Image by Steve Bidmead from Pixabay

This is the follow up on my last post on Sustainable portfolio even the market is up or down

Precious Metals

The 4 core metals to focus on for the time being should be Platinum, Palladium, Gold, Silver (as we explore space this will change).

Dividing holdings between as many of these 4 that you have researched and like the most, (remember everything in your portfolio should have a purpose) and then remember to layer again and keep some close to you and some held by a trusted custodian in the country that you feel is best fit.

Avoid ETFs and other paper Gold/Silver, get the actual commodity.

Don't just hold one metal and don't hold it all in your house, because bank will seize it if it kept in deposit box, so keep some with trustworthy custodian.

When the economic crisis hit, for example in 1933 during the Great Depression, President Franklin Delano Roosevelt nationalized the gold holdings of U.S. citizens in 1933. He did not however “confiscate” gold. Instead, citizens were compensated for what they voluntarily turned over to the government. In a true confiscation, your assets are seized with no compensation. However,should a severe national crisis arise, it’s certainly possible the government wouldn’t be able to afford to pay investors the full value of their bullion. More about this you can find here

In the next post, I will share about Stocks,Treasury/Bond, FIAT and Real Estate as an asset class in your portfolio.

..............................................................................................................................................................................................................................

The post below contain an affiliate links. An affiliate links means I may earn advertising/referral fees if you make a purchase through my link without any extra cost to you. It helps to keep the lights on. Thank you so much for your support!

Empire Intelligence Alerts Membership

Subscribe to Empire Intelligence Alerts Membership

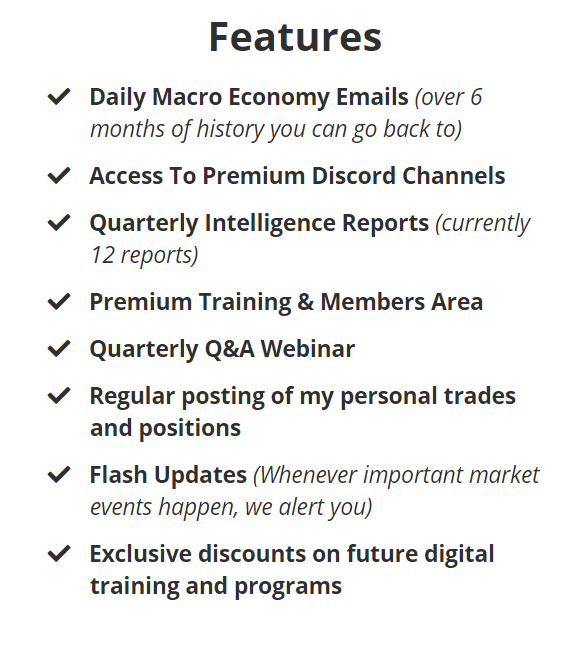

Here are the benefits that you can get from your membership,

Benefits

Finally understand how markets actually work and the underlying thread that drives price action in every single asset class!

Discover the macro cycle that Bitcoin has been following since 2010 and how to position yourself properly for the next bull cycle

Stay up-to-date with the global economy by reading our daily newsletter

Leverage our entire library of data sites we use to deep dive any macro economic topic you need!

Learn how to boost your personal credit score by 100 points in 30 days or less!

Discover what matters most on your FICO score and how to clean up your profile!

Go beyond jobs and stock market data with our quarterly in-depth Macro reports on US economy

From tax haven to recession, understand how in just a few short months Hong Kong has lost their status and is fighting off a hostel takeover

Central banks have been buying up this one thing at a rate not seen in over 10 years, understand what it is and how you can get on the inside!

Discover why IPOs are no longer the easy money grab they used to be and where the money is flooding into

Learn why Warren Buffett and many wealthy families are sitting on cash and what they are waiting for!

I think if we consider long term then gold is the most reliable asset. Other forms of currency always have a risk associated that they might get devalued. Gold has maintained it's position as a valuable asset since thousands of year and will continue to do so for the next thousand years.

Congratulations @cryptokannon! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

I believe precious metals are going to be very important on the next economical crisis but also have some doubts and questions. Who will be able to exchange for example gold to something else to buy some milk for example. Because some economists says there will be hyperinflation and fiat money will worth nothing like it happened in Venezuela. People started swap goods like old days. Do you think it is logical to store some food to prepare for big crush scenario.

Hi @omertalhaozde, thanks for stopping by. If it would be another financial crisis only, the gold would be more valuable to purchase tangible asset like real estate and other assets to increase wealth and to stock up more other basic necessities like food and water just incase total financial collapse coming next. But if it would be total economic collapse, gold might be accepted as a bribe. It is wise to stock up basic necessities like food ,medical supplies and etc besides learning basic survival skill like farming for time like those. I think coffee and battery would be a good currency too.

Thank you for your kind answer @cryptokannon. Never thought about coffee and batteries.

Actually that coffee and batteries was an idea from a kind friend. Good day!