SUMMARY

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Much love and appreciation for this update on GSV.

Love your reports on BitcoinLive haejin!

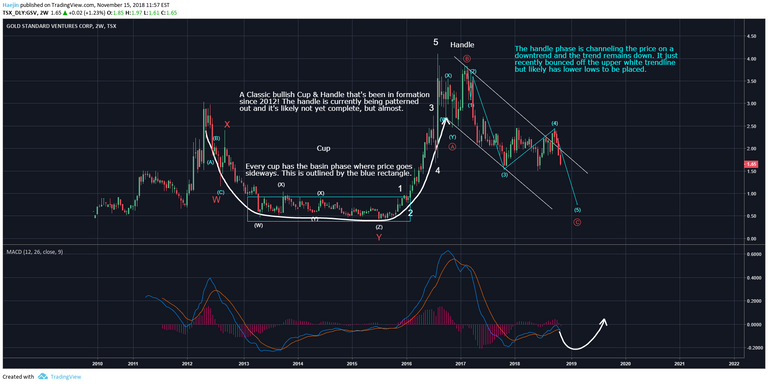

I have GSV and expect it to continue to increase it's gold resource through drilling. They recently had significantly higher grade drilling results. In general they have <<1g/ton gold. It's pretty low grade (average global mining grade is 1g/ton of ore) but they have a large bulk tonnage of it. The lastest drilling is around 2.5g/ton. If they can continue with drill results like these, they should continue to build out a resource size that is economic to build into a mine. Would love to finally see the end of this cup and handle and beginning of the next large up cycle to take effect. Thanks for the post.

howdie morseke1

I saw those and other drill results. Sure hope that NEWS gets around enough for me to sell off at $2 (wishful thoughts...?)

The issue in general for gold/silver mining stocks right now is sentiment is poor. Everyone hates them and have left the asset class for dead. The COT report (Commitment of Traders report is a weekly government report showing the number of long/short futures contracts for an asset) recently showed the speculators with the most net short contracts in the past 17 years. These speculator are always wrong at extremes and will be proven wrong again. It's a great time to accumulate gold and silver mining companies, but pick those with the best resources or potential resources and those that have the most experienced managements.

I have large portfolio of resource positions and read every press release and follow them weekly. If you want a blue sky position, read up on Novo Resources. You won't be disappointed. Literally nuggets of gold the size and shape of watermelon seeds in either porous rock or loose gravel. There was recently an excellent article written about their blue sky upside to the almost 13,000 sq km land package in Western Australia. You can read it here: http://www.thehedgelesshorseman.com/pilbara/novo-pilbara-more-than-meets-the-eye/

Thanks for the heads up on Novo

I own monster boxes of Silver maples.

But personally I believe Haejin that PM's are going up then Crash over the next few years. Silver down to around $6 eeek, I know. but Silver is Insurance.

I am selling off all my miners on the next Ralley in PM's

Makes sense. Gold price needs to go lower and miners are correlated to gold...

Thank haejin. Very insightful as usual. If you have a moment, can you have a look at IFC (Intact financial corp) in Canada. Its an interesting chart since the IPO...

I like GoldMoney Inc.