Anyone else ever heard this sound advice as a gateway to your best life growing up? "To be successful you have to...Go to school, get good grades, stay out of trouble and you'll get a good JOB!" I'm sure all of our parents are either distant relatives or parakeets because I'm sure we've all heard that. But has anyone else noticed that despite doing everything we were told to do that most of us, especially us Millenials are not millionaires yet and jetsetting to the south of France twice a year?

It wasn't until I was introduced to this book that reality started to hit me. We've been given this advice by the people who love us and who truly want us to succeed in life. But unfortunately, if we were to ask ourselves the important question of, "Are our parents and relatives living their ideal lives to this point?" we could be brutally honest and say that they are not. So after reading this book and coming to this conclusion, I began to ask myself, "Do I want to have a good job or do I want to have a good life?"

After reading, I came up with 4 key points that I have personally taken away from the New York Times #1 Financial Best Seller! So without further ado, here we go:

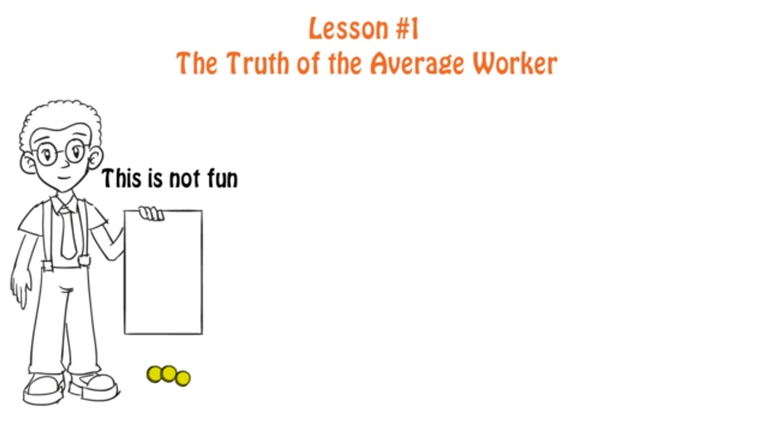

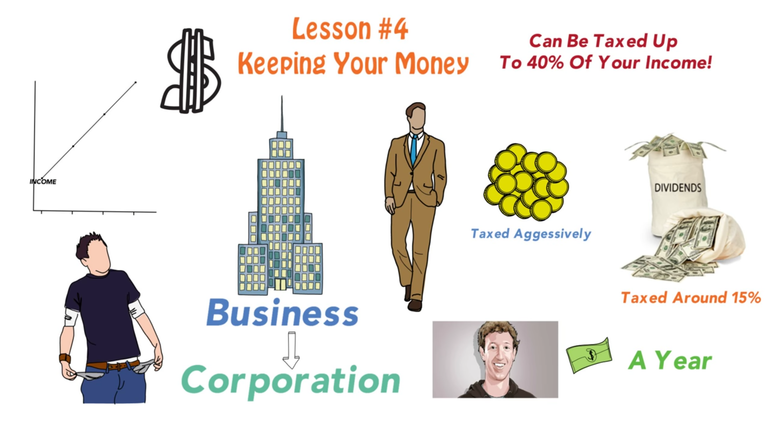

Many people are overworked and underpaid in a job that they do not enjoy for years on end. To add insult to injury, the average worker is taxed 40% of their income and can never seem to get ahead no matter how much they get paid or how much overtime they work.

