The rapid development of technology has had massive impact on the financial services industry and has introduced new rounds of development.

The emergence of new technological opportunities have entailed the expansion of individual and institutional consumers’ demands in ensuring particularised financial service provision and their regulatory stipulation.

Forty Seven is a unique project built to create a modern universal bank both for users of cryptocurrencies and adherents of the traditional monetary system; a bank that will be acknowledged by international financial organisations; a bank that will correspond to all the requirements of regulators.

A team of professionals from the worlds of banking, finance, and IT with expertise and experience in the creation and licensing of payment systems, and building of electronic financial institutions will work to realise the goals of the project.

Our bank will become the biggest structure that corresponds to all the requirements of regulators and the EU Payment Services Directive 2 (PSD2). We will comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) policies in order to guard against agents of the “grey” market.

Forty Seven is based on three principles: relevance, convenience, and security. Our specialists use up-to-date technological developments such as blockchain, biometrics, smart contracts, machine learning and many others. If you are interested in the specific details of our establishment and creation of a hi-tech bank.

Forty Seven team is going to develop a PSD2 compliant system

with integrated blockchain, smart contract, API, biometric and machine learning technologies.Forty Seven will offer unique crypto products like bonds, futures and options. Forty Seven goal is to invent such market- place and take the leading position in both short and long-term perspectives. Companies will be able to attract finances via product invented by Forty Seven Bank – Cryptobonds. Cryptobonds will be traded on various exchange platforms (mainly at the one developed by Forty Seven Bank).

Uniqueness of Forty Seven Bank will be a full technological and legal equipment for cryptocurrency processing and treatment.

In the absence of direct competitors, the bank believes that there could accumulate significant demand for products and services of the bank at the first glance which will create the constructive base for healthy growth in long-term.

During the last half year, total market capitalization of all cryptocurrencies has risen by seven times. In Forty Seven opinion, currently, the market is in its early stage and there is great potential in new projects aimed at invention and development of ecosystem and infrastructure projects for cryptoworld. Forty Seven believe that Forty Seven Bank will be the first in its kind and will take the leading position on the market in short period of time.

During the last year, ICO has become a widely used tool for cryptocurrency holders to contribute resources into dierent projects. ICO has also become another good option for companies to generate finances.

Mission of Forty Seven Bank

The mission of Forty Seven Bank and management team is to provide safe, innovative and user-friendly financial services and products to Forty Seven customers – individuals, businesses, developers, traders, financial and governmental institutions. Forty Seven Bank is a bridge capable of connecting two financial worlds and establishing efficient communication between them, a communication that will open up possibilities to level up the whole modern financial system.

Forty Seven Vision

Forty seven believe that after PSD2 directive comes into force in the beginning of 2018, the future of EU financial sector will change significantly. Forty Seven Bank system will be developed in accordance to upcoming regulatory framework from the early stages – it will give Forty Seven Bank competitive advantage in terms of time and costs. This is a significantly beneficial aspect prior to the traditional banking which has to impose reorganisational procedures in order to meet new standards.

The big portion of financial sector market share will be shifted to financial technology start-ups that will be able to oer and provide unique products and services together with high-quality customer and technological support. We aregoing to take the leading position among these start-ups and become one ofthe pioneers in the changing financial world.

The mission of Forty Seven Bank and management team is to provide safe

Innovative and user friendly financial services and products to Forty Seven customers individuals, businesses, developers, traders, financial and governmental institutions. Forty Seven range of products will unite cryptoworld and traditional finance world and grant new unique opportunities to both of them.

Forty Seven believe that after PSD2 directive comes into force in the beginning of 2018, the future of EU financial sector will change significantly. Forty Seven Bank system will be developed in accordance to upcoming regulatory framework from the early stages it will give Forty Seven Bank competitive advantage in terms of time and costs. This is a significantly beneficial aspect prior to the traditional banking which has to impose reorganisational procedures in order to meet new standards.

The big portion of financial sector market share will be hifted to financial technology start-ups that will be

able to oer and provide unique products and services together with high-quality customer and technological

support. Forty Seven are going to take the leading position among these start-ups and become one of the pioneers in the changing financial world.

Our Value

Transparency

Financial stability

Effectiveness and user firendly procedures

Security and privacy (data protection)

Innovativeness

Customer satisfaction

Market share growth and worldwide expansion

Profit for all stakeholders

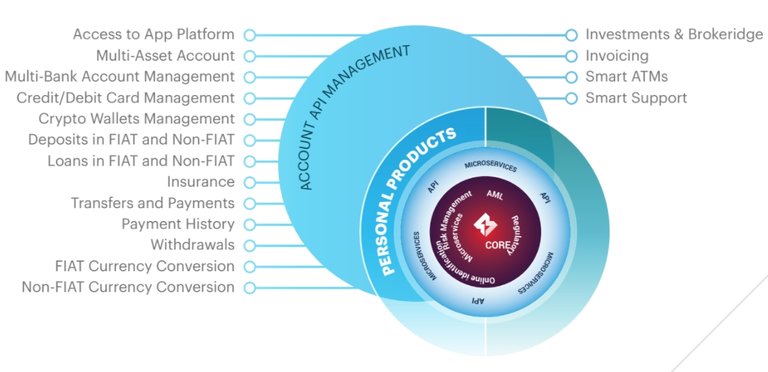

Products and Services - Product for Private Persons

Forty Seven Bank is aiming to provide broad

traditional and digital financial products and

services spectrum for individual clients.

