Hi investors, let's look at Ether (ETH).

Price Action.

The native token of the Ethereum platform is flashing a net gain of 31% YTD ($129 > > $170).

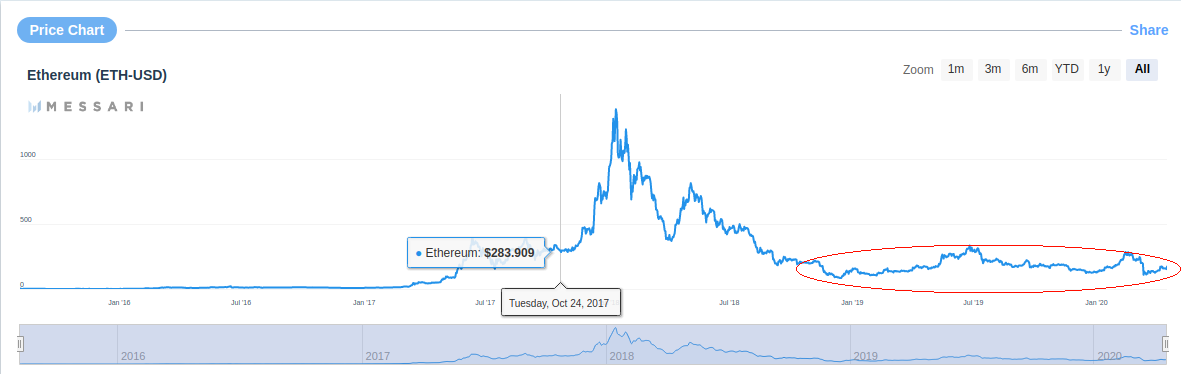

Looking at historical data the price of ETH seems to be in a historical zone of accumulation.

Fundamentals.

With regards to fundamentals, the price of ETH looks quite undervalued compared to the global health of the Ethereum network.

