Solana has become the number one challenger for Ethereum. The chain has gone through a real roller coaster, a sharp collapse two years ago after the FTX saga, and a major recovery in 2024.

At one point in the recent months it claimed to the third position on the market cap rankings, just after BTC and ETH. It has dropped since but it is still up there in the top.

How are the two major chains doing in the last period? Let’s take a look.

The two chains have a different approach. Ethereum has now clearly pivoted to L2 solutions for mass adoption. Solana on the other hand is going L1 first approach, trying to incorporate all the apps on layer one while keeping the fees low. This obviously comes at a cost as there is a need for a big and expensive infrastructure for this.

We will be looking at data for:

- Active wallets

- Number of daily transactions

- Fees

- TVL

- Market cap

The data is extracted from https://ethscan.com/, DefiLama, Dune Analytics, the Block etc.

Ethereum has been around since 2015, while Solana started operating in 2020. Because of this the period that we will be looking at is

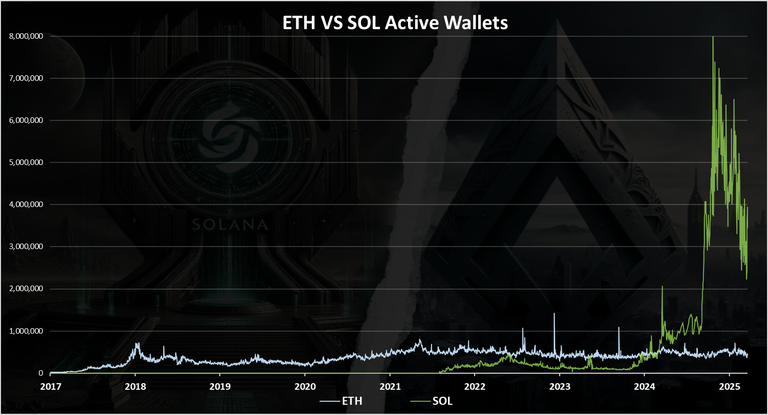

Active Wallets

How many wallets are being used? Here is the chart.

The number of active wallets have clearly growth a lot on the Solana chain and has surpassed Ethereum by a lot in 2024. At one point Solana had 8M DAUs, while on Ethereum network the number of active wallets has been in the range of 300k to 500k DAUs.

In the last month the activity has dropped on the both chains and **Solana is now around 2.5M DAUs, while Ethereum is around 450k.

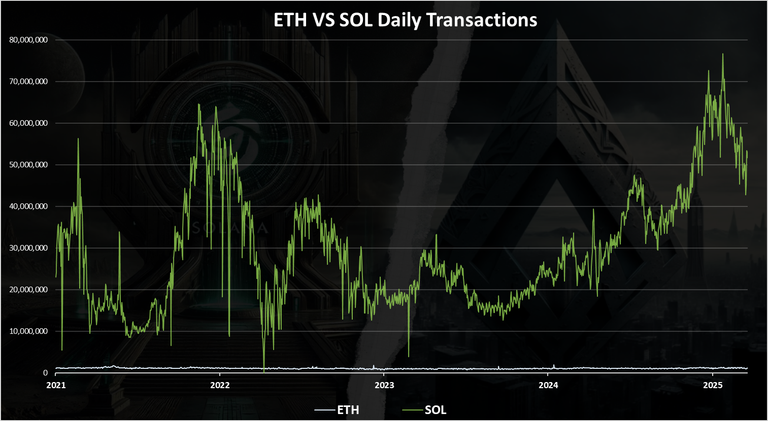

Number of Daily Transactions

Here is the chart for the number of daily transactions.

In terms of daily transactions Solana is absolutely dominant. Ethereum has around 1.2M transactions and the line for the number of transactions on ETH is down and almost flat on the chart.

Solana is known to be fast and cheap and the number of transactions has reached 70M recently and dropped to around 50M where it is now. A 1 to 50 ratio here.

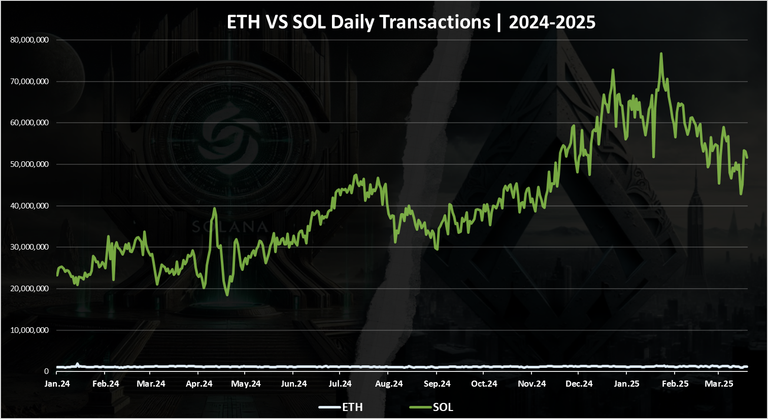

When we zoom in 2024-2025 we get this:

Here we can notice the steady growth in the number of transactions on Solana in 2024. Starting from around 25M and going up to 70M per day. Ethereum meanwhile has been steady around 1.2M.

