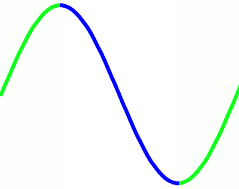

HERTZ is an upcoming Algorithm Based Asset (ABA) which is an market pegged asset (MPA) with a formula which modifies the price feed to oscillate using a sin wave.

The following is the current python reference formula:

hertz_value = reference_asset_value + (amplitude * math.sin(((((current_time - reference_timestamp)/period) % 1) * period) * ((2*math.pi)/period)))

Configurable HERTZ variables:

- The reference asset (USD, CNY, XDR, etc..)

- The reference value ($1.00, $10, etc..)

- The amplitude of the sin wave (how far from 0 on the y axis the sin wave modulates at).

- The phase.

- The reference timestamp (Default: BTS2.0 genesis UNIX timestamp)

- The frequency/period (Default: 1 month = 30.43 days)

The variables will not be light-heatedly changed once the HERTZ asset has become active (given sufficient price feed publishers), so you will not need to worry about the amplitude/frequency of the asset increasing significantly after having shorted the token into existence.

Any substantial variation in the configurable HERTZ variables will be made within a newly created HERTZ asset. The naming convention will potentially follow:

HERTZ.Reference_Asset.Amplitude.Frequency.Phase

If you're interested in calculating potential profit or evaluating the HERTZ variables, check out the HERTZ calculator spreadsheet, it'll be soon updated to include all of the variables (currently only amplitude).

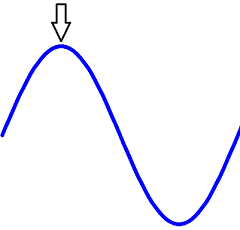

HERTZ market phases ELI5

Peak price

- Peak sell pressure/liquidity (borrowing & shorting)

- Peak settle pressure (holders settling for profit)

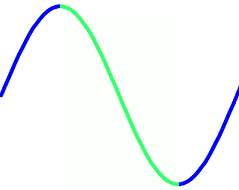

Peak -> Trough oscillation

- Shorter debt destruction

- Increasing buy pressure

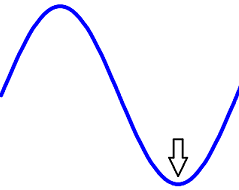

Trough price

- Peak buy pressure/liquidity (chasing price feed appreciation)

- Trough settle pressure

Trough -> Peak oscillation

- Shorter debt appreciation

- Increasing settle pressure

- Decreasing buy pressure

HERTZ market phase further info/thoughts

Shorting at the peak

If you borrow HERTZ into existence and short it at the peak (crest) value, your debt will decrease to:

DEBT * (amplitude * math.sin(((((current_time - reference_timestamp)/period) % 1) * period) * ((2*math.pi)/period)))

With a decreased debt, you can keep a partial amount of the tokens you shorted into existence.

This only applies when shorting from peak and settling debt at the trough, if you short and miss your settle window the debt will appreciate back to the original debt value.

Buying at the peak

Given that during the peak there is peak sell pressure from shorters, you should be able to buy larger sums of HERTZ than bitUSD.

Buying and holding has the least risk associated with the HERTZ token, however you must account for the oscillation of the price feed as it will affect the networth of your HERTZ holdings; if you need to cash out at a later date you may be faced with having to wait until the peak value to settle or having to settle for a lesser price feed value.

If the asset you traded for HERTZ collapsed more than 67% then you'll have benefited regardless of say buying at the top and selling at the bottom.

Settling

When you hold a market pegged asset (such as HERTZ or bitUSD), you have the option to 'settle' which calls the least collateralized position (liquidating their position) in order to fulfill your request to convert HERTZ to BTS at the rate of $1.50/HERTZ. The least collateralized individual cannot reject your settlement (all they can do is to improving their collateral to not be the least collateralized position being liquidated), so there shouldn't be a problem with liquidity exiting (settling, not selling) the HERTZ token. With BSIP-0018 on the way, we're going to see reduced risk (or partial/complete mitigation) of global settlement (black swan events) which will further stabilize this peak price settlement.