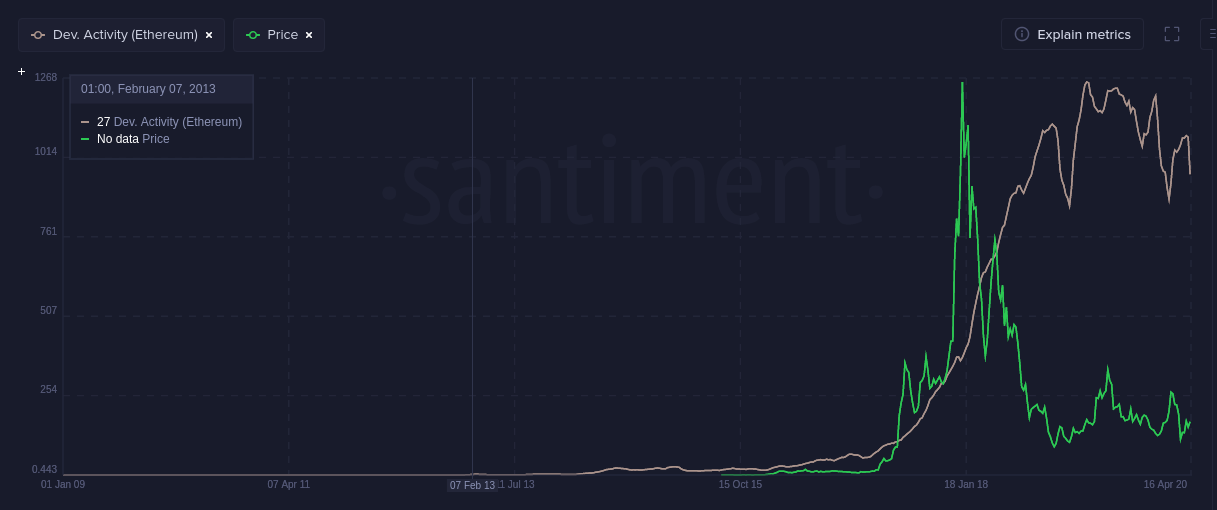

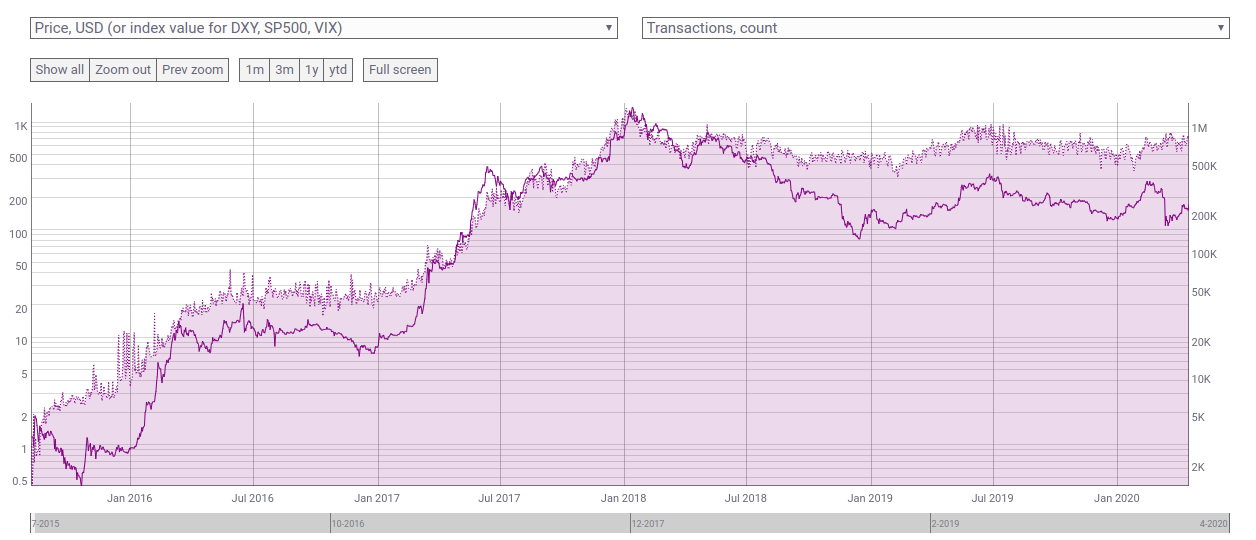

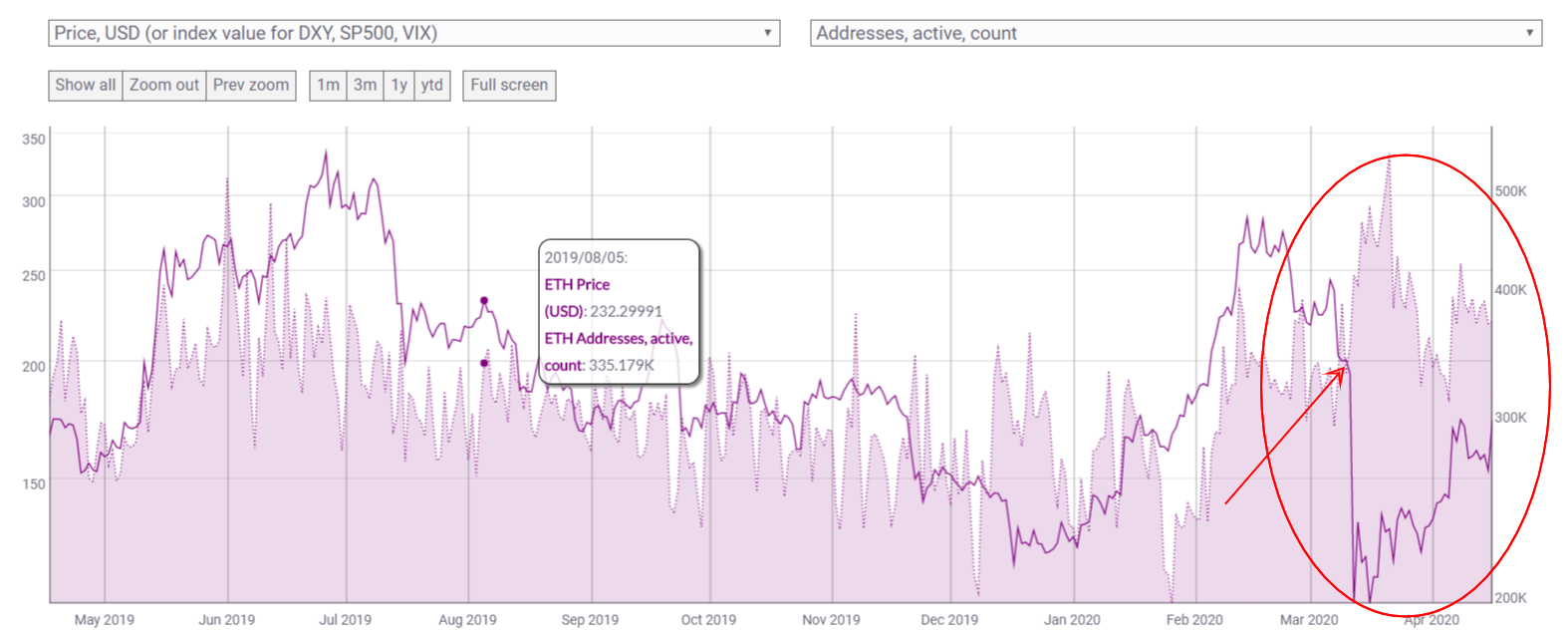

The price of ETH has decoupled since May 2018 with regard to important metrics such as the activity on the network (transactions) and around the network (development).

- Price (green line) to Developer Activity (GitHub repositories):

- Price (opaque line) to Transactions Count:

Then, more recently, the price (opaque line) decoupled from the number of active Ethereum addresses:

