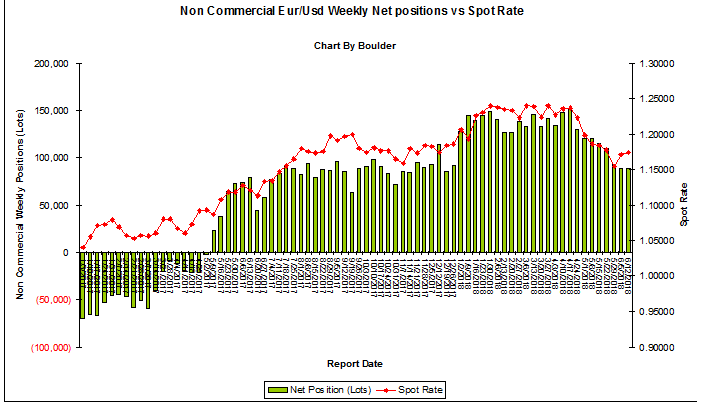

Until Tuesday, institutions continued to cut their Euro bullish bets for 8 weeks in a row , which was shown in the latest COT as of Tuesday, June 12, 2018.

The institutions net long Euro positions decreased last week by 1,010 contracts to 88,225 contracts

3,287 long positions were closed, and 2,277 short positions were closed as well . Now Longs total 236,617 contracts vs shorts total 148,392 contracts .

61% long exposure vs 39% short exposure, which is the same as the previous week

This week Euro started at 1.1716 on 6/5, hit low at 1.1710 support , then bounced up to 1.1839 high on 7th, closed at 1.1744 on 6/12/2018

Despite the bounce in the EUR to 1.1840s this week, Institutions continued to cut their long position , so this looks bearish

Longs being closed indicates they might think the temporary top at 1.1840s ranges; Some Shorts being closed at 1.17s levels, which they might help their longs

also it indicates they might think the temporary bottom at 1.17s ranges;

We did see after COT report, Euro had impulsive move to the downside to the low 1.1543 last Friday on 6/15/2018

Long Term Less Bullish, Short Term Bearish With Some Hesitation

Please note institutions take weeks and months to build a position in the currency market. For Euro, they have built their net long positions since 5/9/2017.

Therefore, the bullish sentiment is more for long term outlook, not intended for short term trading.

FF question.. 8 weeks is solid...eu candle wise.. 7 weeks are rare.. I was wondering in there is anyone plotting cot alone on a chart. If so is 7 weeks rare for cot?

the last time it had 7 green candle, the trend changed.. I wonder about this time with 7 red candles.. the weeks following the 7 are opposite.. meaning candle eigh and 9 are exact opposite when compared. the shapes and wicks are similar.