Buying on the downtrend & uptrend

There should be continuous buy pressure throughout the cycle (except from peak), as there is profit to be made by buying (with no debt risk) waiting until the price feed has appreciated higher than the value you bought at then setting at that point.

Shorting at the trough

Why would anyone sell at the bottom? The bottom (trough) will be the point of maximum buy pressure (since everyone wants the profit from settling with an appreciated price feed) - enabling you to short HERTZ on a large scale (again possibly larger than bitUSD) given this moment of peak buy liquidity.

Trough settlers need to take the debt appreciation seriously, as they may find themselves force settled if under collateralized.

If BTS increases in value as the debt appreciates, your collateral ratio will improve. If however the BTS value decreases then your collateral ratio will depreciate at an increased rate due to the debt appreciation caused by the price feed increasing.

Buying at the trough

If you buy HERTZ at the lowest (trough) value, you can wait until the peak (crest) value to then settle your balance (instead of selling) to make a profit of:

profit_percent = (settle_value/buy_value)*100

If you buy HERTZ at any value lower than the peak value, you can wait several days/weeks until the settle value is greater than the value you bought at, to which you would settle your HERTZ balance (as opposed to selling on the market).

Example:

HERTZ vars: amplitude 50%, reference asset $1.00, period 1 month

Jack has $500 (bitUSD) and trades them for 1000 HERTZ at $0.50 ea, he waits 2 weeks then settles his 1000 HERTZ at $1.50 for a profit of $1.00 for every $0.50 invested. Jack started with $500 and now has $1500 in 2 weeks with minimal risk.

Want to know more?

- HERTZ - Next area of investigation prior to production!

- HERTZ Price Feed Script Updates! September 2017

Have any questions/suggestions?

Please do reply with your questions and or suggestions, I'm especially interested in the possible HERTZ variable values you can come up with.

Best regards,

@cm-steem

There are few other algorithm based Blockchain technology coming to the crypto world. I want to definitely try this to see how it performs. When are you releasing the full variables?

If you don't mind, what are the other ones? I sort of understand what this is saying and would love to see more in action.

Hero is one, it appreciates 5% per year pegged to the USD. Arguably altcap.xdr which is a basket currency could be considered an algorithm based asset since it has a formula behind it, though AFAIK the calculation is done on the IMF's side.

There has been talk of the opposite to hero, an asset which depreciates x% per year which would actually be quite simple to implement as an ABA.

Do you have any ideas for an ABA?

The price feed scripts are fully open source and visible in the links at the end of my post.

Regarding the variables, the only variable that I believe may warrant changing is the amplitude. It was initially set to 0.5 however I think this may be too extreme.

Ideally interested parties would try the spreadsheet out and tell me what they thought would be sensible.

can you send some more lonk for education?

very interesting work and glad to see you on top of this

hello , Invite me ?

now following you

I can't wait for hacking your price feed scripts. Upvoted and resteemed.

If you mean improving or working from the price feeds as a template then check them out: https://steemit.com/bitshares/@cm-steem/hertz-price-feed-script-updates-september-2017

If you mean hacking it to break the production hertz published price feed values, then only the pre approved parties will be allowed to publish, so the only way to attack would be to compromise one of those accounts.

When i read hertz i think of braodcasting wave transmission.

hertz algorithm based asset looks great ! very informative post thanks

nice information, hertz algorithm based asset looks great, i upvote and resteemed this post so most peoples get know about Hertz asset.

Another interesting coin to add wealth on my portfolio. It looks interesting to hodl and keep.

Good post! Thanks for share

best post on this side

Like/Retweet please:

thank you !

Upvoted and RESTEEMED!

can you send some more lonk for education?

good article!

Hi please vote and comments