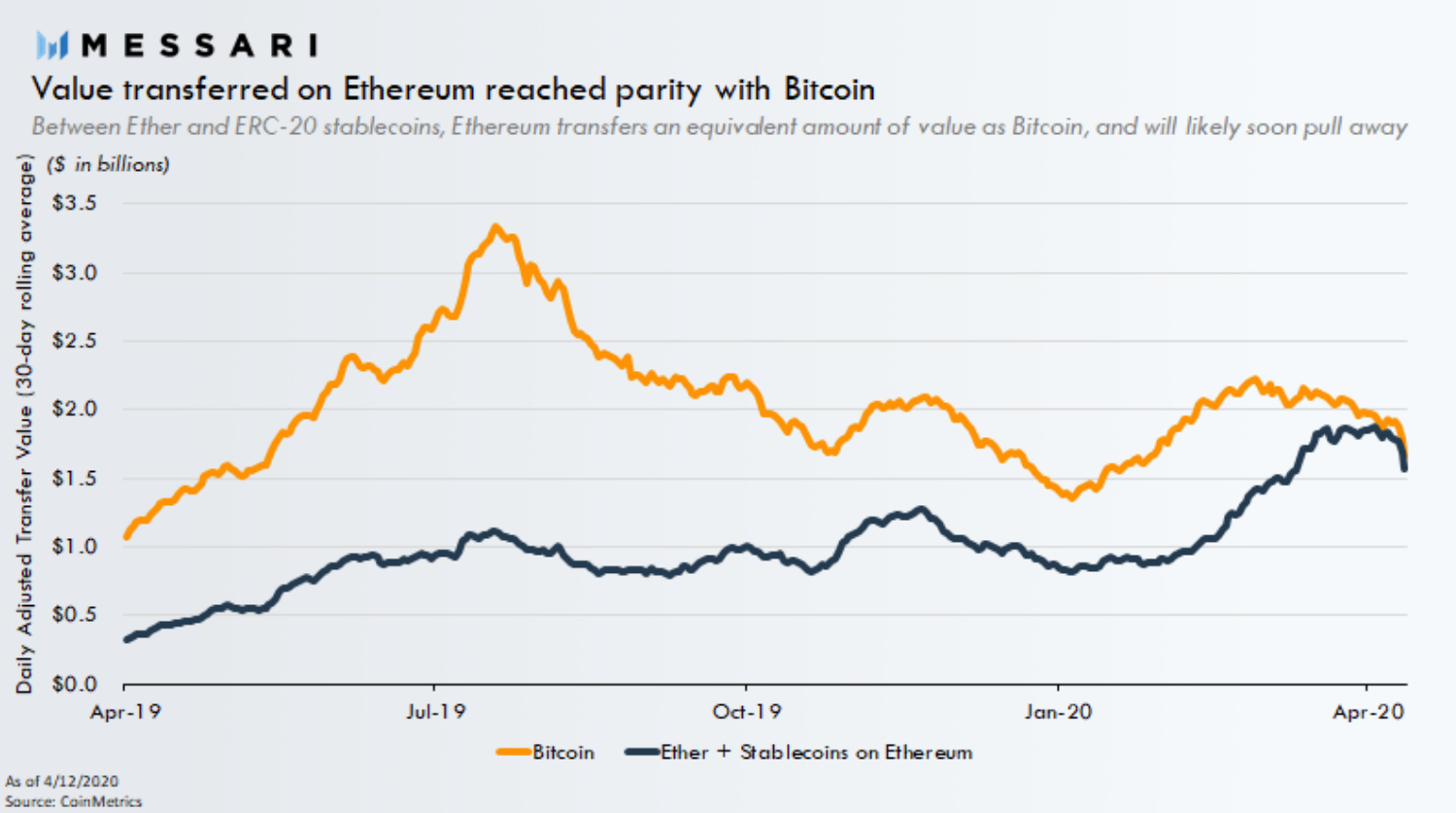

...and we've just got great news of Ethereum reaching value transfer parity with Bitcoin:

