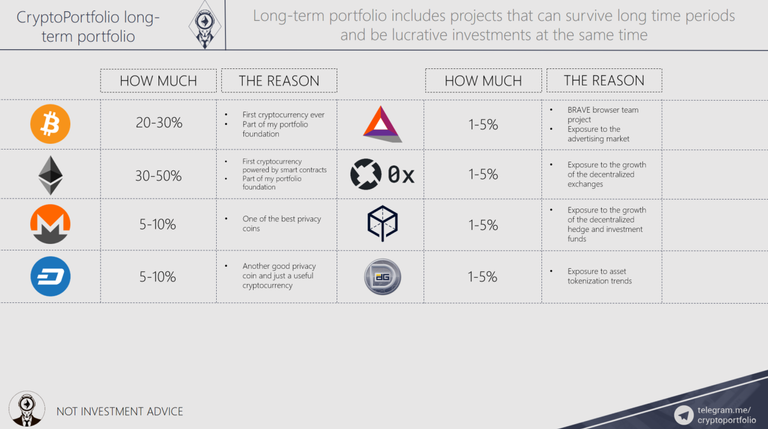

What coins and tokens should be chosen for long-term portfolios? The ones that will survive and be lucrative at the same time.

The first cryptocurrency for my portfolio is Bitcoin (not Bitcoin Cash, not Bitcoin Gold, just BTC). It is the first cryptocurrency ever and has the biggest capitalization. I don’t think that Bitcoin will remain the biggest cryptocurrency in the future, but I expect Bitcoin to remain one of the biggest cryptocurrencies in terms of capitalization.

Ether goes next. It will be the major part of my long-term portfolio possibly reaching 50% of my crypto stack. It is the first cryptocurrency which has actually working smart contracts, huge and still growing community, and it has the best team in terms of quality and quantity. This coin here to stay even though it is riskier than Bitcoin due to its complexity.

Monero and DASH are also important for my long-term portfolio. Both cryptocurrencies showed its resilience to hacks, different conflicts in community, and competition. The next step of our governments in the cryptocurrency sphere will be regulation. Thanks to this, all transactions will be easily audited and all your activities will be analyzed. Not to let this happen, privacy coins exist. I expect that government intrusion into cryptospace will dramatically boost the valuations of privacy coins.

Basic Attention Token. This is the project from Brave browser team. I really liked it, enjoyed the value proposition, and invested long-term. This token gives exposure to the growth of decentralized advertising market.

ZRX, protocol for trading tokens. This token gives exposure to the growth of decentralized exchanges market. Another reason I chose this token to hold long-term is the enormous support from respectable crypto personalities and blockchain projects. If it fails, it will be a show worth watching.

Melonport, decentralized hedge funds on Ethereum. I have a number of videos on my youtube about this great project and I advise everyone to watch them. One of the greatest things about Melonport is that it is truly decentralized (in comparison to its main competitor, ICONOMI), developed by experienced team, and constantly updated. I expect MLNs to be very expensive when Melonport platform goes live.

Finally, Digix DAO. DGD token gives exposure to the asset tokenization trends. On the first stage, Digix will tokenize one asset, creating DGX tokens which equal to 1 gram of gold. I am sure that they will not stop on this and will tokenize other assets based on the most popular requests. Why did I choose this project instead of something else? Digix has much more experience, better developers, and more funds in comparison to other blockchain projects.

Where's LTC? I think it's a good long term hold as well. What's your reason it's been left out?

You are delivering great value Dan, keep up the good work!

Curious what you think of my long-term portfolio though. Let me know :-)

https://steemit.com/cryptocurrency/@cryptotem/my-strategic-cryptocurrency-portfolio-update-5-developments-and-changes-in-investments

Awesome post, i like your strategy behind the porfolio and all the graphics.

Keep up the good work, resteemed!

That was a solid quality post. Keep them coming. You'll get my upvote.

Thank you

Great work CP. Hope you can post more portfolio allocations and updates with the ever changing Altcoins. ie Iota, ADA, how about Ripple?

IOTA is a bag of crap and a dangerous one at that. Many have lost money with there terrible wallet implementation. Ripple is centralized. ADA has great potential, so long as they can iron out their wallet problems, which I suspect they will.

Can I use this post for educational purposes?

Really nice post 👍🏽

How can we contact you on Telegram? Hit me up please @Transisto