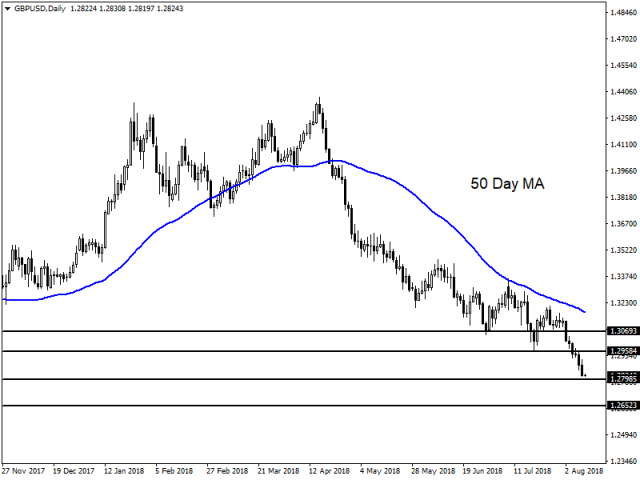

The fallout has continued for another day for the pound, as it continues to find itself coming under immense pressure from financial markets. The only thing now that could provide a welcome boost for the UK economy is GDP figures out today, which are expected to show a boost of 0.4% for the quarter. If we saw a weaker number here coupled with the Brexit fears it could send things sharply lower, so right now is a testing time for the GBP and GBPUSD in particular.

Looking at the #GBPUSD on the charts and it's clear to see that the bears are in control and taking huge swipes whenever the chance appears. but the reality is that we could see a further push through soon in current market climate. On the flip side if we do see a positive GDP reading then we could see the bulls come back into the market and look to retest resistance levels - I'm not sure how much appetite there is for that at present though. When looking at these levels I would focus on 1.2958 and 1.3069 as well, but as mentioned it would be a tough ask in the current market environment.

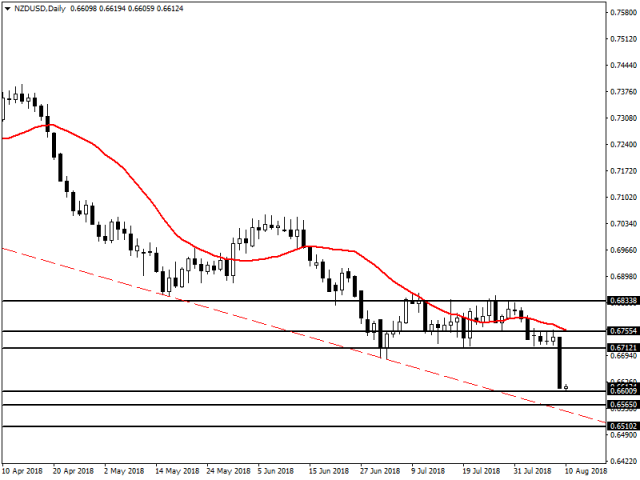

The other big loser in the markets has been the New Zealand dollar, which came under pressure after day befor yesterdays Reserve Bank of New Zealand announcement, that it intended to keep rates flat at 1.75% until 2020 at least. This has been ever further impacted by the national milk company Fonterra cutting milk prices for 2017/2018 which will have a flow on effect for the economy. All in all its not looking up at present for the NZD and it has fallen against all the major pairs as a result. If the central bank is lacking in confidence then markets will be no strangers to lacking it either, the only long term reprieve is of course a weaker NZD means better export earnings which will have a dampener effect on the current situation.

As the NZDUSD continues to find itself under pressure the trend line will be a key factor for the bears and the bulls, as if there was going to be any chance of a resurgence it would be here I feel. Support around the 0.6565 level will also be key to say the least, but if the bulls really want to show there abilities then this will be the key area for it. If that fails then I would expect a quick run down to the next level of support at 0.6510 in the present market environment.