From peer-to-peer trading, to cutting out intermediary fees, blockchain technology has up-ended the rules on finance. Mitchell Mahaffey looks at the projects leading the revolution

The financial services industry is going through the biggest technological shift in its history. Developers and enterprises are using blockchain technology to improve on slow and archaic systems that have hampered the banking sector for decades. Here are some of the most innovative and disruptive projects being developed today.

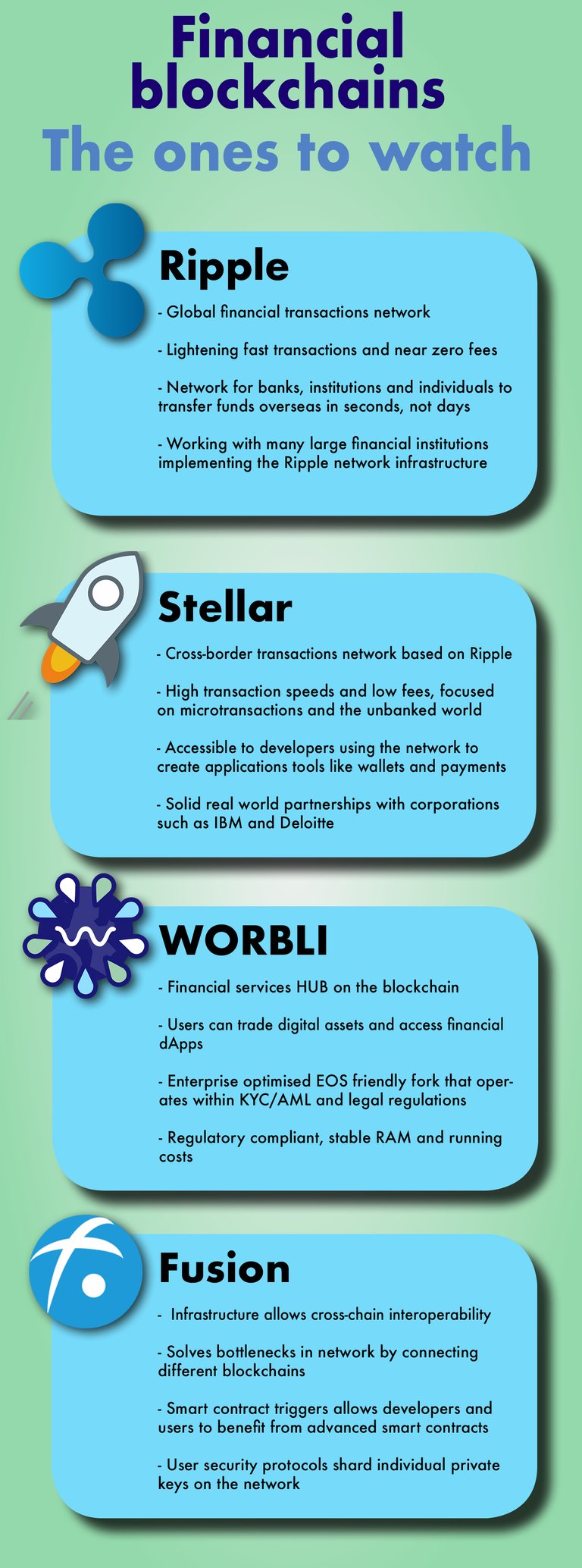

Ripple

Ripple’s strength is in its global financial transactions network. It boasts extremely fast transaction speeds and near-instant, traceable payments. The Ripple infrastructure is targeting large banks and institutions who require a system to transfer wealth across borders and continents.

Current alternatives like Swift can take days to transfers funds between banks or overseas. This is simply too slow and costly for banks and individuals. By contrast, transferring wealth on the Ripple network can take seconds and cost almost nothing.

Individuals are able to utilise the Ripple network to send funds from their bank to overseas entities in an extremely efficient process, whilst remaining fully KYC and AML verified. But this does come at a cost to decentralization. Ripple achieves its speed and efficiency by having a small amount of private nodes. A large amount of the Ripple’s total supply is held in a private wallet. As a result, the network has come in for some criticism for being too centralized.

Stellar

The Stellar network is a code fork of the Ripple blockchain. It has a similar infrastructure with high transaction speeds and low costs. The Stellar network is focused on cross-border digital payments, like Ripple. Stellar sets itself apart by having a greater focus on micro-payments and providing unbanked populations with access to financial services.

Using Stellar Core, an open source distributed payment network, developers can easily build tools for applications like mobile wallets and payment systems. Stellar has made significant progress in acquiring large corporations to utilise their technology, including IBM and Deloitte. Also like Ripple, Stellar has sacrificed decentralization for speed and affordability. There is no mining and no incentives for participants on the network.

WORBLI

WORBLI is creating an all-inclusive financial services network, where individual users can buy, sell and store digital assets, whilst having access to many of the financial dApps (distributed applications) and services that are developed on the network.

The infrastructure has been designed with enterprise in mind, allowing for business features that cannot be found elsewhere. These features include a KYC/AML verified network of block producers and users; stable RAM and utility costs on the network; and merchant services to reduce the digital asset volatility. WORBLI uses EOSIO software and is a code fork of the EOS Mainnet .

By being an EOS friendly fork, WORBLI can optimise its compliant chain for enterprise. With the prospect of more regulation down the road, this is essential. To do this, WORBLI has sacrificed some decentralization but not to the same extent as others. With a delegated-proof-of-stake protocol, its block producers are voted in by its community.

Fusion

Fusion is providing a distributed financial infrastructure that can facilitate efficient financial dApps and cross-chain activity. By doing this, Fusion seeks to solve bottlenecks that occur when applications interact with other digital assets. The Fusion network allows blockchains to be more connected, improving efficiency. Using smart contract triggers, developers and financial institutions can deploy advanced applications on the network. User information is kept secure with a protocol that splits private keys, ensuring no entity has access to a full private key. Fusion is still early in development, but it will be exciting to see this project in action once it comes to fruition.

All of these projects use distributed ledger technology in slightly different and ingenious ways to solve a variety of problems facing finance today. In such a broad industry, there is room for many more different applications and approaches, including those above. As innovation progresses, billions of people stand to benefit from faster, efficient and fairer system of finance.