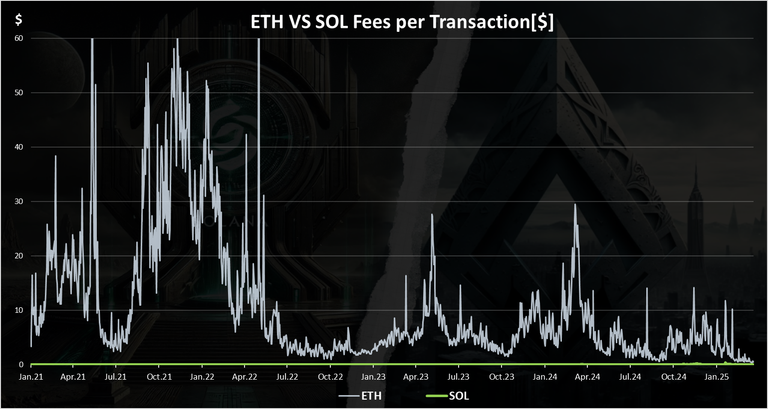

Fees

The chart for the fees looks like this.

These are the average daily fees per transaction in $ value.

In terms of fees the line for Ethereum is clearly visible while the line for Solana is on the bottom of the chart. Fees on Ethereum have been volatile, going up to 50$ from a few dollars. In the recent period they have been low around 2$ to 3$ per transaction. But even this is high compared to fees on Solana where they have been less than a cent for most of the period. In 2024 though the fees on Solana have increased a bit and are now around one cent, 0.01$.

What interesting is that in the last month the fees on Ethereum have dropped bellow one dollar for the first time in a long time and they are almost comparable now.

TVL

How about Total Value Locked? This is a metric that usually represents the amount of outside capital stored in DeFi protocols on chains. Here is the chart.

When it comes to TVL, Ethereum is leading by a lot. At the moment ETH is close to 50B in TVL while Solana is around 7B.

But what is interesting is that Ethereum haven’t broken the previous ATH for its TVL from 2021, while Solana has a new ATH. The trend is positive for Solana and not so much for ETH.

Ethereum VS Solana Market Cap

The interesting topic for Ethereum VS Solana is will Solana overtake Ethereum at some point?

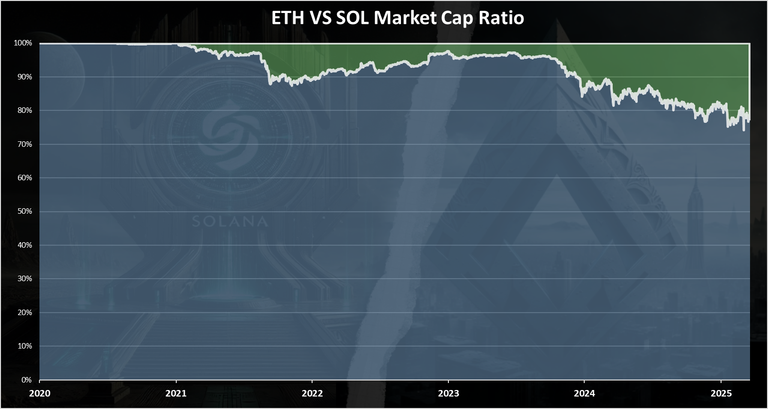

Here is the historical chart for the Ethereum VS Solana market cap.

Ethereum is obviously dominant when it comes to market cap. At the moment Solana is at all time high when compared to Ethereum wit 22% of the share.

Although still far from ETH, the trend here is also in favor of Solana and it has constantly taking ETH share in the last years.

Here is the chart how the ratio of the market cap between the two looks at the moment:

An 78% for ETH, and 22% for Solana. At the highest point for Solana.

From all the above it’s obvious that Solana has gain a massive traction in 2024 and overtook Ethereum in terms of active wallets, transactions etc. But in terms of capital Ethereum is still dominant by a lot, but Solana has gained a positive momentum.

All the best

@dalz

The rewards earned on this comment will go directly to the people( @davideownzall ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

Some interesting numbers! Since I don't follow the two currencies very closely, I didn't notice the pump at all in terms of activity on Solana.

Solana token is outperforming eth token, I am impressed by the performance of this token

Solana is like that new kid who shows up and suddenly outruns the class champion. Fast, cheap and growing like crazy. But Ethereum still holds the cash. Going to be something to see if Solana keeps up

I guess solona act as a short term investment, while ethereum is better off long term. however ethereum is still on the top chart above solana in binance, lets see if it will go below it.