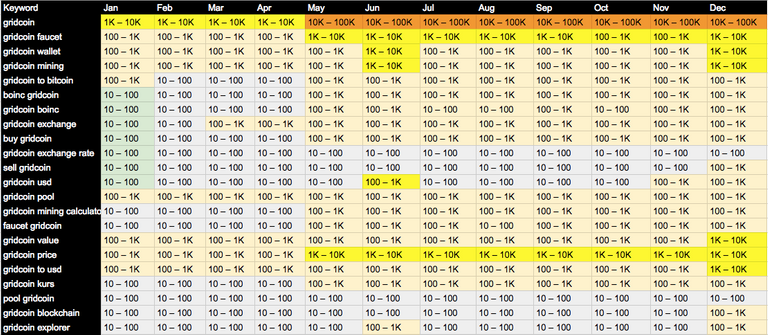

Straight to a point, these are keywords searched in regards to Gridcoin, and the changes over the months of 2017.

It would be good to start tracking whenever we publish something new and measure an impact from now on. This would give us good analysis where we are performing well, or not so well, identify strong and week points as well as where to push.

It should be good if we can make a single place to track all the work done per month and measure an impact.

From the current analysis, it looks we got one stable peak in May/June, and one in relatively smaller in December.

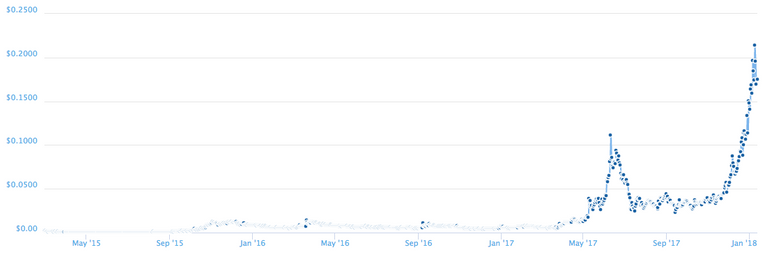

It would be very interesting to connect public interest, projects done and price into a single representation like this one. That could become an useful tool for planing as well as predicting an impact.

If you take a look at the price chart, it's exactly the May/June and December that peaks.

What we are missing in order to have full analysis, is what exactly we did to make this happen so we can repeat strong points

Also, whenever there is a drop in public interest of a keyword, we should be able to tell what caused that drop.

The bottom line is, I think we need an Analyst Volunteer to track all of our projects and their impact :) Anyone interested?

The problem is that this is a chicken-or-egg scenario. Did the interest peak because of a pump, or is it that people started buying in because of some news that we aren't all aware of? Sadly, I suspect it's more the former. We just got a Bloomberg mention yesterday and today we're at the lowest volume levels in a week.

So it would be good to get an analyst on it, but we should be pretty careful that we do real analysis and not jump to conclusions:)

Can't agree more but it starts with gathering data which in time can be converted into information taking into account (and stating) any assumptions. People can still reject the analysis but this at least starts the discussion.

@nateonthenet Hmm, well the job of an analyst is to prevent anything from getting under the radar. That's exactly why I think we need one.

Luckily we already have @parejan who like statistics. I agree with him we should open up a discussion on Slack.

Have in mind, the above is far from a good analysis. It's a bulls**t, with just some basic parameters. The good one will take many other aspects into accounts, including the movement of other cryptos among other markers. It's a very complicated and time consuming job.

In my opinion, GRC do perform great. In last 2 months, raised by double while almost all the other cryptos failed, including but not limited to Bitcoin, Monero etc..

These projects have very good teams of analysts standing behind, and GRC raised strong above others without all that fancy s**t. I could only imagine how much we could achieve if we employ best industry practice in decision making processes and base them on high quality analysis.

Talking about analysis it is indeed all about looking at data from different angles. Two days ago I wrote a short article on Steemit (here] where I compared bitcoin with the "science" coins. In conclusion Gridcoin did a great job compared to Bitcoin but Foldingcoin did even better. In this case there seems to be a general interest in "science" coins.

I agree that the analysis can take a lot of time so it can be a limiting factor but it is better to start and do something than do nothing at all. This is why I teamed-up with @jringo for SotN and I'm would like to look at the info you presented above as well.

Hmm, just read your post and leave a comment there so I am not going to repeat everything, but you obviously did a good observation of few points that i totally missed.

I think such an analysis and the continuation of this analysis will be very beneficial moving forward.

