Those who held Bitcoin and other cryptocurrencies in their investment portfolios for the last six months have experienced a range of emotions - from the euphoric highs of Dec. 2017, when the price of Bitcoin almost blasted through the $20,000 barrier, to the crashing lows of Feb. 2018. When the market has entered the green light, it might seem a little irrelevant, we all know about the potential for enormous volatility that lies ahead.

Assuming the cryptocurrency market capitalization were to maintain a long-term upward trajectory forever, it would make sense to never sell your coins—presuming they have strong fundamentals—by “HODLing” them indefinitely.

However, if there’s one thing cryptocurrency investors have learnt this winter: it’s that sometimes it pays to take profits, which can then potentially be used to buy back into the market later when prices are lower. The problem, of course, is knowing when to take out profits and when to buy back in.

Technical analysis strategies involving the study of price and volume patterns of charts can work well here, but they require skill and practice to master. On top of this, charts can be interpreted differently depending on the analyst - what looks like a sell signal to one may appear as a buy signal to another. This room for interpretation may also open the door for emotional biases when analysing the charts, meaning sometimes investors see the patterns they want to see.

Introducing LUCRE! LUCRE has been building a trading algorithm which tries to outperform the performance of just HODLing the Cryptocurrencies. Build on a philosophy - Don’t HODL; Trade!, LUCRE development team believes that holding a Cryptocurrency hasn’t been the best way to increase your wealth. What is LUCRE? And how it works? You can find out in this brief review.

What Is LUCRE?

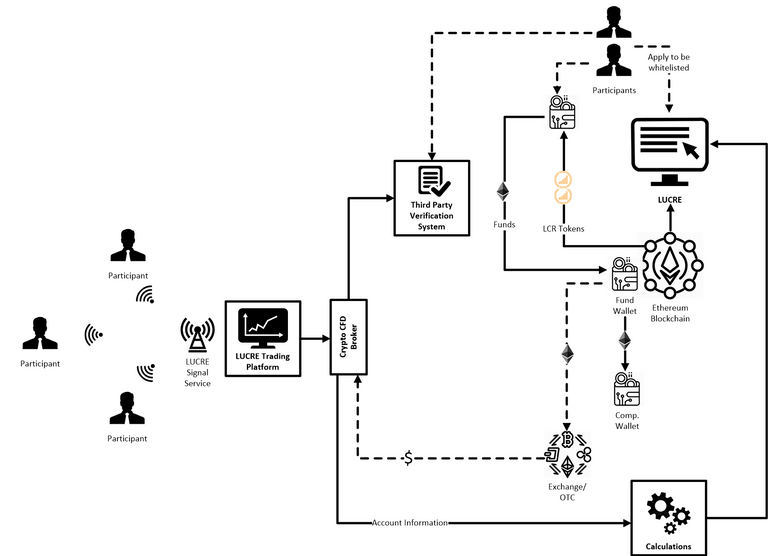

Lucre serves as a tokens platform that is currently backed by algorithmic trading performance. Powered by blockchain technology, the platform currently serves as an automated signal and trading system service for the crypto universe. The platform was created with the aim of outperforming the crypto holding strategy.

LUCRE algorithm was build on a philosophy - Don’t HODL; Trade! allowing trading both ways long and short. The great appeal of this project is the ability to generate revenues in all market conditions, buying and selling at every perceived opportunity. Even when the market is going south the algorithm attempts to make profit by shorting it.

Currently LUCRE Trading algorithm only trades BTCUSD (Bitcoin) derivative (CFD). Other Cryptocurrencies will be added in due course. Performance of just HODLing was great only in good times when market kept going up but it turned sour after peaking on Dec 18th 2017. However the algorithm trading performance was unmatched.

There is a distinction between ’high risk’ and ’unacceptable risk’ in the minds of many participants – cryptocurrencies have traditionally been seen as the latter. LUCRE aims to bring the risk to an acceptable level for allocation to retail participants. The maximum drawdown of LUCRE algorithm trading was 30% in the 1 year of trading test results. In comparison BTCUSD has been down 70% from the peak in December.

How It Works?

Hodling occurs because people in possession of cryptocurrency wait for the ideal market condition to reap the maximum price for their cryptocurrency investment. Lucre’s underlying algorithmic structure liberates the participants from worrying about any fluctuations by generating revenue irrespective of the market situation. This is achieved by making short and long-term trades on the Metatrader trading platform via the aforementioned algorithm.

Automated trading allows to establish specific rules for both trade entries and exits that, once programmed, can be automatically executed via a computer. Once the rules have been established, the algorithm monitors the markets to find buy or sell opportunities based on the trading strategy specifications. Depending on the specific rules, as soon as a trade is entered, any orders for protective stop losses, trailing stops and profit targets will automatically be generated. In fast moving markets, this instantaneous order entry can mean the difference between a small loss and a catastrophic loss in the event the trade moves against the trader.

Features of LUCRE Trading Platform

Trading on the LUCRE platform allows for both long and short-term trades. One of its biggest appealing strategies is its ability to create revenue, regardless of the prevailing market conditions. This means that traders will be in a position to buy and sell, regardless of the opportunities that are prevailing in that market. LUCRE top features include:

Signal Service

Traders get to receive high-quality close/sell/buy alerts. They also get exclusive trading signals coupled with a seventy-five percent trading accuracy. This means that they can use these signals to trade on any exchange or with a broker they prefer.

