There is open conjecture that a "whale" made a 30 million dollar transaction on June 21st, 2017, causing the market to crash, my goal today was to find a media outlet that has a citation pointing to such a trade. From the GDAX blog, Adam White appears to give the most credible statement, "... a multimillion dollar market sell ..."

Before I go on, let's back up to a headline concerning June 20th, when Ethereum reached a milestone. "Ethereum’s Transaction Levels Rise Above 300,000, Overtaking Bitcoin" (TrustNodes, June 21, 2017)."Ethereum processed 308,000 transactions, nearing an all-time high for any digital currency, while the bitcoin network handled just under 270,000."

308,000 transactions does not seem like a lot, until you consider that selling 1000 ETH in one transaction, might require bundling 10,000 buyers at 0.1 ETH. This question will bug me enough that I will eventually look up the formal definition for "transaction".

Back to the $30 million claim, I have not found a citation for that amount, but a multi-million dollar transaction was referenced in the Ethereum Facebook forum, that transaction appears to originate from Genesis.

https://etherscan.io/address/0x7d551397f79a2988b064afd0efebee802c7721bc

At 317.81, the dollar value of 39,300 ETH would have been $12,489,933.00, which falls a bit short of $30 million. As I mentioned in my earlier post this transaction is labeled as "RelaySafeSplit". A little research reveals that a RelaySafeSplit is a routine used to separate ETH from ETC. (Read more about the Ethereum DAO split here)

The Genesis transaction that was launched at Jun-21-2017 06:59:33 PM +UTC (18:59:33 UTC). The previous transaction was for 5 ETH, they must have had their reasons for loading up the network with one large transaction on the very next try, Right?

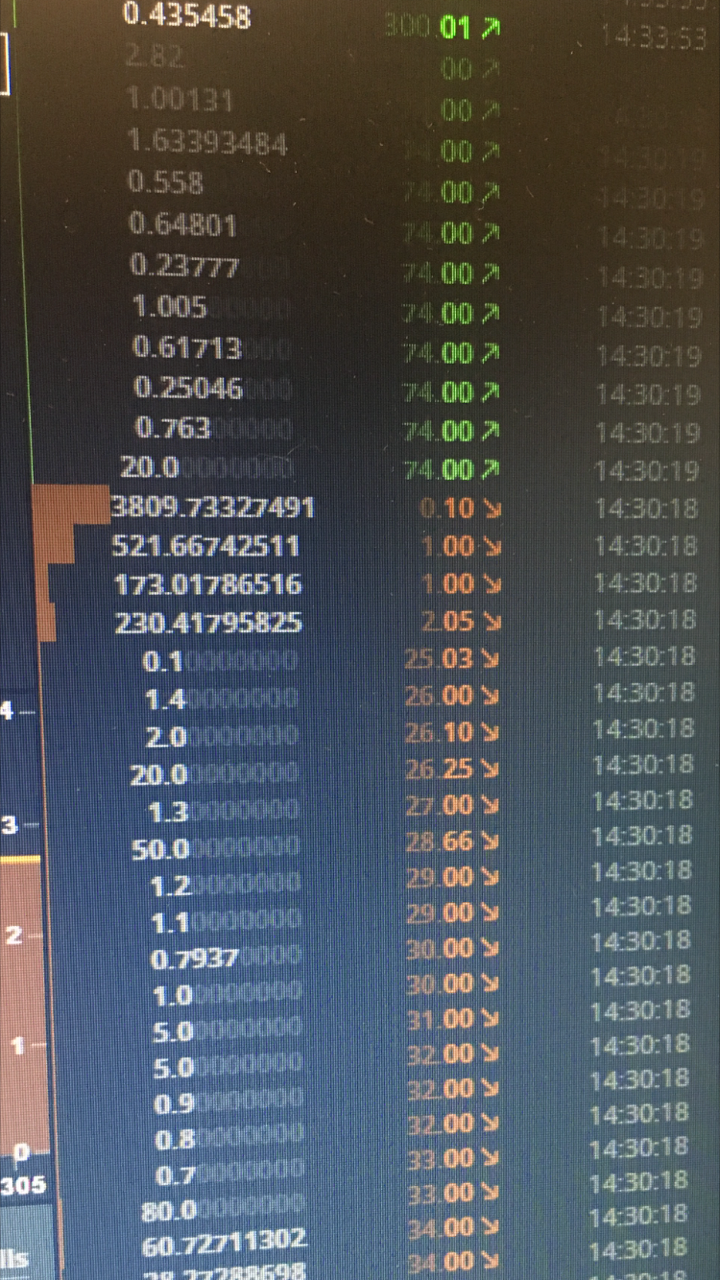

TrustNodes has posted a screengrab of what is apparently the GDAX Trade History window.

Source: TrustNodes "Someone Sold $30 Million Worth of Eth, Sending Price to $0.10 Temporarily"

I checked the GDAX output, it is adjusted to local time, so the 10 cent buy order in the screengrab, at 14:30:18, would make it 19:30:16 UTC (12:30:16 Pacific Time as widely reported). Here is what Coinbase says about their GDAX Trade History display color-coding.

[Source]

- The color of the price reflects whether or not the trade was made on the buy or sell side of the order book. Prices shown in green take liquidity from the sell side, and are an indication of buying pressure. Prices in red are the opposite.

- The sizes of a trade are represented by grey number in the left hand column, and also by the length of the red or green volume bars along the left hand side of the table.

So we still are not sure where the $30 million figure comes from, but we do have proof of a large transaction and who made it roughly a half hour before the actual crash. It would be interesting to know when the lowball automated buy orders were placed, if the ten cent buy order was placed back when ETH was valued at $20.00 it would be a lot less suspicious than if it was placed on the morning of the 21st.

In a reddit forum, an unfortunate soul tells how $3000.00 in ETH evaporated due to the flash crash in combination with the $316.00 stop order. Some have suggested "stop limit orders", but there is also conjecture that a stop-limit order would not have been adequate protection. The DOW and NASDAQ have circuit breakers to avoid these types of catastrophic losses.

Investopedia Stop-Limit Order

http://www.investopedia.com/terms/s/stop-limitorder.asp

Investopedia Stop Order

http://www.investopedia.com/terms/s/stoporder.asp

Investopedia Circuit Breaker

http://www.investopedia.com/terms/c/circuitbreaker.asp

Previous post: "Ethereum Flash Crash -- June 21, 2017 (Coinbase Chart)"

I think you discount the idea that margin trading can be manipulated by a crowd and not by simply one bad actor. Why must one whale drop it so low?

Surely, a whale might aspire to such an amazing play, but what is more likely is that a series of crescendoing series of whales took advantage of each other's plays.

Whales are trading with the API and making trades in a fraction of the time it takes one to manually enter.

Sure there could be a number of mitigating side effects creating a perfect storm scenario. I think this might remain a bit of a mystery for some time.

I love a good conspiracy as much as anybody, but it really would not take a genius, nor a whale, to simply set a lowball buy offer. So far, nobody has produced a record of a 30 million dollar transaction, but we do have the Genesis transaction, started 30 minutes before the crash, and it's a pretty sure bet that they are on the backbone.

This looks like an unforced error to me.