I would sound a note of caution, however, when using this analysis in the current state of the crypto markets. I think that projects in the crypto markets at this time serve more as market catchers and not market makers. By this I mean that there is so much money moving into all cryptocurrencies, regardless of their rate of development and marketing -- even some dead currencies are seeing amazing growth -- that we might end up with some false correlations if we tie news, projects, and marketing to price growth.

I think tying these things to user adoption would be more appropriate at this time.

A summary of how I view the markets:

In general, fiat is entering the crypto markets at an incredible rate. So are new users. This is why I think alts are rising at the rate that they are rising. Those with better tech, more active and reputable communities, and better use-cases will see stronger and more sustainable rises, while those without might be more vulnerable to volatility (relative to other more stable cryptos and communities) and market crashes.

When we consider the psychology of what is happening in crypto markets, I think that people see a rise in a coin, buy the coin... any coin, then decide to sell or hold based on the activity of the development and community (and the quality of the community) behind that coin, along with the use-case of the blockchain and currency in question.

tl;dr - Very rarely do we see news, projects, and marketing causing crypto market moves. Rather, we see these things mitigating major market crashes, or catalyzing long term trends, particularly with regards to user adoption.

To see something like this being built in front of your eyes, I'd recommend following the State of the Network reports put together by myself and @parejan.

SotN #5

I know for me personally, I got into GRC this last month as a result of 2 main factors: my newly found interest in cryptos in general, and my previous use of the BOINC research network.

I had used BOINC years ago simply to donate my idle CPU power to scientific research of projects I felt were important and interesting. I did it then with no profit motive and no incentive other than purely humanist altruism. That is why I believe strongly in the GRC long term sustainability, because there is a large group of people who will always contribute to BOINC regardless of the profit motive, so it will only make sense that as more and more BOINC hobbyists like myself discover it, it will continue to grow and at a more sustainable rate than other cryptos. Unlike mining of other cryptos, people have been doing the work of mining for GRC before it existed, and they continue to even if mining becomes less profitable. If larger cryptos like bitcoin continue to become more diffocult and less profitable to mine, they will inevitably see a drop in overall mining power or a shift to higher fees per transaction, which puts a burdon on the network and the community, but GRC has an infrastructure that will not be subject to those same problems.

I know this is anecdotal evidence, but that's why I chose to be a part of GRC, and I'm sure I'm not the only one. I believe having access to the reasons why people get into GRC will shed light on whether the recent growth is suatainable or just a bubble that will burst.

@jringo First of all, State of Network already have almost all the internal parameters we need. It's just a thing of repacking the information into a math formulas. What you did by collecting all of that is amazing.

But as for the violate behaviour, I think we can't compare GRC to other cryptos. GRC seems to behave on it's own set of rules, that I am still trying to understand / hence this analysis proposal.

If we take a look in last few months, we can observe a jump from 0.08 to 0.8 (200%) compared to USD, while Bitcoin, Monero and many others dropped or stands still.

Understanding that set of rules that makes GRC behaves the way it does is crucial in my opinion. One thing is for sure, the large independence from other cryptos that could be observed in GRC only, as to my best knowledge.

I dont think we'll agree any time soon with regards to GRC behaving differently than other cryptos = ). I honestly don't see anything different about its market actions when compared to others. Its catch around .03 was pretty neat, but that's about it.

But if you want to discuss either making the SotN reports more complete, or using the details from those reports for a second analysis, I'm completely on board. Whatever I can do to help!

That's exactly the point :) Rather then to agree or disagree, it would be nice to have an exact figures how much it depends, on what, to a level of known error correction factor. If it happens that I am right, and GRC behave to large extent as a independent organism, that would open up a possibility to learn something new about crypto-economy. But of-course I could be wrong.

What made me think about this, is inability to collerate and predict GRC behaviour based on other cryptos, while it's relatively easy to find common related behaviors if we take any other pair.

Yet to see who is right, but have in mind that my standpoint is still just an assumption.

Lets discuss on slack @crt but in principle I'm keen to do that (being a stats freak :) ).

You must be sent straight from the goods from Olympus. Everybody hate statistics :) I'll get on slack latter tonight (I'm GMT+1). Just drop me a message with the best time for you. I'll try also to prepare other params that should be taken into account. The above is the very basic one with many important factors omitted.

I'll certainly upvote any such analysis published on Steemit ;D