The first week of the New Year turned out to be quite hectic for the precious metals markets. The news was multidirectional; investors saw a sharp rise in prices by the middle of last week and a significant drop by the end of the week. Political turmoil in the United States, the Brexit deal, the strengthening dollar and rising Treasury yields were among the main factors affecting the markets.

The strengthening of the power position of the US Democratic Party raises expectations of an expansion of stimulus programs, but at the same time raises concerns about faster Fed action to raise interest rates in the event of a successful recovery of the American economy.

The current week is expected to be active: important statistics on GDP, prices and industrial production will be released, representatives of leading Central Banks will speak, and the Fed's Beige Book will be published. Market volatility should remain high. The US fiscal stimulus bill has not yet been signed into a $ 2,000 payout to US citizens and is likely not to be discussed soon in light of the changes in the American political arena. At the same time, the control of the Democratic Party over the US Congress could mean more aggressive stimulus measures that can be discussed and approved soon after the inauguration of the country's new president, Joe Biden. This significantly raises inflationary expectations and concerns about dollar devaluation.

At the same time, rising inflationary expectations could trigger a quicker response from the US Federal Reserve in terms of tightening monetary policy, especially with the active economic recovery that we have already seen in recent months.

According to the IMF, in November 2020, central banks again became net sellers of gold. World official gold and foreign exchange reserves in November decreased by 6.5 tons. Purchases in November amounted to 16 tons. The main buyers were: Bank of Uzbekistan (bought 8.4 tons of gold), Bank of Qatar (bought 3.1 tons), Bank of India (bought 2, 8 t), Bank of Kazakhstan (bought 1.7 t). Sales by central banks in November totalled 23.5 tonnes of gold. The main sales were carried out by the Bank of Turkey, selling 20.9 tons of gold to local commercial banks, as well as the Bank of Mongolia, which sold 2.4 tons of metal.

Last year was a good year for the precious metals markets. The average annual cost of gold in London in 2020 was $ 1,771 / oz, silver - $ 20.53 / oz, which is 27% higher than the average annual prices in 2019.

Gold prices last week rose to a strong resistance level of $ 1960 / oz, after which they dropped to the level of $ 1820 / oz. under the influence of the strengthening of the US dollar and the growth of treasury bond yields. The deteriorating epidemiological situation in China may support gold prices in the global market soon.

According to the Australian Mint (The Perth Mint), sales of gold coins in December 2020 amounted to 76.80 thousand ounces versus 84.16 thousand ounces in November 2020. Sales of silver coins in December amounted to 942 thousand ounces against 1119 thousand ounces. ounces in November 2020. Despite a decrease in monthly sales in December, the average monthly coin sales in 2020 are above the 2019 level by 100% for gold coins and 42% for silver coins. Investor demand has remained strong throughout the past year, and rising inflationary expectations and low-interest rates leave the outlook for 2021 bright.

Silver prices in Chicago last week rose to $ 27.92 / oz. in correlation with the gold market, but currently, the market has corrected down to $ 25.17 / oz. The ratio of prices for gold and silver increased to 73.73 (average value over 5 years - 79.5). The platinum/silver ratio rose to 40.73 (5-year average - 57).

According to Reuters, investments in the largest ETFs investing in gold and silver last week grew by 0.7% and 0.4%, respectively. Last year turned out to be very successful for palladium, the average annual value of which increased by 43% to the level of 2019, reaching $ 2,195 / oz. The average annual price of platinum in 2020 is up 2% by 2019 to $ 882 / oz.

At the same time, the beginning of this year so far indicates a greater potential of the platinum market: last week prices tested the resistance level of $ 1138 / oz. in correlation with the gold market, from which there was a decline to $ 1038.5 / oz. The spread between gold and platinum narrowed to $ 784 / oz, between palladium and platinum - to $ 1305 / oz.

The main supporting factors for platinum prices are the expected growth in industrial demand in the automotive industry and from the green energy sector, the possible replacement of more expensive palladium with cheaper platinum, and the likely shortage of the metal on the market due to production problems in South Africa.

High volatility in the palladium market remains - at the beginning of last week, prices rose sharply to $ 2,514 / oz. after which they fell to $ 2360 / oz. At the same time, palladium prices have been consolidating in the range from about September 2020 $ 2200 - 2500 / oz Over the past week, investments in the largest ETFs investing in platinum rose by 0.2%, according to Reuters, while investments in palladium are unchanged.

My new way to invest in gold

I have recently learned about a cryptocurrency project that offers us to invest in precious metals using cryptocurrency. The project acts as a stable coin in the cryptocurrency market. It is an important market element and also a great tool.

I liked the Digital Gold project, and I began to transfer part of my assets into this coin. In my opinion, this coin is not only stable. The Digital Gold project has growth potential. After all, the coin is tied to the rate of gold, but as we all understand it is constantly growing.

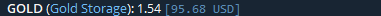

Now I buy some digital gold every month. Of course, I still don't have a lot of it, only 1.54 grams. But I am going to invest in digital gold in the long term by constantly adding gold to my piggy bank.

Digital Gold is a universal tool in the world of cryptocurrencies. A good investment tool for the long term. An excellent tool for trading in the cryptocurrency market.

Contacts

👑Website: https://gold.storage/ru/home

📞Telegram: https://t.me/digitalgoldcoin

📞 Steemit: https://steemit.com/@digitalgoldcoin

📞Youtube: https://www.youtube.com/channel/UCUo-D88vDTvntg2QhxDqBGQ

📞Reddit: https://www.reddit.com/r/golderc20/

📞 ANN: https://bitcointalk.org/index.php?topic=5161544.0

🌏 Coinmarketcap: https://coinmarketcap.com/currencies/digital-gold/

Autor:

Telegram: @carbodex

Bitcointalk Username: anatolij.shishkin

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2280356

ETH 0xae291938EcF7887cbD6edAa42Dec3d9abC9dEa94

Interesting!

I'd like to look into that Digital Gold!

Yes, quite an interesting product. While I was holding the stablecoin, it grew by $ 10. Everything is governed by the price of gold. Thank you for visiting me.