Automated Trading

The platform has a fully automated trading system that is compatible with all Forex CFD brokers and cryptocurrency exchanges. You can use your LUCRE account to connect with these exchanges and move your money seamlessly without any worry.

Trading Pool

All the LUCRE (LCR) tokens that get deposited into the trading pool are to be managed by the platform algorithm. The trading team will also assist in the management of these tokens.

Benefits of LUCRE Automated Trading

There is a long list of advantages to having a computer monitor the markets for trading opportunities and execute the trades. Some of the advantages are listed below:

Minimize Emotions - Automated trading systems minimize emotions throughout the trading process. Since trade orders are executed automatically once the trade rules have been met, traders will not be able to hesitate or question the trade. In addition to helping traders who are afraid to "pull the trigger", automated trading can curb those who are apt to overtrade – buying and selling at every perceived opportunity.

Ability to Backtest - Backtesting applies trading rules to historical market data to determine the viability of the idea. Careful backtesting allows to evaluate and finetune a trading idea, and to determine the system's expectancy – the average amount that a trader can expect to win (or lose) per unit of risk.

Preserve Discipline - Because the trade rules are established and trade execution is performed automatically, discipline is preserved even in volatile markets.

Achieve Consistency - One of the biggest challenges in trading is to plan the trade and trade the plan. Even if a trading plan has the potential to be profitable, traders who ignore the rules are altering any expectancy the system would have had.

Improved Order Entry Speed - Since computers respond immediately to changing market conditions, automated systems are able to generate orders as soon as trade criteria are met. Getting in or out of a trade a few seconds earlier can make a big difference in the trade's outcome. As soon as a position is entered, all other orders are automatically generated, including protective stop losses and profit targets.

24X7 Market - as Crypto market is open 24X7 it is almost humanly impossible to trade every entry signal round the clock manually.

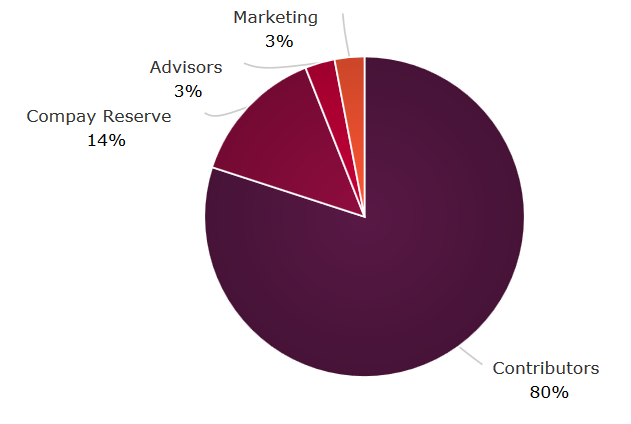

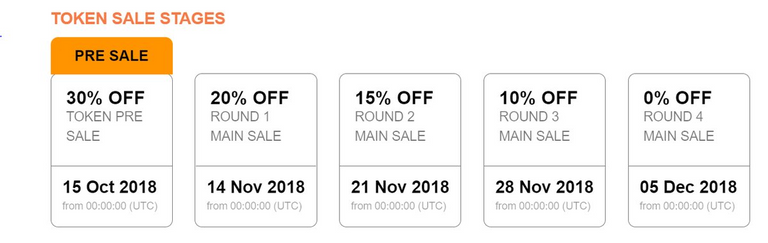

LUCRE Token: LCR

Lucre’s utility token is called LCR which is initially valued at 1 USD. This value is derived from net asset value which is dependent on the performance of algorithmic cryptocurrency trading with real currency. LCR can be traded anytime with full transparency ensured. Lucre’s fully automated system is compliant and compatible with other cryptocurrency exchanges and forex brokers which makes it a one-stop solution for the LCR token holders. LCR can be obtained from November 14th and will continue to be available for further four weeks. Up to 10 million LCR will be sold to ICO investors, which is equivalent to 80% of the token supply.

As an intimation system to the users who invested more than 1ETH during the token sale, Lucre algorithm will send out a signal every time a trade takes place. To scrutinize the performance of the algorithm, daily updates and calculations are set in place and will be made available on Lucre dashboard. Another unique and exclusive incentive provided for Lucre token sale participants is allotment of recurrent profits whereas other platforms require additional funds to achieve this.

A valid question which arises here is that if someone hasn’t participated in the token sale will they have access to Lucre features such as trade intimation signals and auto-trading? The answer is that these features can be accessed on condition that LCR tokens are purchased from original participants.

Useful Links:

Website: https://www.lucretoken.com/

Whitepaper: https://www.lucretoken.com/docs/Lucre_WhitePaper_EN.pdf

ANN Thread: https://bitcointalk.org/index.php?topic=4959492.0

Bounty Thread: https://bitcointalk.org/index.php?topic=5023814

Facebook: https://web.facebook.com/lucreToken/

Twitter: https://twitter.com/LucreToken

Telegram: https://t.me/LucreToken

Author: Binar Bumi

Bitcointalk Profile : binar234