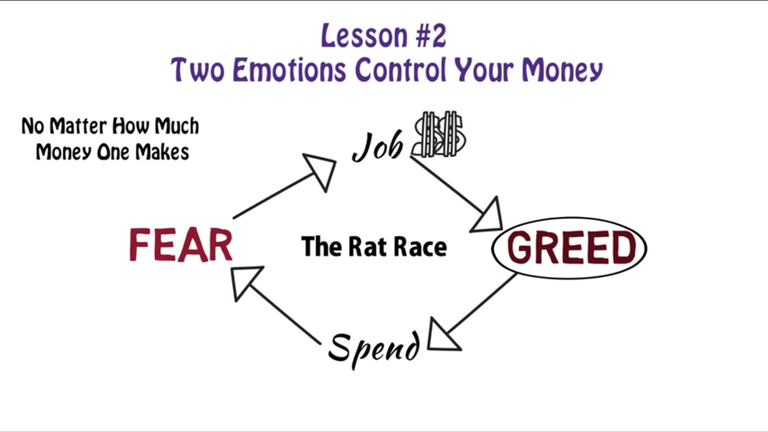

The 2 emotions that keep us in the proverbial "Rat Race" are GREED and FEAR. The fear of not having money to survive puts us in fear mode, but when we finally find a job and start getting paid, greed takes over and we start to imagine all of the things we can buy. So most of the time we overspend on things because psychologically we know we can make more money at our job, and the cycle has begun: time for money, time for money, rat race, rat race. No matter how much we get paid at our jobs greed and fear rule our habits and our behaviors.

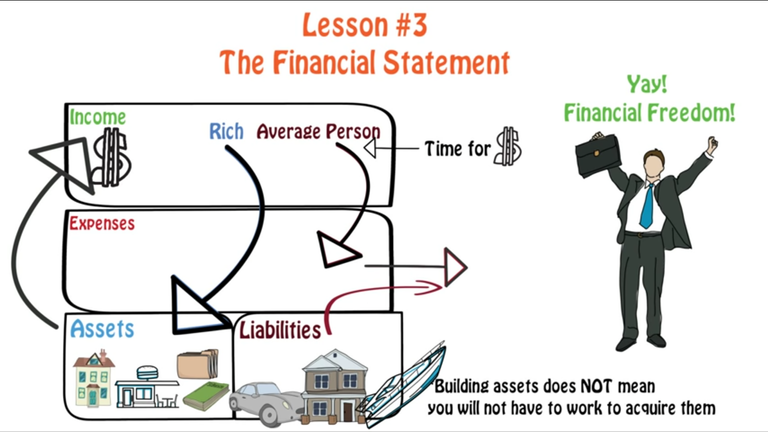

The average working person lacks financial literacy because we weren't taught it in school. In the book, Kiyosaki breaks down how the rich get richer and poor stay poor. In essence, the rich use the extra money from their working income to buy assets such as small businesses, crypto, stocks and real estate to build a passive income. A passive income is money that comes into your account whether you are physically there or not. Most times the rich have to work to build the asset so the income exceeds their expenses, but they tend to reinvest their money into things that put more money in their pockets. Unfortunately, the average person spends their extra income on liabilities such as a car, clothing, dinner, expensive vacations etc. These don't put money in your pockets, but rather they take money from them which makes the average person go back to work for years and years because their money never works for them but they work for it. Hours for dollars rules the average person's life whereas the rich eventually build Cashflow that sustains their lifestyle and they have the option to work if they want or never work again.

I suggest visiting

richdad.com/classic

And playing the Cashflow game for free. It teaches the very basics about money in a real-life simulation.

It's not how much money you make but how much you keep. Taxes are often the biggest expense for the average person working a job because they are taxes at 40% of their income. But rich use legal tools such as corporations which are technically legal documents in a folder, not huge buildings on Wall Street like we think. When the rich build lucrative businesses, they hide that income into corporations. This way a business man such as Mark Zuckerburg can pay himself $1 a year salary which is heavily taxed. However, Zuckerburg makes most of his money in heavy stock holding which pays him dividends. Dividends are taxed at 15% which is significantly less than the average person. So this is how the wealthy are able to retain their wealth and build upon it!

I'm still a student of this financial game, constantly learning the rules so that I may also live my best life! I hope that you've found this post informative!

Please don't forget to upvote and follow and I'll be sure to return the favor! Thanks for reading Steemians! 😊😁

Im literally staring at that book on my desk that I picked up a few months ago.. I haven't even read a page in that book yet. I am not a big reader but I think I should take the plundge and read the book!

For sure @lifewithdanny! I make it a point to read that book at least once a year just because it's so important with how we all deal with money. I'll be sure to follow! Thanks for the upvote and I can't wait to hear your takeaways from the book!

It might take me some time to get through the book but if I remember ill definitely let you know what I think of it!

Do it man! I approve this message!

Ill probably end up starting it next week at some time! Try to remind me!

LOL sets calendar to remind @lifewithdanny

honestly i hope you did lol