I don't want to look back in five years time and think, 'We could have been magnificent, but I was afraid.' In five years, I want to tell of how fear tried to cheat me out of the best thing in life, and I didn't let it." - Unknown

The majority of people are afraid to take risks with their money. They see an opportunity, but often don't take advantage of it. I myself have personally missed out on plenty of opportunities.

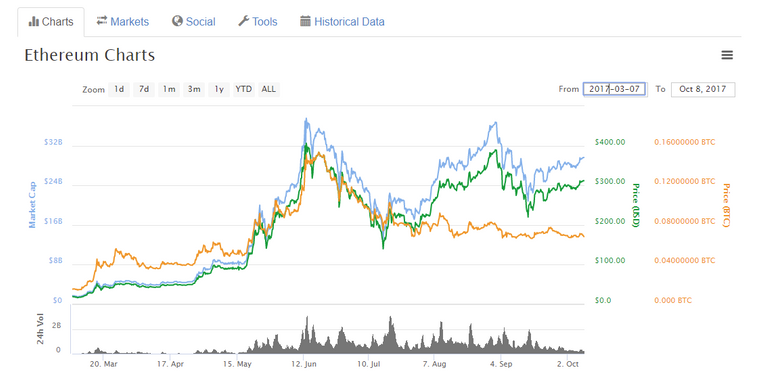

One of those opportunities came in March of last year. I was looking into Bitcoin for several years, but never pulled the trigger because of the difficulty of entry and uncertainty about the future. In my short-term college mind, I thought that spending the $100 at the bar would have been a better use than buying say 50-100 bitcoin (messed that one up). In March, while working the busiest part of my busy season (up to 90 hours a week), I started looking into Ethereum. Ethereum was $12 at the time, and I saw its 400% increase over the past few months. I saw the massive potential, but was hesitant that it had increased too rapidly and was going to crash. I ended up not investing in Ethereum until it hit roughly $150.

Source - Coinmarketcap.com

Three months after that there was another cryptocurrency that grabbed my attention. By now I had been involved somewhat in the market, and began diversifying. I came across a cryptocurrency valued at $.25 which was called Ubiq. Ubiq is similar to Ethereum, but processes transactions faster. I thought that it may be a good hedge against Ethereum, and decided to invest. I transferred money from my bank account into coinbase, and during the seven days I was waiting for the transfer to finalize, Ubiq went up to $1.00. I had debated the idea of transferring in money through coinmama or another medium which would allow for faster transfer but a 13% loss on fees.

Source - Coinmarketcap.com

There are decisions that we make like this every day. Psychology shows that we're often much more worried about the potential for loss, than the potential for gains. To make a long story short, basically the negative association with loss outweighs the positive euphoria of a gain, which causes us to be hesitant about making those financial decisions. To put it into perspective though, here were the gains that I could have realized with the above scenarios.

Buy $10,000 of Ethereum at $12/token. 833.33 Ethereum

Sell 50% of my Ethereum share to buy Ubiq at $.25/Ubiq (Ethereum's price at this time was roughly $300). 416.66 * 300 / .25 = 499,992 Ubiq.

Ubiq a few weeks ago hit a new high at roughly $3.20/token. Sell my shares of ubiq at $3/token for $1.5 million.

Net gain of $1,490,000 in 8 months.

Granted, there were a lot of things that had to go right with the above scenario. I needed to play the moves pretty much perfectly, but it shows you the potential of missing out on a financial opportunity. Not every financial opportunity will be as lucrative as this either, probably 99% of them will not be.

The important thing to note however is that, especially when you're young, you have the opportunity to take some risks. You can make back the money through working and what not, but they could prove to be very fruitful opportunities. Invest the time to look into opportunities fully, know what you'd be getting into, and if you think that it could possibly turn into a fruitful investment, think about taking a chance. If you end up missing an opportunity, don't worry about it, don't dwell on it, and just use it to learn and grow so that you can get the next one.

One thing that can help you to decide whether or not you should enter into an opportunity is to figure out your risk/reward ratio. Calculate the expected return from the investment, and the potential loss. If the return/potential loss exceeds your risk to reward ratio, this may be a good opportunity. My rule of thumb is that I want my reward/risk ratio to be about 2:1. That way I can fail twice for every time I succeed and still break even (hoping that I am successful more than 33% of the time).

**

I hope that you found this post interesting. If you have any questions, please comment below. My goal with this profile is to make frequent posts about finance, cryptocurrencies, investment, and wealth generation. I plan to not only make posts, but also youtube videos, and give away free excel workbooks to assist you in your personal finance goals. If this interests you, please let me know and follow my profile. Additionally, if you would like to reach out and ask any questions/request that I make a post on a topic, please reach out to me at [email protected].

**

@originalworks

I found this post very useful and the story you wrote was really interesting. In fact, i was kinda hooked after reading the first few sentences. I think you can go far here on steemit. I really like what you have made and i really like what you're going to make (frequent posts about finance, cryptocurrencies, investment). For that reason i'm also going to follow you. I wish you the best of luck in the future here on Steemit!

@lillieskold

The @OriginalWorks bot has determined this post by @irishfan686 to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

To enter this post into the daily RESTEEM contest, upvote this comment! The user with the most upvotes on their @OriginalWorks comment will win!

For more information, Click Here! || Click here to participate in the @OriginalWorks sponsored writing contest(125 SBD in prizes)!

Special thanks to @reggaemuffin for being a supporter! Vote him as a witness to help make Steemit a better place!

Thank you @lillieskold! I really appreciate that and look forward to talking to you in the future!

So true. I wish I had risked even a little on crypto a year ago. Would have been worth it.

Happy to say that I'm in now and trading. I'm doing quite well from a percentage perspective, but it may be a month or two more before I am making serious money.