Product for Private Person

Together with secured remote on-line identification, automated scoring, due diligence and AML of the client, customers could proceed with quick and secure banking. The bank is going to do that according to latest technologies using biometrics. The use of biometrics in the banking sector has proven its eectiveness and precision and that is why it is rapidly growing over the last years and is yet far from its peaks.

After the full identification of the potential client and further registration in the operational database is completed, the client can access the following services provided by Forty Seven Bank: IBAN, access to secure crypto wallets and tokens, credit and debit cards, personal and travel insurance, loans, access to Forty Seven App Platform with wide range of applications, invoicing, investment and brokerage services, etc.

Product for Private Persons

Figure 1 below presents the range of products and services that will be oered by Forty Seven Bank to private persons.

By the virtue of the new banking regulations and decentralisation of the services which optimises

communication between transaction parties, the PSD2 directive imposes significant operational changes and creates single digital market in Europe where consumers can proceed their financial management from the platform which aggregates previous individual services. Forty Seven Bank in this case, outstands by the fact of the digital cryptocurrency transaction services and processing support. Forty Seven Bank clients will have an opportunity to analyse and manage all financial operations in fiat and non-fiat currencies using flexible analytical functions of our smart software. For technically advanced clients, there will be the possibility to manage a bank account via API.

Account Management

Forty Seven Bank clients will have a lot of possibilities related to account management. Having access to just one application, a customer will have access to all his accounts in dierent banks at one place – it will be easy to manage personal finance in such a way. Besides that, a client is going to have access to all his crypto wallets, investments in traditional financial assets (stocks, bonds, commodities, etc.) and credit or debit cards. This is a featured product oered by the bank and it is called a “Multi-Asset Account”. The product will reduce complexities of using dierent types of assets by centralising all the financial activities of our private customers at our single system. It will be easy to quickly transfer resources from one fiat currency to another, or from fiat currency to a digital currency, or vice versa. Moreover, transaction costs will be reduced substantially by doing that at Forty Seven Bank. Our App Platform will also allow clients to use several analytical applications that might help in personal finance management.

Invoicing

Forty Seven Bank will support its customers who are oering small products and services as individuals without having a company.

Such individuals might be freelancers, copywriters, developers, translators, handcraft professionals, etc. The bank will provide user friendly and simple invoicing services for such customers. By using the service, a client will be able to automatically issue invoices and receive both fiat and non-fiat funds to cover them.

Deposits and Loans

The bank will oer deposits and loans in traditional fiat currencies like EUR, USD and others, as well as in non-fiat digital currencies like BTC, ETH and others. At the moment, there is no financial institution in the world that is oering similar products in non-fiat digital assets, whereas we see that there is huge potential in developing and introducing classic banking products for non-fiat digital currencies.

Investments and Brokerage

Individual clients will have opportunities to create and manage their investment portfolio by using investment and brokerage services provided by Forty Seven Bank. The bank is going to develop its own exchange in addition to partnering exchanges that could be connected to by using Forty Seven Bank platform via API.

Other Services

The bank will also oer traditional products and services like insurance, payments and transfers, payment history and analysis, cash withdrawals at Forty Seven Bank Smart ATMs, as well as at ATMs of our partnering banks. Additionally, Forty Seven Bank will provide smart support with integrated machine learning technologies to our individual customers – it will help to resolve issues between the bank and its customers in effective way.

Emission of tokens

What is a Forty Seven Token: Forty Seven Bank Token (FSBT) is a cornerstone of Forty Seven Bank infrastructure. FSBT tokens will be demanded by partners-developers in order to be able to upload their fintech applications into Forty Seven Bank App Platform. FSBT will also be demanded by businesses in order to improve the effectiveness of financial and operational activities via smart contracts. For private customers FSBT tokens will give several benefits in using Forty Seven Bank products and services, as well as token holders will be top priority customers of the bank according to loyalty program and will get loyalty rewards on yearly basis based on performance of the bank. After the crowd-funding campaign is finished, FSBT tokens will be available for trade at various cryptocurrency exchanges.

Abbreviation: FSBT.

Control over emission: is provided by the system of interconnected smart contracts.

Actual rate: 1 FSBT = 0.0047 ETH (including current bonus).

Maximum amount of tokens to be generated: 5 555 555 FSBT (incl. bonus tokens, tokens for bounty and founders).

Softcap: 3 600 ETH.

Hardcap: 18 077 ETH.

Accepted currencies on ICO: ETH, BTC.

ICO: now – 30.04.2018.

For More Information :

Website : https://www.fortyseven.io

Whitepaper : https://drive.google.com/file/d/0BzvESRkgX-uDeHc1QjRzbHRBelU/view

Ann Thread : https://bitcointalk.org/index.php?topic=2225492

Facebook : https://www.facebook.com/FortySevenBank/

Twitter : https://twitter.com/47foundation

Telegram : https://t.me/thefortyseven

Medium : https://medium.com/@FortySeven47

My Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1210304

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://icorating.com/upload/whitepaper/bAckRmuBiP0bGiOvNnSXu8Dj3e44yegqNHss4uvQ.pdf