I often wish I had a mentor when I first got into crypto 6 y ago, but the market losses are our biggest teacher. Along the years, I have tried to make peace with my personality and see how I can trade based on my individual traits. I continue to learn something new every day, and have been reading a lot - first time since teenagehood I read SO many books :)

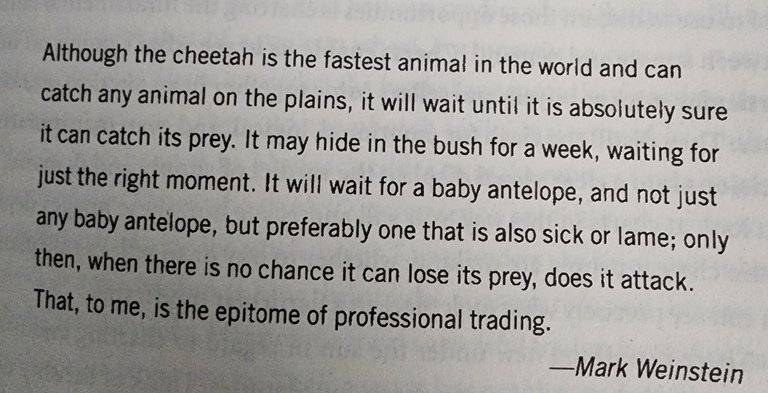

The above quote by Mark fits me very well in fact. I have so much market patience, and will wait months or years (holding BTC for example) until the right time before I take big buy or sell decisions. My most notable example were my BTC sell orders past winter, and I was even public about this on LinkedIn (image below). By the time April’s massive dump came, I was 90% in cash and re-buying the fear. Spent the time in between watching series to kill time, to avoid boredom trading.

Mistakes:

I did not size as big as I should have during April’s dip. I ended up selling an asset at break even, I sold half of another asset and held the other half (should have held all), and should have definitely bought more BTC and equities.

I tried my best to analyze Trump’s behavior as well in my posts. Actually looking back at my profile, I’m so proud of myself. I predicted the tariff pause before anyone else, me, the little agriculture major.

I was mocked when I said disclosing tariffs rates is bullish. How I saw it back then is the tariff news being known is no longer bearish, and the next “unknown” is cuts, pauses and deals, which makes the unknown bullish!

Mistakes:

Not having enough confidence in myself regarding trading, not writing down my trade strategy with possible scenarios and clear TP, invalidation, size and reasoning.

It took a lot of pain and tears to improve and grow. Complacency keeps us weak, discomfort is where the real success begins. I am thankful to say that I now have a clearer trading strategy. We should be proud not of how much profit we make, but how well we stick to our plan.

Market Outlook Going Forward:

I believe Q4/maybe Q1 will be good, but I am ready for a market catastrophe too. Short term doesn’t matter to me, I don’t bother with charts below 1D or single TA metrics. I kept adding BTC past month and have not sold the April BTC or the ones I sniped during the Iran/US conflict dip.

Reasoning is historically crypto performs very well in the winter seasons. Moreover, I have not witnessed euphoria after November 2024. Though BTC has a brief history, there is one certainty which is market top is always accompanied by euphoria. A weaker USD is good for BTC and I am betting on a potential flow from gold’s rush to other assets, including BTC. I will add that BTC is the best horse to bet on with all the institutional attention, first mover advantage and cult support. Alts' biggest disadvantage is all the dispersion and divided attention. Though crypto is a risky asset, when financial institutions or rich investors want to explore the addition of crypto to their portolio, the first and most obvious answer is the purchase of BTC.

However, if unfavorable news or conditions arise, I will be ready to change my opinions. I have a list of theories whereby I think the market may top. I await the signals to flash :)