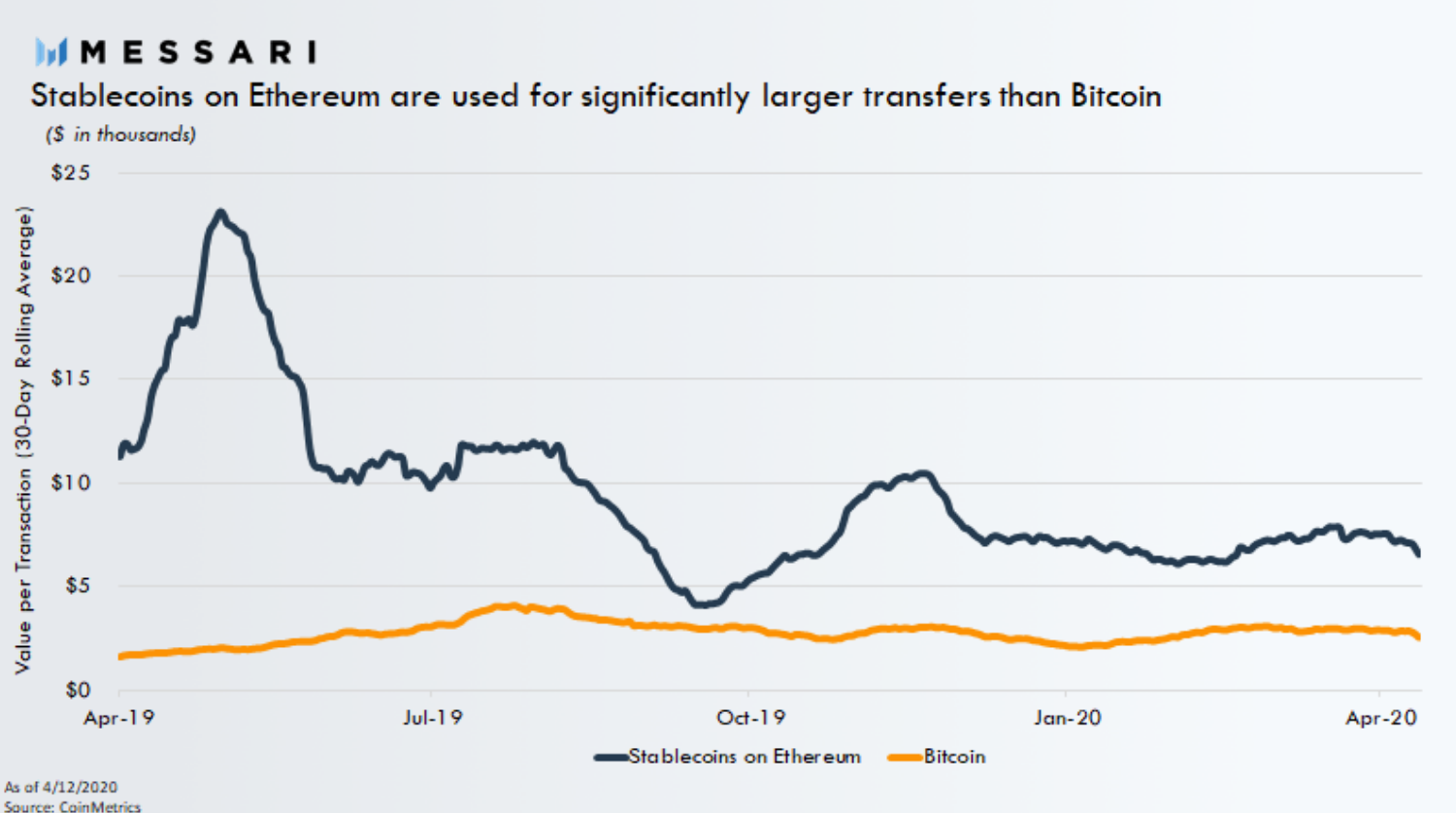

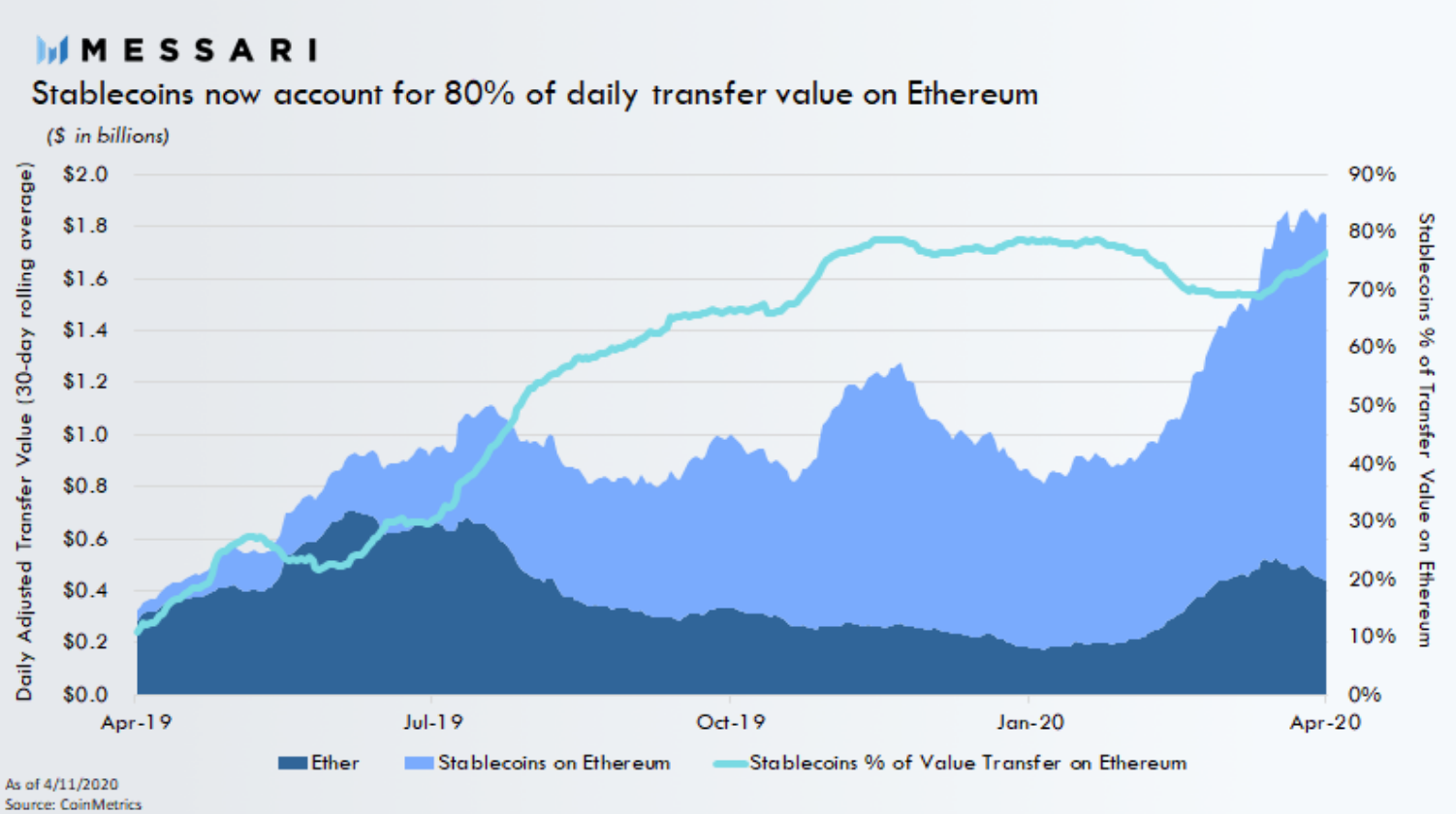

This surge in value transacted on Ethereum seems to be largely due to the recent popularity of stablecoins...

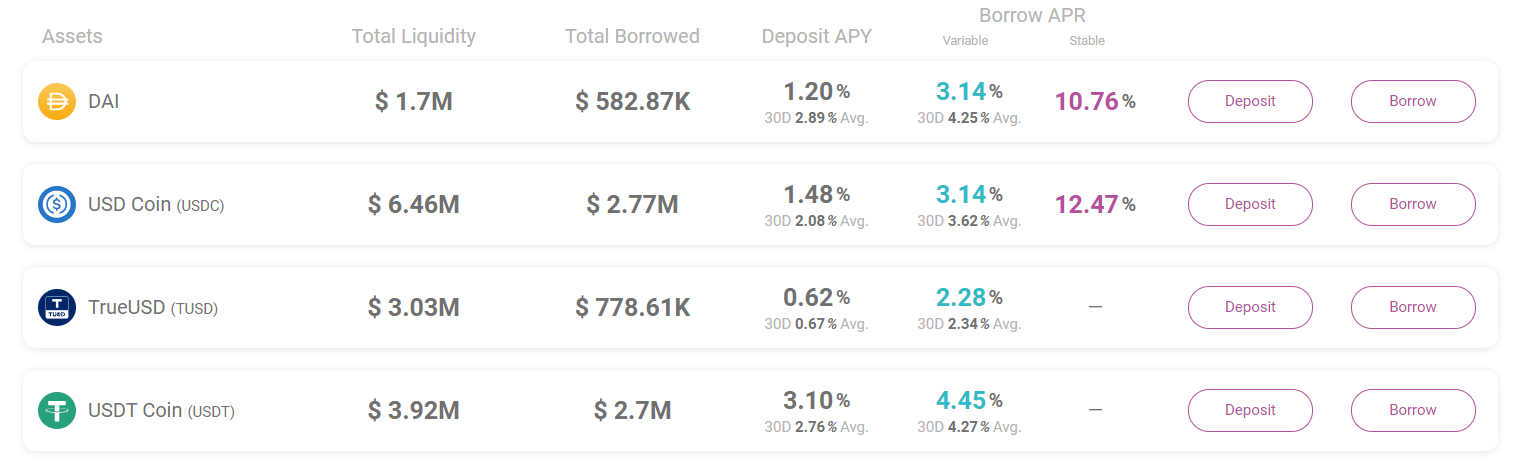

...which can be staked into liquidity pools in exchange for a considerable amount of yield.

The health of the network has predictably put ETH on the watch-list of a number of institutional investors, with Grayscale notably reporting "over $110m in quarterly inflows [into its Ethereum Trust], compared to combined inflows for the past two years of $95.8 million"

With Ethereum 2.0 looming large on the horizon and on-chain privacy solutions being developed for DeFi by AZTEC and EY, Ethereum is poised to maintain a firm lead in the "programmable blockchain" space over the so-called ''Ethereum-killers".

Analysis.

I personally wouldn't surprised to see Ethereum attracting exponential enterprise use in the next 2-5 years as enterprises get more comfortable with the idea of having some of their business logic running on a public blockchain.

It's also worth noting that Ethereum has always had friendly ties with the corporate world, notably through the foundation of the Enterprise Ethereum Alliance.

It now remains to be seen how much value will accrue to ETH itself. Although the jury is still out on that point, it seems inevitable that some of the network growth will translate into accrued value to the native token itself. That is, as long as ETH remains the main/only way to settle transaction fees on Ethereum.

I believe the transition to Proof-of-Stake will also help draw more investors in. When ETH becomes a capital asset the allure of holding some ETH to help secure a global financial network while earning passive income will prove a very attractive narrative to retail and institutional investors alike.

All in all, it's great to see Ethereum develop into one of the most exciting open source projects in the world right now.

In the meantime we'll keep you posted about Ethereum and ETH.

Until then,

F0x.